- within Corporate/Commercial Law topic(s)

- in European Union

- in European Union

- within Law Practice Management, Tax and Law Department Performance topic(s)

Summary for Founders:

- Lock down the grant date before you promise equity so your strike price lines up with a defensible Fair Market Value ("FMV").

- Get a valuation compliant with Section 409A of the Internal Revenue Code before issuing options and treat it as the document that supports your pricing if questions come later.

- Set the strike price at no less than FMV on the grant date and confirm your equity plan, grant terms and board approvals match that valuation.

- Refresh the valuation after a material event like a financing, major data readout or meaningful commercial deal before you issue new grants.

- Keep your equity records clean with consistent board minutes, grant paperwork and a cap table that matches what was approved.

- Remember that special rules may apply to Founders or other corporate officers who receive incentive stock options ("ISOs").

Why Granting Stock Options Creates Immediate Tax Risk

Because the path to commercialization can stretch over years, you need a way to keep early employees, engineers, scientists and executives motivated while aligning them with the company's long-term success. Cash is usually limited at the early stages, so equity becomes the natural incentive.

Issuing equity, however, carries tax and legal consequences. That is why every founder who plans to grant stock options needs to understand how a Section 409A valuation works. This article explains why the valuation exists, the problems it is designed to prevent and the steps your startup should take to remain compliant.

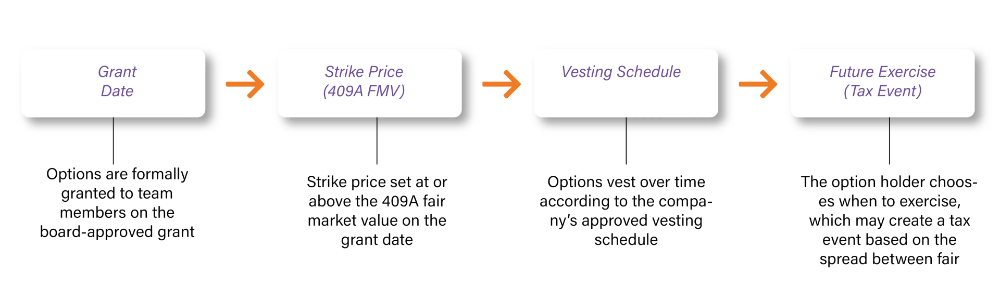

Key Terms and Dates You Need to Have Straight Before Issuing Stock Options

Before you can make sense of valuations, compliance or consequences, you need a clear picture of how Section 409A ties value to specific moments in time. The terms below come up repeatedly and each one matters because of when it applies, not just what it means.

- Grant date

The grant date is when the company takes the final corporate action that actually grants the option, creating a legally binding right with the core terms set. In most startups, that is the board approval date, as long as the approval is final and not conditioned on something else.

- Fair market value ("FMV")

This is the value of the private company's common stock on the grant date, determined through a reasonable valuation process.

- Section 409A valuation

This is the qualified independent appraisal used to support FMV for stock options in early-stage companies. It anchors the exercise price and provides a defensible record under Treasury Regulations issued by the Internal Revenue Service ("IRS"). It is valid for no more than 12 months after its issuance.

- Exercise price or strike price

This is the price the option holder must pay to purchase the company's stock. Section 409A requires this price to be no less than the fair market value on the grant date. Special rules apply to Founders and corporate officers who receive ISOs.

- Vesting date

Vesting determines when an option becomes exercisable. It does not reset fair market value or change the valuation used for Section 409A purposes.

- Material event

Events such as a funding round, a significant change in financial performance or a shift in the business model can invalidate an existing valuation. When this happens, relying on an outdated fair market value, even if it has been calculated within 12 months of the grant, can create noncompliance.

- Exercise date

This is when the option holder actually purchases the stock. Depending on the option type, this date may trigger tax liability, but it does not retroactively affect the Section 409A valuation used at grant.

This framework gives you a timeline to work from. Once these terms and dates are clear, the mechanics of Section 409A and the consequences of getting it wrong become much easier to follow.

What Section 409A Covers and Why It Exists

Section 409A of the Internal Revenue Code ("IRC") is designed to address a specific risk in equity-based compensation, particularly for private company stock options. The provision exists to prevent situations where stock option grants are issued with a strike price that sits well below the company's reasonable FMV.

Absent this rule, a familiar pattern could emerge. A founder or early executive would receive stock options with a very low exercise price. As the private company grows and raises capital, the value of its common stock increases.

