Through our Viewpoints series, Riveron experts share their opinions on current topics, business trends, and industry news.

Monetary policy wields significant influence over the economy, and its impact is often most felt through the movement of interest rates. As the cost of capital rises, it becomes more difficult for companies to justify investments in capital expenditures or new hires. For highly leveraged private equity investments, this can be especially detrimental, as the increased debt servicing burden puts further strain on equity returns and business growth.

Exploring interest rate trends

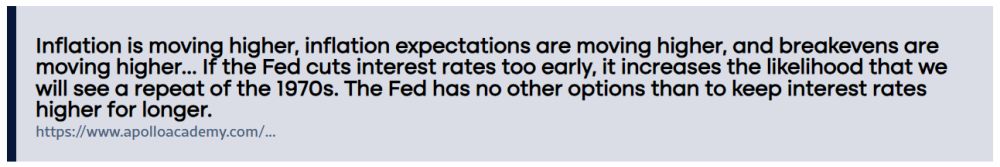

Torsten Slok, Chief Economist at Apollo, recently remarked, "If the Fed cuts interest rates too early, it increases the likelihood that we will see a repeat of the 1970s. The Fed has no other option than to keep interest rates higher for longer."

Image Source: Bloomberg, BLS, Apollo Chief Economist

The higher-for-longer policy stance has proven detrimental to many over-levered companies, as rising interest expenses erode available cash flow, leaving little or no distribution for shareholders.

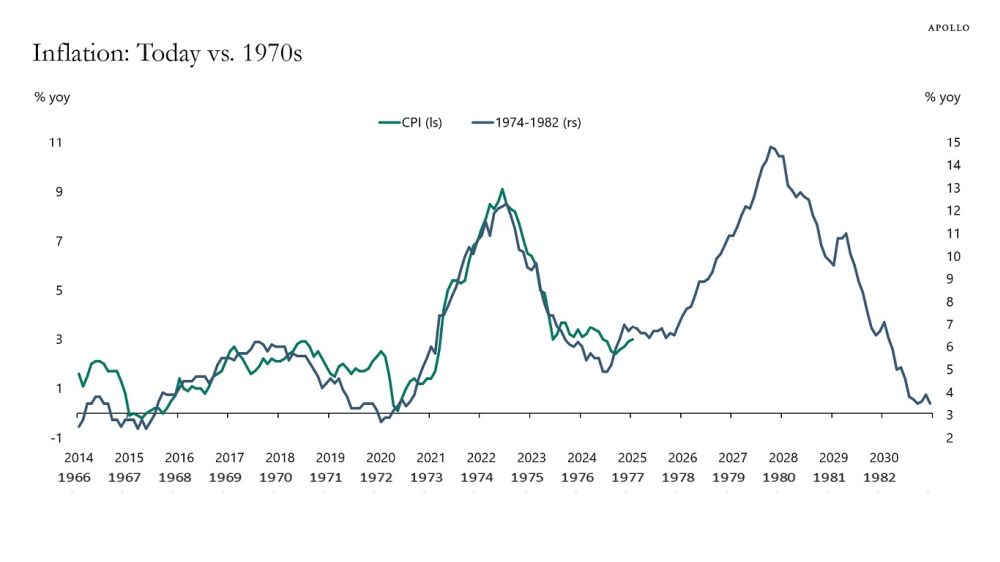

Higher interest rates effectively shift value within the capital structure, favoring senior debt holders over junior equity holders(see illustration below). While equity holders bear the brunt of higher rates, lenders may benefit from higher returns, particularly if the company has substantial equity.

Image Source: Penta Mezz

Obstacles and opportunities: How companies are affected by interest rates

In this environment, companies that lack earnings or cash flow are especially vulnerable, as they struggle to meet elevated debt servicing costs. On the other hand, companies with strong earnings or pricing power can often outperform, as they are better positioned to absorb the increased debt servicing burden. The broader goal of higher interest rates is to moderate growth and make value investing more appealing compared to growth or distressed investing.

This is the intention behind the Federal Reserve's decision to maintain higher interest rates: to curb excessive risk-taking, particularly in capital structures lacking earnings or cash flow.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.