- within Government, Public Sector, Antitrust/Competition Law and Immigration topic(s)

Labor, Employment & Benefits Legal Update

Many of us have our special traditions to ring in a new year: taking down holiday decorations, making New Year's resolutions, and organizing our homes and offices. But employers, especially in the Pacific Northwest, now have another New Year's tradition: bracing themselves for a host of new employment laws. But have no fear! Read on for how employers in Oregon and Washington can welcome 2024 with open arms (and updated policies).

OREGON

A Look Back: Oregon Laws Effective in 2023

Employers should double-check to ensure they are complying with these Oregon employment laws that became effective during 2023:

- Paid Leave Oregon. Contributions to this new state leave program began in January 2023, and leave became available to employees in October. Consult Lane Powell's Legal Update for more information on employer obligations.

- OFLA Protection for Bias Crime Victims. Oregon's Family Leave Act (OFLA) already provides protected leave to victims of sexual assault, sexual harassment, and stalking. HB 3343, effective on July 31, 2023, expanded OFLA to cover victims of bias crime. This means crimes based on the perception of a person's race, color, religion, gender identity, sexual orientation, disability, or national origin.

- Temporary Disability Benefits. Previously, injured workers could not collect temporary disability benefits for work-related injuries for the first four hours after leaving work to obtain medical services. Oregon's SB 418, effective on June 1, 2023, now permits injured workers to begin collecting temporary disability benefits immediately when the worker must leave work to receive compensable medical services.

- Limits on Settlement Agreements. HB 3471, effective on July 27, 2023, makes it unlawful for employers to make offers to negotiate settlement agreements contingent on a no-rehire provision. This restriction currently applies only to settlement agreements disposing of all or part of a claim for workers' compensation. This law permits the imposition of $5,000 civil penalties for violations.

Coming to Oregon in 2024

- Privacy Law

Oregon's Consumer Privacy Act will impose comprehensive data privacy restrictions on businesses handling personal data and will provide consumers with increased control over their personal data. The law applies to businesses that conduct business in Oregon, are not exempt, and meet at least one of the minimum data processing thresholds. The Act becomes effective on July 1, 2024, except that it will not apply to nonprofits until July 1, 2025. Consult Lane Powell's Legal Update for details. - Anti-Discrimination Laws

- OJT and Apprenticeships. Effective January 1, 2024, Oregon extends anti-discrimination and retaliation provisions contained in ORS 659A to individuals participating in registered apprenticeships and on-the-job (OJT) training programs. While such individuals engaged in apprenticeships and on-the-job training programs will not be considered employees, the law will extend protection from discrimination and retaliation that historically has only been applied to employees.

- Hazardous Exposure Refusal. Starting January 1, 2024, a new Oregon law creates a new category of protected activity and expands existing anti-discrimination provisions to employees who refuse to perform tasks at work that would expose them to hazardous substances or conditions, or to potentially unlawful activities. The law prohibits employers from discharging or discriminating against any employee or applicant who has refused workplace exposure to a hazardous condition that could result in serious injury or death to the employee or applicant, or could be unlawful under civil or criminal laws. The law also expands permissible uses of sick time and any other paid or unpaid leave time to compensate for time during which the employee refused to perform such work.

- Military Leave

A new Oregon law, effective on January 1, 2024, clarifies that military service includes active service in the Oregon National Guard and Reserves, including for service-related military leave. Previously, Oregon's militia leave law appeared limited to service in the federal branches of the military, but the new law clarifies that covered services for the purposes of Oregon military leave laws and related statutes include service in the Oregon National Guard and Reserves.

WASHINGTON

A Look Back: Washington State and Local Laws Effective in 2023

EPOA. The Washington Equal Pay and Opportunities Act was amended, effective January 1, 2023, to require that all employers with 15 or more employees in Washington disclose in each job posting the wage scale or salary range and a general description of all benefits and other compensation to be offered to the hired applicant. See Lane Powell's Legal Update for more information.- City of Seattle Prohibits Caste Discrimination. Effective March 2023, Seattle became the first jurisdiction to add "caste" to the list of protected categories from discrimination. Employers should update their anti-discrimination policies and employee handbooks, train front-line managers, and caution against assumptions about managers from caste-based communities.

- City of Tukwila Law. Effective July 1, 2023, the City of Tukwila implemented a Secure Scheduling Law, which covers employers with 15 or more employees or those with gross revenue of over $2 million and any employee working within the City of Tukwila (including remote employees). The law imposes a new minimum wage, requires employers to provide "fair access" to available hours of work to qualified, part-time employees, and imposes notice, recordkeeping, and compliance obligations.