When those options are later exercised or sold, the economic gain functions as compensation for services provided but avoids ordinary income treatment under the tax code.

Behind the scenes, that structure allows compensation to be recast as future investment gain while taxes are deferred without a reliable valuation anchor in place.

Section 409A forces a discipline point into that process. If a company issues stock options, the exercise price must be tied to a defensible FMV at the time of the grant, typically supported by a Section 409A valuation prepared through an independent appraisal.

The Consequences of Getting Section 409A Wrong

At a practical level, Section 409A asks you to pause before granting employee stock options and anchor the exercise price to a reasonable FMV of the company's common stock as of the grant date.

For early-stage companies and pre-revenue startups, that valuation must be defensible because there is no public market to fall back on later.

The table below captures what the tax code expects you to do before issuing stock options and the underlying purpose of each requirement.

| What you should do before issuing stock options | The purpose behind the requirement |

| Obtain a Section 409A valuation for the private company's common stock | Establish a defensible FMV that can withstand IRS review and later scrutiny |

| Set the strike price at no less than the FMV on the grant date | Prevent equity grants from functioning as discounted compensation |

| Use an independent and qualified appraisal or valuation firm | Reduce exposure to IRS audits by relying on an up-to-date independent valuation process |

| Confirm the valuation reflects the company's capital structure | Account for preferred stock, common stock and outstanding equity grants |

| Refresh the valuation after a material event | Avoid relying on stale market value following a funding round or other significant change |

When these steps are skipped or handled casually, noncompliance shifts tax liability away from the company and onto the individuals receiving the option grants. That financial burden is the consequence Section 409A is designed to impose.

How Section 409A Penalties Are Triggered

If the IRS determines that your company granted a stock option with an exercise price below FMV, the tax code treats that option as noncompliant deferred compensation. At that point, the issue is no longer about process or intent. The classification attaches automatically under the IRC.

Once an option is treated as noncompliant, the consequences fall on the individual holding the option, not on the private company that issued it. The following results apply to the option holder:

- The deferred compensation must be included in taxable income immediately, even if the stock options have not been exercised and even if no cash has been received. This creates tax liability disconnected from liquidity.

- A Federal tax penalty equal to 20 percent of the deferred amount is imposed under the tax code. This charge is statutory and applies in addition to ordinary income tax.

- Interest accrues on the underpayment, calculated from the year the compensation should have been taxed. Depending on where the option holder resides, State penalties may also apply.

For early-stage companies using equity compensation to retain talent, this outcome turns stock option grants into a financial burden for employees rather than an incentive.

Common Compliance Traps That Hurt Founders and Their Teams

The traps below show up in early hires, advisor negotiations and board approvals. Each one can trigger penalties for the company and its team.

- Strike price set below FMV

This happens when the company uses an expired valuation or guesses at the price. A strike price that is too low creates immediate taxable income for the recipient.

- Granting options before the board approves them

The IRS follows the grant date, not the offer date. If valuation changes between those dates, the strike price can fall below the FMV.

- Issuing options after the valuation has expired or after a material event

Once the valuation is stale, every new grant becomes a Section 409A problem.

- Missing or inconsistent board minutes

Investors and auditors expect the strike price to match a valuation approved by the board on a specific date. Gaps and inconsistencies weaken the company's compliance record.

Why Startups Need a Section 409A Valuation

If you issue stock options as a startup founder, Section 409A of the IRC requires that those options be priced at FMV or higher on the grant date. A Section 409A valuation exists to document that value in a way that aligns with IRS requirements and can be defended later if reviewed. ISOs issued to Founders or corporate officers must be priced at no less than 110% of FMV and can have a term of no more than five years.

The valuation supports the exercise price of employee stock options by establishing the FMV of the private company's common stock at a specific point in time. Without that anchor, equity compensation can be treated as discounted deferred compensation, which exposes option holders to immediate taxation and tax penalties.

A proper Section 409A valuation reflects where the company actually stands. It considers financial performance, the company's capital structure and how the business compares to other companies in the market. Depending on the company's stage and business model, the valuation provider may rely on different appraisal methods.

Types of Section 409A Valuation Methods

Common valuation approaches include:

- Income approach

This method estimates value based on expected future cash flows, often using a discounted cash flow model. It is more common once the company has revenue visibility or credible financial projections.

- Market approach

This method looks at comparable companies and recent transactions to estimate market value. It is often used when there is relevant data from similar private or public companies.

