- within Insurance, Media, Telecoms, IT and Entertainment topic(s)

In Dealmaker's Digest, read the top 10 latest developments in global transactions. We offer insights into M&A activity across industries and borders. To receive our M&A thought leadership, please join our mailing list.

Key Takeaways

- Annual global M&A activity in 2024 rebounded significantly from 2023's sluggish deal landscape. Aggregate value of transactions ($100m+) increased 14% across all buyer types, with sponsor-led deals jumping 36% year-over-year.

- Crossborder transactions played a key role for dealmakers in 2024. Inbound U.S. transactions, totaling nearly $350B, jumped 21% from 2023, while outbound U.S. activity rose 18% (surpassing $430B for the year).

- More mega-deals were struck in 2024 compared with 2023; more than 25 U.S. transactions exceeded $10B in value, a 23% increase.

Global M&A Activity Update

1. Deal Value Trends

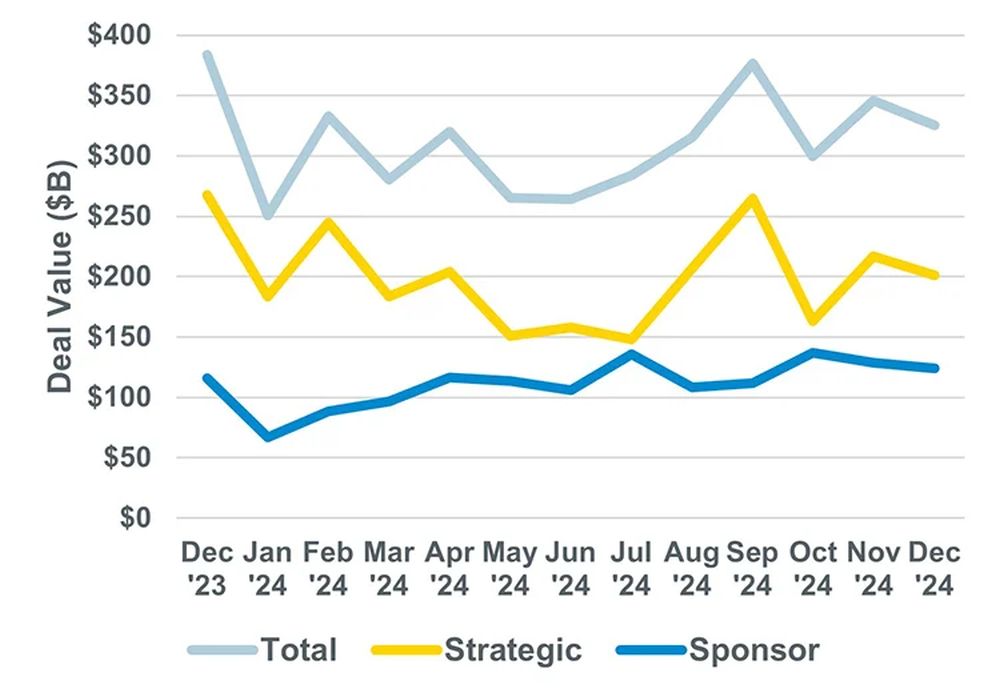

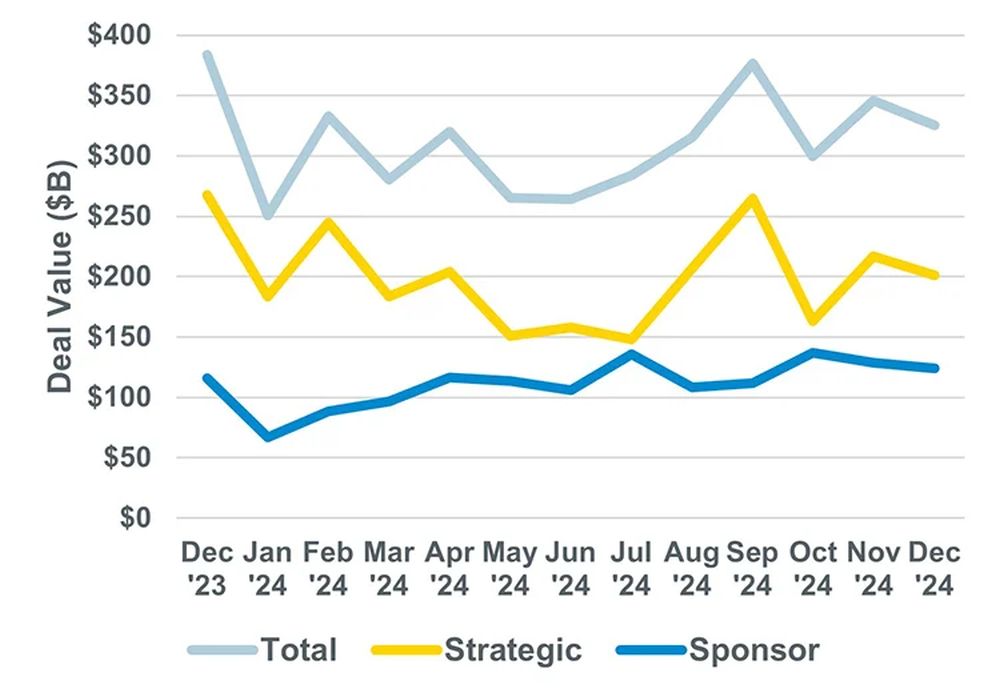

![]() Aggregate global monthly deal

value1 decreased moderately in December, down about $20

billion (6%) from November. Total monthly deal value decreased 15%

year-over-year.

Aggregate global monthly deal

value1 decreased moderately in December, down about $20

billion (6%) from November. Total monthly deal value decreased 15%

year-over-year.

![]() Transactions involving strategic

buyers in December also declined in value (7%) from November.

Strategic deal value in December dropped 25% year-over-year.

Transactions involving strategic

