Neurodiversity Services market overview

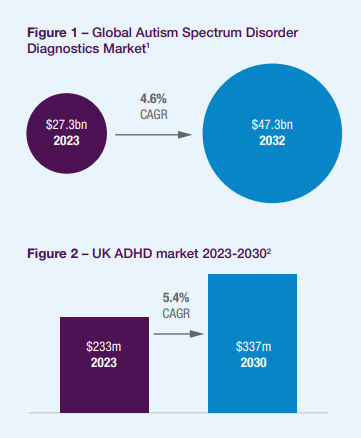

Neurodiversity is an umbrella term that includes a range of neurological conditions that include ADHD, autism, dyspraxia, dyslexia and Tourette's syndrome. These conditions lead to differences in the way people receive, process, and respond to information about the world. Core neurodiversity services span diagnostic assessments, therapies and medical management, workplace assistive technologies, educational assistance and wider community and social support. Not long ago, the neurodiversity services market was virtually non-existent, with few resources or support networks available to meet the needs of neurodivergent individuals.

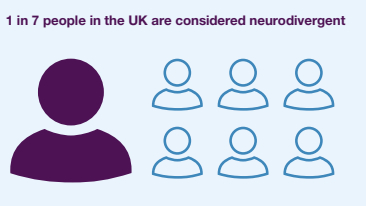

Only in recent years has awareness translated into tangible services, creating an industry rife with growth potential. Neurodivergent individuals represent around 15% of the UK population. This share of the population has been identified following a surge in diagnoses, with Autism diagnoses alone rising by 787% between 1998-2018.2 Recognition of these conditions point to a broad, lifelong need for specialised services across health, education and social care. The identification of systemic barriers in employment against those with neurodivergent conditions has prompted a shift from service models designed for neurotypical populations to neuro-inclusive frameworks. These new frameworks offer adapted diagnostic pathways, accessible communication formats, as well as workplace accommodations.

The UK Government has established plans in place in order to try and tackle some of the systemic barriers such as the National Strategy for Autistic Children, Young People and Adults. However, already struggling services—particularly within the NHS—have left many families facing long wait lists and limited support, creating space for the private sector to step in. As both awareness and demand escalate, the neurodivergent services market is poised for continued expansion.

M&A Summary

Recent M&A in the neurodiversity services sector has been driven by the need to expand diagnostic and treatment capacity, diversify service offerings and create scalable platforms capable of meeting rising demand.

Acquirers are typically larger healthcare groups or private equity-backed platforms pursuing buy-and-build strategies, with transactions often aimed at integrating smaller, specialist clinics and service providers into broader networks. This consolidation is not only about increasing capacity but also about professionalising fragmented markets, introducing more consistent governance and embedding digital pathways to improve efficiency and patient access.

The Covid-19 Pandemic further accelerated demand for remote assessments and digital therapies,5 highlighting the scalability of online delivery and making established digital platforms attractive acquisition targets for larger groups.

Changes in the NHS procurement regime are also pushing providers toward greater scale, with organisations that have robust systems better placed to secure long-term contracts. Looking ahead, we can expect continued activity as investors target resilient, socially impactful assets and operators look to accelerate growth, with acquisitions increasingly favoured over slower organic expansion.

Changes in the NHS procurement regime are also pushing providers toward greater scale.

Recent Neurodivergent Services transactions

Additional sector activity and recent innovations

Recent investments in the sector have significantly accelerated the development and implementation of systems designed to support neurodiverse individuals.

Educational assistance has emerged as a particularly dynamic sub-sector in recent years, with frequent M&A activity and funding fuelling innovation. For instance, in November 2022, multiple VC investors backed Healios, a leading private provider of children's mental health and neurodevelopmental services. Healios focused on creating new assessment and intervention programmes while advancing machine learning, data science and clinical research.