- Asset approach

This method focuses on the value of the company's underlying assets and liabilities. It is more typical for very early-stage or pre-revenue startups where cash flow is not yet meaningful.

Once completed, a Section 409A valuation is generally relied on for up to twelve months. That reliance period can end sooner if a material event occurs, such as a funding round or a significant change in company performance. As a founder, monitoring those developments is part of maintaining compliance as the company grows.

Material Events That Can Require a New Section 409A Valuation

| Event | Does the company need a new valuation? |

| Closing a new financing round | Yes. A priced financing resets the FMV and makes any prior valuation unreliable |

| Announcing significant scientific or technical data | Yes. Data readouts, validation results or technical breakthroughs materially change valuation assumptions |

| Entering a commercial partnership or licensing deal | Yes. Commercial agreements often increase perceived value, revenue potential or technical credibility |

| Achieving a major product, regulatory or Research & Development ("R&D") milestone | Yes. Milestones such as Investigational New Drug ("IND") acceptance, prototype completion or regulatory designations typically shift valuation |

| Receiving acquisition interest or signing a letter of intent ("LOI") | Yes. Mergers and Acquisitions ("M&A") discussions signal new value expectations and invalidate the old valuation |

| Material changes in financial performance | Yes. Large revenue changes, cost structure shifts or revised projections require a valuation refresh |

| Hiring waves planned within the next few months | Maybe. If the current valuation is approaching the 12-month safe harbor limit, refresh it to help avoid granting options with an expired valuation |

| Routine operations with no major milestones | No. If nothing material has changed, the current valuation remains valid for up to 12 months |

| Minor internal developments that do not affect financial or scientific expectations | No. If the change does not alter market perception or financial expectations, the company can rely on its existing valuation |

What Investors Look for During Diligence

Investors view your Section 409A history as a window into how disciplined the company is. A clean valuation record tells them the business is managed with structure. A broken or inconsistent record signals avoidable risk.

| Clean record | Red flag record |

| All equity grants documented and signed | Missing or unsigned option grants |

| Cap table matches board approvals | Cap table does not match what investors were told |

| Section 409A valuation current and unbroken | Expired valuation or grants issued after a material event |

| IP assignments signed by all founders and key contributors | Missing IP assignments or unclear ownership rights |

| Corporate minutes up to date | Missing minutes or retroactive board approvals |

How Crowley Law LLC Helps Startups Maintain Clean Equity Practices

Crowley Law LLC works with founders to structure equity programs that hold up under investor scrutiny and align with Federal tax requirements. We focus on the details that early-stage companies often miss so option grants remain clean, compliant and defensible.

Our work typically includes:

- Valuation timing and option grants

We help you align each option grant with a current Section 409A valuation, so strike prices reflect FMV requirements and reduce avoidable tax exposure for your team.

- Equity documentation and approvals

We review equity plans, grant forms and board approval processes to confirm that each option is properly authorized and consistently documented.

- Governance practices around equity

We help you maintain accurate cap tables, consistent board minutes and clear records of all equity activity so diligence does not surface gaps or inconsistencies later.

Our role is to help you build an equity foundation that supports hiring, growth and capital raising without hidden compliance risk.

FAQs

| What Does a 409A Valuation Mean? | A 409A valuation is an independent appraisal of the FMV of a private company's common stock, prepared to comply with Section 409A of the IRC. You use this valuation to set the exercise price for stock options so that equity compensation is not treated as discounted deferred compensation under Federal tax rules.For founders, the practical purpose of a 409A valuation is to establish a defensible strike price for employee stock options at the time of grant. |

| What Is the Valuation of a Company if 10% Is $100,000? | If 10% of the company's equity is valued at $100,000, the implied total company valuation is $1,000,000.This calculation reflects a simple proportional valuation. In practice, how that number is used depends on context, such as whether the valuation refers to preferred stock or common stock, whether it reflects a financing round and how the company's capital structure is organized. A Section 409A valuation focuses specifically on the FMV of common stock, not headline ownership percentages alone. |

| Is a 409A Valuation Required for Every Company? | A 409A valuation is required for companies that issue stock options or other forms of equity-based compensation and want to comply with Section 409A. If you are not issuing stock options or other forms of equity-based compensation, the requirement does not apply. For early-stage startups that use equity to compensate employees, advisors or executives, obtaining a 409A valuation is the standard way to establish FMV and reduce exposure to IRS penalties. |

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.