buyers in December also declined in value (7%) from November.

Strategic deal value in December dropped 25% year-over-year.

![]() Financial, or sponsor, buyer

transactions in December held steady, decreasing only 4% from

November, rounding out a comparably steady Q4 for sponsor

acquisitions. Sponsor buyer deal value increased 7%

year-over-year.

Financial, or sponsor, buyer

transactions in December held steady, decreasing only 4% from

November, rounding out a comparably steady Q4 for sponsor

acquisitions. Sponsor buyer deal value increased 7%

year-over-year.

2. Deal Count Trends

![]() Global deal count held steady

from November to December, ticking up 4%, and rounded out the most

active quarter by count for the year. Monthly deal count increased

16% year-over-year.

Global deal count held steady

from November to December, ticking up 4%, and rounded out the most

active quarter by count for the year. Monthly deal count increased

16% year-over-year.

![]() Strategic buyer deal count in

December increased moderately, up 6% from November and 11%

year-over-year.

Strategic buyer deal count in

December increased moderately, up 6% from November and 11%

year-over-year.

![]() Sponsor buyer deal count in

December remained steady month-over-month, decreasing just 1% from

November. However, sponsor deal count rose dramatically (28%)

year-over-year.

Sponsor buyer deal count in

December remained steady month-over-month, decreasing just 1% from

November. However, sponsor deal count rose dramatically (28%)

year-over-year.

