- within Litigation and Mediation & Arbitration topic(s)

The year 2022 was a landmark one for private credit, which emerged from the pandemic in robust health having endured its first real test as an asset class.

Faced with new challenges from turbulent public markets, record inflation and rising interest rates, private credit once again proved its resilience as investors favored its timely characteristics of downside protection, floating rates, sizeable equity buffers and pragmatic credit selection.

From the current vantage point, as borrowers increasingly battle with rising prices, supply chain pressures, constraints in the syndicated lending markets and uncertainty in the stability of their relationship banks, private credit is proving an attractive option thanks to its ability to provide flexible, tailored and relationship-based financing at a time of growing liquidity constraints. With the threat of recession looming, and with so many leveraged buyouts having been financed with private debt in recent years, predictions of more widespread distress will put credit funds on the front lines of supporting businesses through the next challenging economic cycle.

Looking ahead, we expect companies facing a myriad of issues around liquidity needs, near term maturities and potential breaches of financial covenants to seek out more creative financing solutions from credit and special situations lenders. In this report, we explore four areas of focus, looking in depth at liability management transactions, opportunities for private debt in growth capital and renewable energy, and the importance of sanctions provisions in loan agreements.

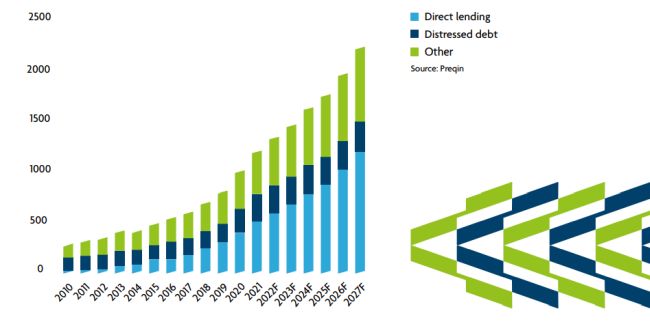

Global private debt assets under management ($bn) by sub-strategy, 2010–2027F

Investors will continue to favor credit funds, and special sits-focused funds in particular, during turbulent times, giving them access to a wall of dry powder. As deal volumes remain stunted, direct lenders will face increased competition for new deals – particularly in popular and traditionally resilient sectors such as health care, business services and software – and we anticipate a diversification of market participants as the asset class grows in response to both investor appetite and sponsor demand.

As we explore in the following commentary, there is a growing appetite for opportunistic credit as borrowers seek to make room for additional debt in existing structures, including from third parties. Sponsors chasing fewer, more complex transactions will look for both senior and junior capital solutions, and will seek lenders able to bridge the gap between equity contributions and secured lending and leverage the benefits of multiple instruments.

We will continue to see structures and documentation become more lender friendly this year, as direct lenders get creative in their support for current deals and shift their role on new deals from providers of primarily growth capital into growing supporters of rescue financing. Such a transition will call on more tools in the capital provider's toolkit, driving the potential for another year of outsized returns.

Liability management grows in prevalence

As the macroeconomic climate shifted in 2022, companies faced a myriad of issues

As the macroeconomic climate shifted in 2022 and companies faced a myriad of issues including liquidity needs, near term maturities and potential breaches of financial covenants under their loan agreements, the need for many borrowers to seek out more creative financing techniques, and to look for flexibility in existing documents, became front of mind.

Liability management transactions, both through which companies transfer collateral away from creditors, and in which one set of creditors are given an advantage at the expense of other, previously similarly situated creditors, have become more common in the U.S. syndicated loan market over the past several years. These transactions enable participating creditors, and offer opportunities for new incoming creditors, to position themselves for any potential upside while reducing downside risk—as well as to deploy capital into the top of the capital structure.

One reason for the growth in these deals has been the increasingly borrower-friendly terms that have made their way into syndicated loan documentation during hotter financing markets of the past several years, and the failure of the syndicated loan market to effectively push back on those terms. In the three years of Covid, distressed sponsors and companies have begun to utilize these flexibilities to consummate transactions that benefit themselves by providing longer runway on their equity investments and certain selected lenders at the detriment of other lenders.

Liability management transactions broadly fall into two buckets: those that transfer assets and collateral away through an unrestricted subsidiary or other nonguarantor subsidiary, and those that see a company work with a subset of lenders to execute a priming financing transaction (often including both new money and a roll-up) that is senior in priority to the existing loans.

These transactions have not so far been widely seen in private credit for several reasons. First, private credit documentation has generally remained more lender friendly than the equivalent in the syndicated market. Further, private credit deals typically involve much smaller groups of lenders and are heavily relationship based.

It now seems likely that liability management will start being more widely used in the European market and will make its way into private credit.

As we step into the evolving market, the prevalence of liability management transactions by sponsors will inevitably impact private credit. In the last six to eight years, private debt has had exponential growth in the LBO market as private credit institutions have taken up increasingly more significant ticket sizes. Historically, liability management transactions have most often involved private equity-sponsored portfolio companies and a large portion of the debt we initially see moving into situations ripe for liability management will be acquisition financings. Private credit funds will need to become more attuned to covenant flexibility, voting rights and other minority lender protections as their credit investments may become distressed.

Glancing ahead, we expect to see deal dynamics evolving as lenders increasingly mobilize and get into groups much earlier on in transaction processes. Sponsors will continue to take a more active role in initiating the organization of lender groups and proposing liability management

transactions, increasingly seeking their own solutions with lenders that may or may not already be in the credit. With the downturn impacting credits through rising interest rates, increasing inflation, supply chain issues and geopolitical instability, more direct lenders will be addressing borrowers facing liquidity issues and equity investors less willing to step up, driving a requirement for more creative financing solutions. Historically, liability transactions have been primarily utilized to address liquidity issues. However, in the upcoming year, we expect sponsors to explore using the tools of liability transactions to potentially address maturity and interest expense issues in a coercive manner.

In the year ahead, creative and opportunistic financing will be a growing feature of the market, as more direct lenders face up to the realization that their role may shift somewhat from growth capital providers to providers of rescue financing. That will drive a change in mindset for many with regards to how they get compensated for risk. Private credit funds will need to be more focused on the provisions in financing agreements that allow for liability management transactions and they should proceed with caution on these points.

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.