- within Insolvency/Bankruptcy/Re-Structuring, Transport and Immigration topic(s)

MANUFACTURING AND INDUSTRIALS

SAMVARDHANA MOTHERSON

We assisted SAMVARDHANA MOTHERSON International Limited (Motherson) in entering into definitive agreements through its subsidiary SMRP BV to acquire a 95% stake in Japanese automotive parts manufacturer Atsumitec Co, Ltd (Atsumitec).

Atsumitec specializes in metal and machining—primarily manufacturing chassis and transmission parts—with nine facilities across China, Hong Kong, Indonesia, Japan, Mexico, Thailand, the United States, and Vietnam. The acquisition involves a series of transactions, including the purchase of at least 48.02% of Atsumitec's shares from shareholders and a share repurchase by Atsumitec from Honda Motors Co. (Honda), resulting in a 95:5 strategic partnership between Motherson and Honda. The transactions are expected to be completed in early 2025, pending clearance from Japanese merger control authorities.

The deal team advising Motherson was led by lawyers from Singapore, Hong Kong, Tokyo, and Shanghai, with local counsel across Indonesia, Mexico, Thailand, and Vietnam. US advice was provided by lawyers in our Seattle and Nashville offices.

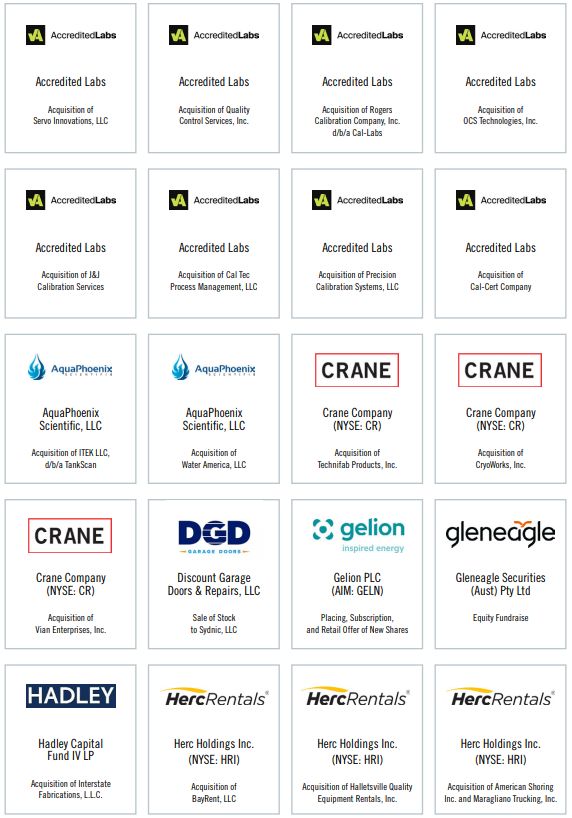

MANUFACTURING AND INDUSTRIALS HIGHLIGHTS

TECHNOLOGY

LEONARDO.AI

We advised innovative generative AI company LEONARDO INTERACTIVE PTY LTD (Leonardo.ai) in its strategic acquisition by Canva, Inc., a globally renowned graphic design powerhouse founded in Australia. Leonardo.ai, an Australia-based platform supported by prominent venture capital firms such as Blackbird and Side Stage Ventures, empowers users to create intricate visual assets through advanced AI technology. Canva, celebrated as Australia's largest private tech entity, offers cutting-edge online graphic design and publishing solutions.

Canva's strategic acquisition recognized the value of Leonardo.ai's robust foundational models, as well as its team of 120 researchers, engineers, and designers. Leonardo.ai will continue to develop its platform, expecting to accelerate its already impressive growth with Canva's backing.

A team of cross-border mergers and acquisitions, emerging growth and venture capital, and tax lawyers managed the transaction. Lawyers from our New York, San Francisco, Sydney, New York, and Palo Alto offices led the deal team, providing crucial advice on US law and related tax structuring.

Leonardo.ai is a distinguished portfolio company of Blackbird, a long-term client of the firm. We previously advised Blackbird on its investments in Leonardo.ai, further solidifying their collaborative relationship.

" K&L Gates proved to be exceptional partners and advisors across every aspect of the acquisition. We operated an accelerated process to complete the transaction in record time, and K&L Gates expertly delivered across all facets of the deal, at speed."

– Chris Gillis, co-founder and CFO of Leonardo.ai

To view the full article click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.