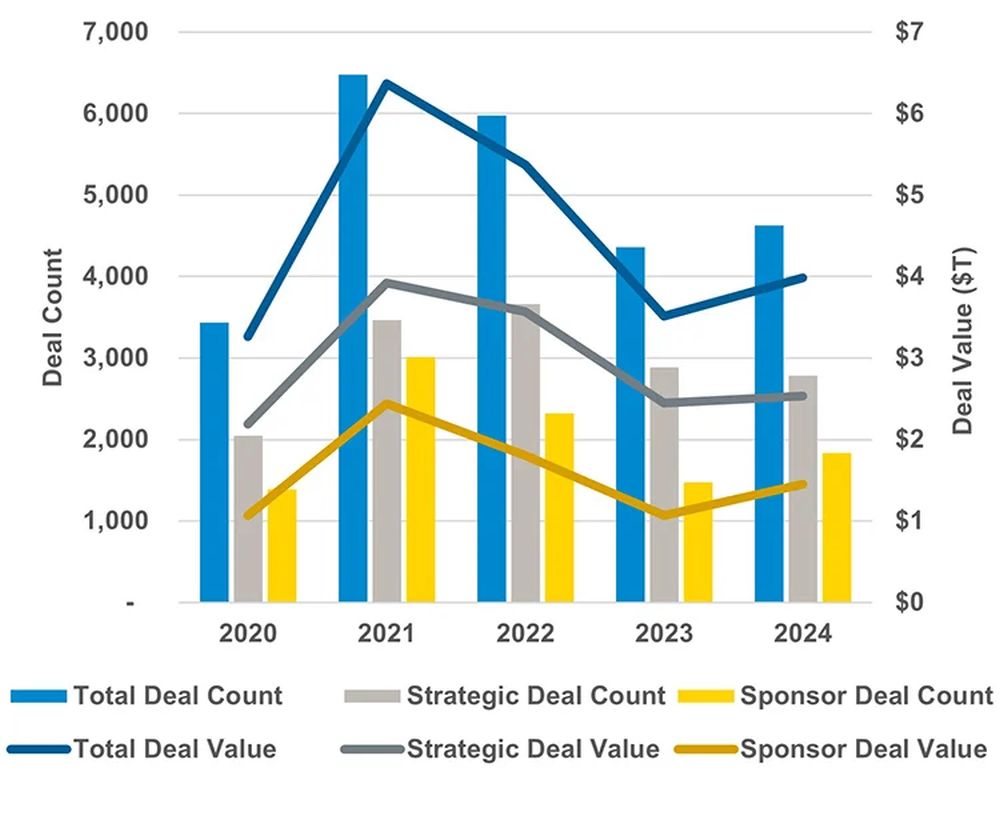

3. Annual Global M&A Activity (Transactions $100M+)

- M&A activity increased in 2024 by nearly all metrics as dealmakers seized opportunities amid more favorable transacting conditions, including consecutive interest rate cuts and tampered inflation.

- Aggregate value of transactions $100m+ increased significantly in 2024 compared with 2023, up 14% across all buyer types. Aggregate value of sponsor buyer deals led the increase with a 36% jump, while strategic acquisitions held steady, up just 4%.

- The number of transactions valued at $100 million or greater increased 6% globally in 2024 vs 2023. Sponsor acquisitions jumped 24% by count, while acquisitions by strategic buyers held steady (declining a marginal 3%).

- The uptick in 2024 M&A activity was a noticeable rebound following consecutive declines in dealmaking since 2021's $6.4 trillion record.

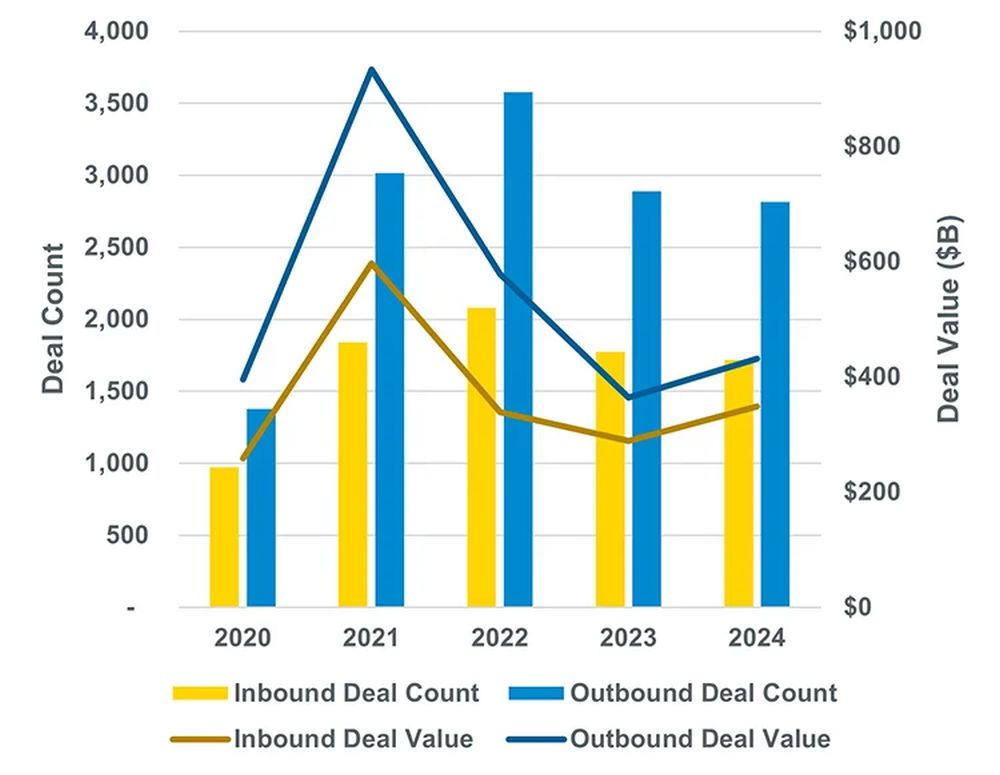

4. Annual U.S. Crossborder Activity

- Inbound U.S. activity in 2024 jumped 21% by deal value from 2023 and held steady by deal count (declining just 3%). The value of U.S. companies acquired by non-U.S. buyers in 2024 totaled nearly $350 billion.