In April 2023, Cognassist secured a £4 million investment from Gresham House Ventures. This funding is enabled Cognassist to further develop its SaaS platform, which identifies and supports individuals with learning needs. The company is now working to expand into the enterprise market while maintaining its strong presence in the education sector.

More recently, in April 2025, Outcomes First Group (OFG) acquired Tute Education. This acquisition integrates Tute's purpose-built online platform, covering Key Stages 1-5, with OFG's commitment to delivering high-quality, personalised education. The move allows OFG to broaden its reach, providing more young people with tailored and flexible learning opportunities.

These developments underscore a sector experiencing rapid innovation and growth, with increasing momentum behind companies that are transforming how neurodiverse needs are addressed and supported.

Sector Outlook

The expansive growth of the Neurodivergent Services market can be attributed to rising awareness, policy changes and crucially the structural inefficiencies of the NHS. A key catalyst has been the NHS Right to Choose (RTC) scheme which grants patients the legal right in England to select any qualified NHS-contracted provider for assessments for a neurological condition like ADHD or Autism.

This scheme has enabled independent operators such as: Psychiatry UK, Psicon, and ADHD 360 to offer faster pathways for patients either through the NHS scheme or privately. It should be noted that some of these clinics have been involved in controversies regarding false positive diagnoses,12 however they claim efforts have been made to rectify this issue since.

However, recent announcements from the UK government has suggested some potential short-term headwinds. Proposed reform to the RTC scheme could give local Integrated Care Boards (ICBs) the power to block referrals to independent providers. Furthermore, some NHS bodies are seeking to impose 'artificial' minimum waiting times in order to manage budgets which may delay treatments and reduce private sector throughput.

Despite these potential obstacles, the medium to long-term outlook for the Neurodivergent Services sector remains strong. Waitlists continue to balloon from 17,40013 people waiting for an ADHD assessment in 2019 to 549,000 waiting in 2025.14 Demand continues to grow and government policy reflects the dual challenge of reducing NHS spending while addressing extensive waiting lists. This creates a balancing act, where current measures may prioritise budget control, but the persistent rise in demand signals strong growth potential for the sector in the longer term.

A culmination of growing corporate and educational focus on neuro-inclusivity, the increasing pressures on an overburdened NHS, as well as a strong pipeline of innovation and investment, the Neurodivergent Services sector retains significant headroom to grow beyond some potential regulatory induced volatility in the short-term.

Footnotes

1 "Neurodiversity" NHS England, June 7, 2024.

2 Ginny Russell et al, "Time trends in autism diagnosis over 20 years: a UK population-based cohort study" The Journal of Child Psychology and Psychiatry 63, no. 6 (2022): 674.

3 "Autism Spectrum Disorder Market" Zion Market Research, February 2024.

4 "UK Attention Deficit Hyperactivity Disorder Market Size and Outlook" Grandview Research, 2024.

5 Report of the independent ADHD Taskforce: Part 1, NHS England June 20, 2025.

6 "Keys Group Welcomes ADHD 360 to the Family in Exciting new Acquisition" Keys Group, May 20, 2025

7 "Agathos supports Lexxic to acquire Do-IT Solutions" Agathos, November 4, 2024.

8 "UK: QPE invests in UK's leading provider of digital psychiatry services" investors in healthcare November 1, 2024.

9 "Agathos backs management buy-out of Lexxic" Agathos July 8, 2024.

10 "EMK Capital-backed Onebright acquires Psicon" RealDeals October 5, 2023.

11 "Clinical Partners buys Oxford ADHD and Autism Centre" Health & Protection, June 26, 2023.

12 "ADHD: Private clinics exposed by BBC undercover investigation" BBC News, May 15, 2023.

13 "ADHD surge driven by rising awareness rather than more cases" Financial Times, 4 June, 2025

14 Amy Borret, "Almost 2.5mn people in England estimated to have ADHD" Financial Times, May 29, 2025

Originally published 29 September 2025

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.