- within Law Department Performance and Insolvency/Bankruptcy/Re-Structuring topic(s)

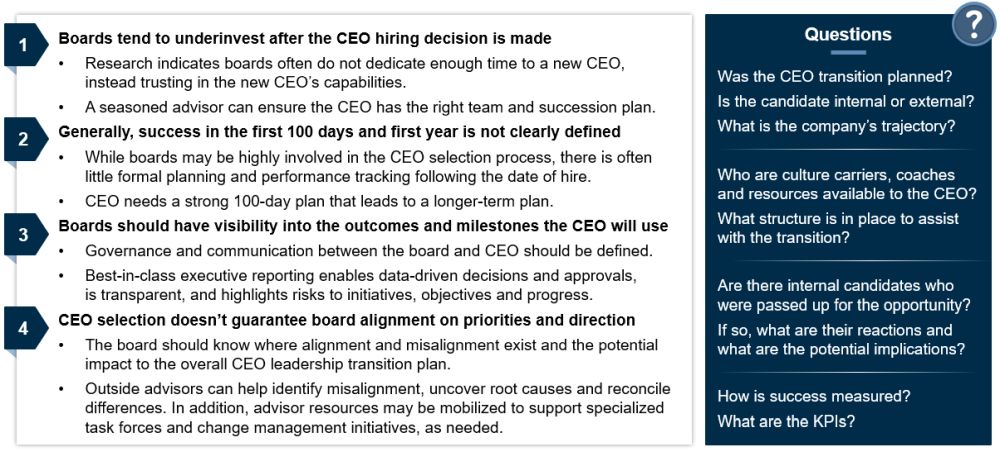

Leadership changes have the potential to significantly impact a company's trajectory. Research indicates that more than 50 percent of executives fail in the first 18 months in their new role, potentially putting at risk the company's strategy, operational stability and stakeholder confidence.1 A key factor contributing to the success or failure of any CEO transition is the board's level of engagement with the CEO after the hiring decision is made. Surprisingly, while many board members are typically highly involved in the CEO selection process, research indicates that most board members often underinvest time spent with the new CEO. Instead, board members often choose to place their trust in the new CEO's capabilities and capacity to lead without putting in place a formal transition plan, support team or adequate performance tracking.

Early on, the board can expect the new CEO to engage in a thorough business review. He or she will likely look to internal leaders and influencers to bringing him or her up to speed on the business. In addition, new CEOs can benefit from the advice and leverage provided by outside advisors to offer perspective, accelerate learning and highlight issues that may be uncomfortable for internal leaders to address directly. Outside advisors can also help identify misalignments, uncover root causes, reconcile differences, and be mobilized to support specialized tasks forces and change management initiatives.

What we have observed guiding successful CEO transitions and their implications

An Actionable Corporate Strategy – Six Components

Following the business plan review, the board should work with the CEO to develop an appropriate level of visibility into the outcomes and milestones the CEO will use to drive the business forward. The newly appointed CEO should deliver a clear, actionable corporate strategy within the first 100 days, supported by operational and financial key performance indicators (KPIs) that he or she will use both to drive the business forward and hold the management team accountable. While desired outcomes may vary based on the CEO's vision and the specific near-term needs of the business, the following six areas should be addressed within the corporate strategy.

Growth Trajectory: The CEO should present a clear vision for the company's growth over the next three to five years, identifying key market opportunities, competitive position and revenue targets. Growth initiatives may be organic, inorganic or may come through capex and other investments. The CEO should convey to the board his or her top priorities for driving growth as well as the required expected investment. Board members will want to assess the feasibility of the growth projections, ensuring they align with the company's long-term goals and current market conditions.

Operating Model: The company's operations may need to evolve to support the company's growth strategy. The CEO should propose any necessary changes to the structure, processes and KPIs. Considerations for the board include evaluating the scalability of the proposed model, its cost efficiency, and how it positions the company to outperform competitors while maintaining operational agility.

Talent: An assessment of the current leadership team is useful to identify any talent gaps or succession risks, as well as to ensure that the CEO has the executive team that he or she needs. Proposals for attracting, retaining and developing top-tier executives should be highlighted, along with strategies for fostering a leadership culture that aligns with the company's future needs.

Compensation Structure: A discussion on the management team's compensation structure should clearly lay out how compensation incentives align with individual performance goals and desired outcomes. Compensation structure should be reviewed at both the executive level and for all critical roles. Recommendations may include changes in salary structures, bonuses, equity plans and long-term incentives. The board should ensure that the compensation strategy incentivizes the right behaviors, drives performance and aligns to shareholder interests by reflecting a competitive market rate.

Technology Enablers: Today, technology plays a critical role in driving efficiency, innovation and growth. The CEO should highlight existing gaps in the company's tech infrastructure and propose investments in key areas like automation, data analytics or digital transformation. The board will need to assess the balance between investment costs and the anticipated return, ensuring the tech strategy aligns with the company's broader objectives.

Risk: Lastly, the CEO should provide a comprehensive analysis of the key risks facing the company — both internal and external — and propose mitigation strategies. This enterprise risk assessment should include financial, operational, market, data, regulatory and compliance risks. The board should evaluate whether the risk management plan is properly designed to protect the company's assets and reputation at the right cost to the business.

A thorough business review will set the tone for the new CEO and result in a substantiated strategy that he or she can stand behind. Moreover, the board will benefit from increased transparency into the business with actionable KPIs to track performance. The board should keep in mind that CEO selection does not guarantee board alignment on priorities and direction. Therefore, it is critical the board know where alignment and misalignment exist and the potential impact to the overall CEO leadership transition plan.

CEOs often turn to outside, action-oriented advisors like A&M to get an objective view of the business and quickly develop a go-forward plan that is supported by the board.

Footnote

1. Mike Ettore, "Why Most New Executives Fail – And Four Things Companies Can Do About It," Forbes.com, March 13, 2020, https://www.forbes.com/councils/forbescoachescouncil/2020/03/13/why-most-new-executives-fail-and-four-things-companies-can-do-about-it/.

Originally Published by 15 October 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.