- Outbound activity in 2024 jumped 18% by deal value from 2023 and remained stable by deal count, declining just 3%. The value of non-U.S. companies acquired by U.S. buyers in 2024 totaled over $430 billion.

- Canada-based acquirers drove the most inbound transactions in 2024 (287), followed closely by the UK (278). Japan-based buyers took third at 147 transactions.

- U.S. acquirers most frequently looked to targets in the UK during 2024 (572), with Canada (382) and Germany (198) rounding out the top three ex-U.S. target countries.

Active M&A Industries (U.S. Targets)

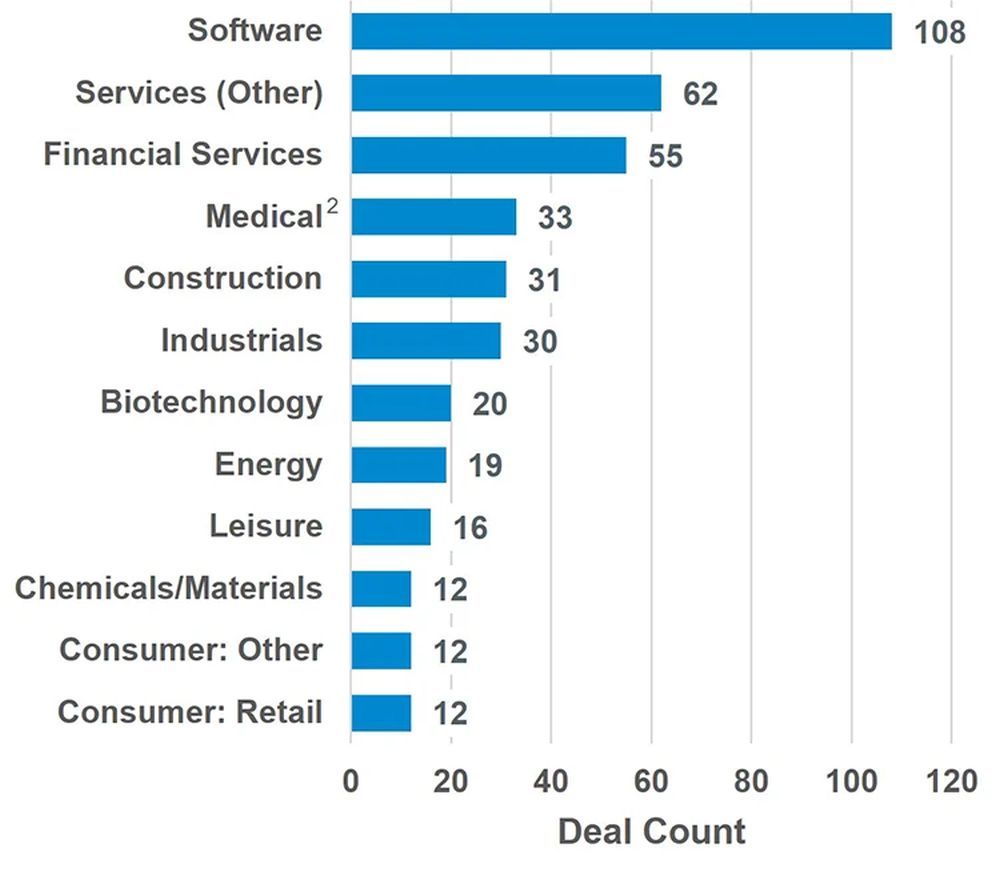

5. By Deal Count

- The software industry once again topped the list of U.S. M&A activity by deal count in December, continuing its streak as the leading industry by volume and rounding out a full year at number one.

- Services industries also remained active, with financial services and other professional services again rounding out the top three sectors in December by deal count.

