- within Employment and HR topic(s)

- in China

- with Senior Company Executives, HR and Finance and Tax Executives

- in China

- with readers working within the Insurance, Oil & Gas and Law Firm industries

D.C. Council Preserves Tip Credit

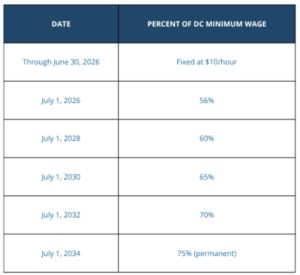

On July 28, 2025, the D.C. Council voted to scale back Initiative 82, a voter-approved measure that would have eliminated the tip credit by 2027, so that tipped workers earned the full minimum wage, currently $17.95 an hour. The Council's new legislation implements a nine-year phase-in schedule culminating in 2034, when the tipped minimum wage will reach 75% of D.C's regular minimum wage. A schedule of the revised tip schedule appears below.

Key Provisions:

- The tipped wage stays at $10/hour until July 1, 2026. On that date, it increases to 56% of the standard minimum wage. Starting July 1, 2028, the percentage jumps by 5% every two years, reaching 75% by July 1, 2034. As a result, a 25% tip credit becomes permanent.

- Employers are now required to include a breakdown of tipped wages, tips, commissions, and bonuses on employee pay stubs.

- The District's Chief Financial Officer will perform a biennial economic analysis of the restaurant industry to track the impacts of the wage schedule.

What This Means for Employers:

- Employers need to make sure that payroll systems meet the new pay stub requirements.

- Businesses should plan for gradual wage increases and evaluate long-term budgets through 2034.

- Advocacy efforts continue, and further changes are possible. Employers should monitor developments closely.

Revised Tipped‑Wage Schedule:

Shulman Rogers' Employment and Labor Law Group is ready to assist clients in navigating these changes and ensuring compliance with D.C.'s wage laws. We also invite you to subscribe to our newsletter to stay informed on the latest laws impacting employers by clicking HERE to subscribe.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.