Background

Our survey analyzed the terms of 287 venture financings closed in the fourth quarter of 2021 by companies headquartered in Silicon Valley.

Key Findings

Valuation results again reach new record highs

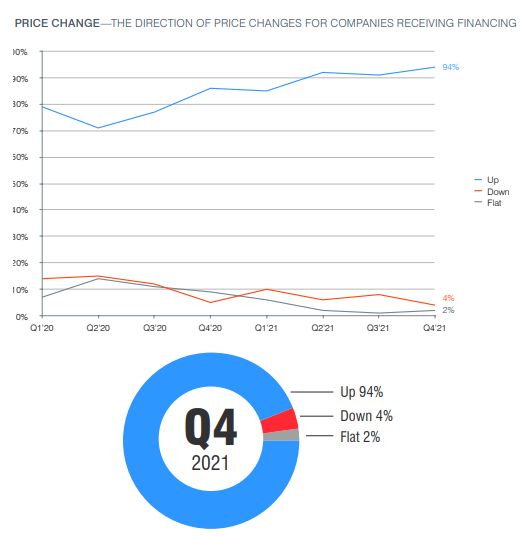

- Up rounds exceeded down rounds 94% to 4%, with 2% flat in Q4 2021, an increase from the previous quarter when up rounds exceeded down rounds 91% to 8%, with 1% flat. This was the highest percentage of up rounds and the lowest percentage of down rounds recorded in a quarter in the history of this survey.

- The Fenwick Venture Capital Barometer" showed an average price increase of 216% in Q4, up from an average price increase of 190% in Q3. The average price increase reached a new record high in every quarter of 2021.

- The median price increase of financings increased from 136% in Q3 to 168% in Q4, also a new record high.

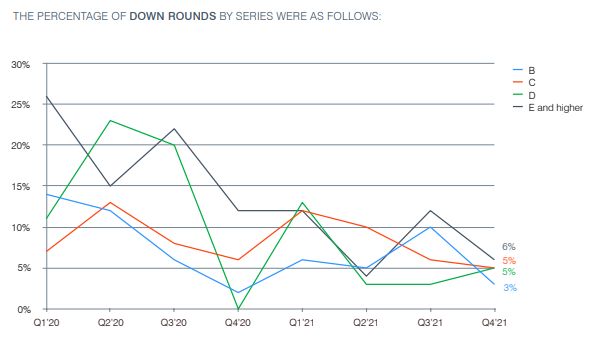

Series B and C financings record historically strong valuation results

- Series B and C financings recorded the strongest valuation results in the quarter and the highest average and median price increases for those series of financings in the history of this survey. Series D and E+ financings, meanwhile, recorded weaker valuation results in the quarter compared to the previous quarter.

Valuation results for life sciences industry weaker compared to previous quarter

- The internet/digital media and software industries again recorded the strongest valuation results in the quarter. Valuation results for the hardware industry recorded the greatest gains in average and median price increases compared to the previous quarter, while the life sciences industry recorded weaker valuation results compared to the previous quarter.

Price Change

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.