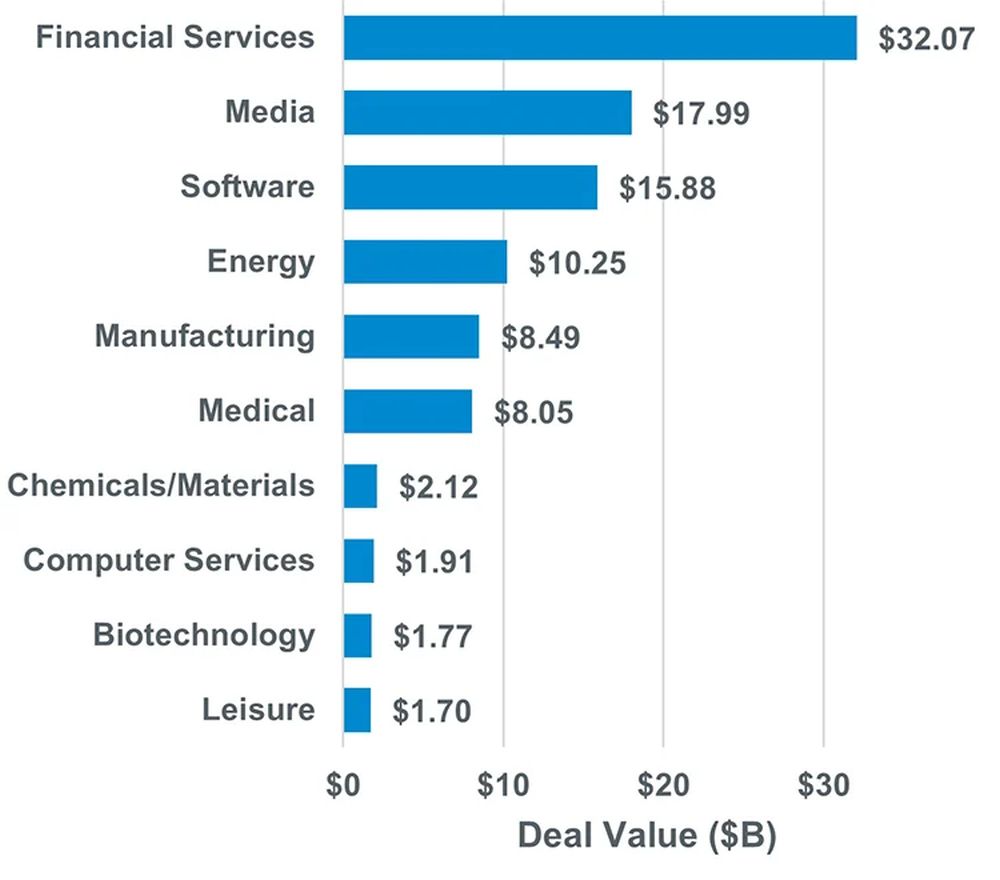

6. By Deal Value

- Financial services was the leading U.S. industry by deal value in December, with two of the five largest deals of the month, together totaling more than $25 billion in deal value.

- Media was the second most active by deal value in December, bolstered by Omnicom's blockbuster acquisition of Interpublic. Software targets were the third most active, at just over $15 billion in deal value.

December Blockbuster Deals

7. Largest U.S. Media Deal

Omnicom Group has agreed to acquire The Interpublic Group of Companies, Inc. in an all-stock transaction valued at approximately $13.75 billion.

8. Largest U.S. Asset Management Deal

BlackRock, Inc. has agreed to acquire HPS Investment Partners, LLC in an all-stock transaction valued at approximately $12 billion.

9. Selected Annual Highlights

More than 35 transactions exceeding $10 billion were announced globally during the year, demonstrative of the comparably favorable market conditions following tempered activity in 2023. Transformative deals were struck in a variety of sectors, including those highlighted below.

| Industry | Target | Buyer | Deal Value |

|---|---|---|---|

| Consumer Goods | Kellanova | Mars, Incorporated | $36 B |

| Financial Services | Discover Financial Services | Capital One Financial Corporation | $35 B |

| Software | ANSYS, Inc. | Synopsys, Inc. | $34 B |

| Media | Paramount Global | Skydance Media and RedBird Capital Partners | $28 B |

| Energy | Endeavor Energy Resources, L.P. |

Diamondback Energy, Inc. | $28 B |

| Pharma | Catalent, Inc. | Novo Holdings A/S | $16 B |

10 .2024 M&A Activity Recap

A snapshot of 2024 metrics, and how they stack up against 2023.

| 2024 | 2023 | Δ% | |

|---|---|---|---|

| Global Deal Value | $3.91 T | $3.49 T | 🡅 12% |

| Global Deal Count | 43,101 | 42,546 | 🡅 1% |

| U.S. Deal Value | $1.77 T | $1.58 T | 🡅 12% |

| U.S. Deal Count | 11,412 | 11,695 | 🡇 2% |

| # of $10B+ Deals (U.S.) | 27 | 22 | 🡅 23% |

Footnotes

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.