New Laws in Washington in 2024

- Personal Cannabis Usage

As of January 1, 2024, it is unlawful for most Washington employers to reject an applicant based on the applicant's off-the-job use of non-psychoactive cannabis metabolites. Employers using pre-employment drug screening who are covered by the new law should instruct their testing provider to avoid testing for and reporting any non-psychoactive cannabis use. Consult Lane Powell's Legal Update for more information.

- Salary Threshold Increase for Non-Competes

Since January 2020, Washington law has limited non-competes to workers who earn certain monetary thresholds, among other restrictions. Whether the worker meets this annualized threshold is determined on the date of separation or the date of enforcement, whichever is earlier. These thresholds increase every year. On January 1, 2024, the employee salary threshold increased to $120,559.18. Likewise, the independent contractor threshold based on earnings paid by the business increased to $301,399.98. Consult Lane Powell's Legal Update for more information. Businesses seeking to enforce these restrictions before the worker meets the threshold must ensure that the non-compete agreement states that it will be enforceable in the future. - Wage and Hour Laws

- Washington Minimum Wage Act Exemption Threshold. Employees are exempt from Washington's Minimum Wage Act (MWA) for overtime compensation purposes only if the position meets the duties test and the salary meets the minimum threshold. In previous years, the salary threshold was tied to the employer's size, but for 2024, employers in both the small (1-50 employees) and large (over 50 employees) categories must pay two times the minimum wage to meet the salary threshold. This means that small and large employers must pay exempt employees at least $1,302.40 per week, or $67,724.80 per year, to avoid laws imposing overtime compensation, meal periods and rest breaks, and other requirements.

- Overtime for Agricultural Workers. Beginning January 1, 2024, agricultural workers in Washington who work over 40 hours a week must be paid the overtime rate for hours worked above 40. This is the third and final phase of a three-year-long expansion of overtime protections to agricultural employees. Each year, the phase-in schedule gradually reduced the number of hours agricultural employees would need to work in a workweek to be eligible for overtime pay. In 2022, overtime pay was required when agricultural workers worked over 55 hours; in 2023, it was required for working over 48 hours, and beginning January 1, it is 40 hours.

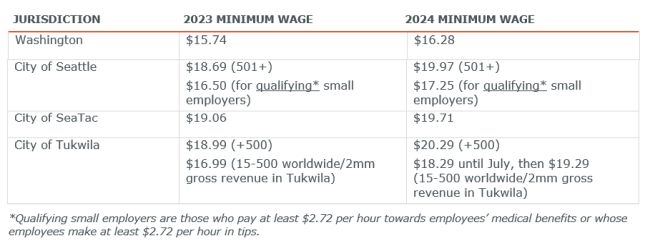

- Minimum Wage Increases. The new year brings

several minimum wage increases across Washington state:

- Changes to Paid Sick Leave Law

Washington's Paid Sick Leave Act became effective on January 1, 2018. As adopted, employees were entitled to use accrued paid sick leave beginning on the 90th calendar day after beginning employment, although employers could waive this waiting period. Similarly, under the 2018 law, employers were not required to pay out accrued sick leave upon an employee's separation. Under a new state law effective on January 1, 2024, most construction workers will now be entitled to payment for accrued but unused sick leave upon separation, even if they have not worked for 90 days. Certain construction workers are exempted, such as residential building construction workers (NAICS Code 2361). Read the full law here.

The Department of Labor and Industries has also amended its sick leave regulations to make significant changes affecting employers' sick leave policies and practices, especially for Paid Time Off (PTO) plans. These changes include: (1) employers cannot deduct from an employee's Paid Sick Leave (PSL) balance unless the employee has authorized the use of leave because the use of sick leave is the employee's choice; (2) new requirements for PTO programs, including that employers must notify employees of their intent to utilize a PTO program to satisfy PSL requirements; (3) employers may set different requirements for employees to access more generous PTO accruals if certain conditions are met, including separately tracking types of leave; and (4) employers who allow employees to enter into negative PSL balances are engaging in frontloading and must follow rules applicable to frontloaded leave plans.

What Should Employers Do Now?

- Audit your wage and hour practices to ensure that your exempt employees continue to meet the duties test and their salaries meet the minimum thresholds to maintain exempt status and avoid triggering overtime compensation, meal periods and rest breaks, and other requirements imposed for non-exempt employees.

- Confirm that your non-exempt employees are being paid consistently with new minimum wage requirements.

- Confirm that your non-compete agreements comply with governing law, including the increased earnings threshold for employees and contractors in Washington state.

- Employers with construction workers working in Washington state should modify their paid sick and safe leave policies to comply with the new law.

- Employers with agricultural workers working in Washington state should review their overtime practices to ensure they are meeting the new limitations in 2024.

- Ensure your employee handbook policies, especially your leave of absence, discrimination, and paid sick leave policies, comply with new laws.

- Stay tuned! 2024 is sure to bring new challenges and considerations for employers. Keep up-to-date by subscribing to Lane Powell's Legal Updates.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.