- with Finance and Tax Executives and Inhouse Counsel

- with readers working within the Automotive, Business & Consumer Services and Law Firm industries

With just weeks before the school year begins, families are making hard choices about their footwear purchases. Tariff-induced sticker shock is real, and it's hitting where it hurts most: the checkout line.

NEW YORK (July 16, 2025) — As summer break winds down, U.S. families are facing a triple threat to their wallets: rising tariffs, deepening household debt, and a volatile economic backdrop that's reshaping how America shops for back-to-school staples—including footwear.

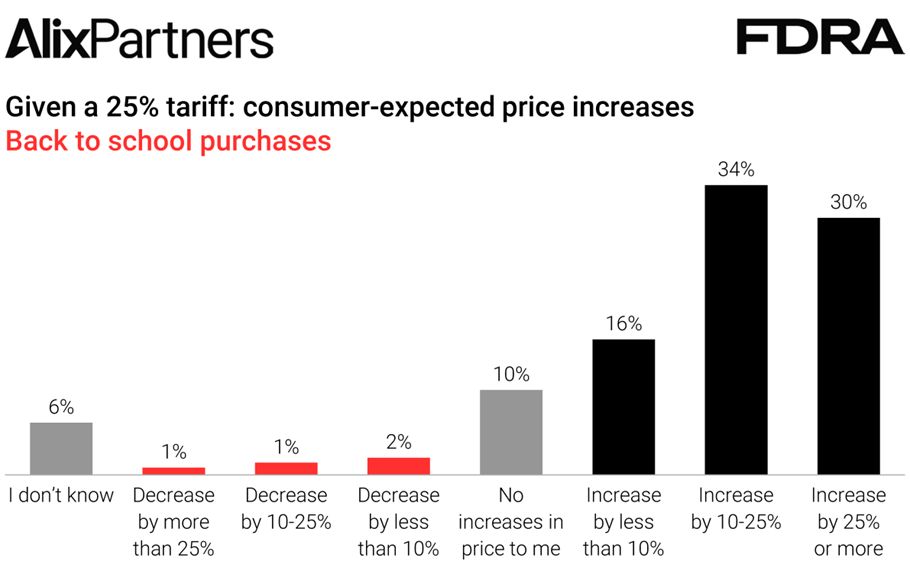

The 2025 AlixPartners U.S. Consumer Footwear Survey, in partnership with the Footwear Distributors and Retailers of America (FDRA), showed 80% of consumers expect to pay more for children's shoes this fall, with more than half citing tariffs as the key driver. The survey, which polled over 1,000 U.S. consumers in June, highlights a worrying shift in consumer behavior just as retailers enter one of their most critical sales seasons.

"Families are stuck," said Bryan Eshelman,

Partner & Managing Director at AlixPartners.

"They're trying to spend less, but shoes are getting more

expensive. That tension is forcing retailers into a dangerous

balancing act—raising prices just enough to protect margins

but not so much that they scare customers away."

Sticker shock and shrinking margins lead to trading

down

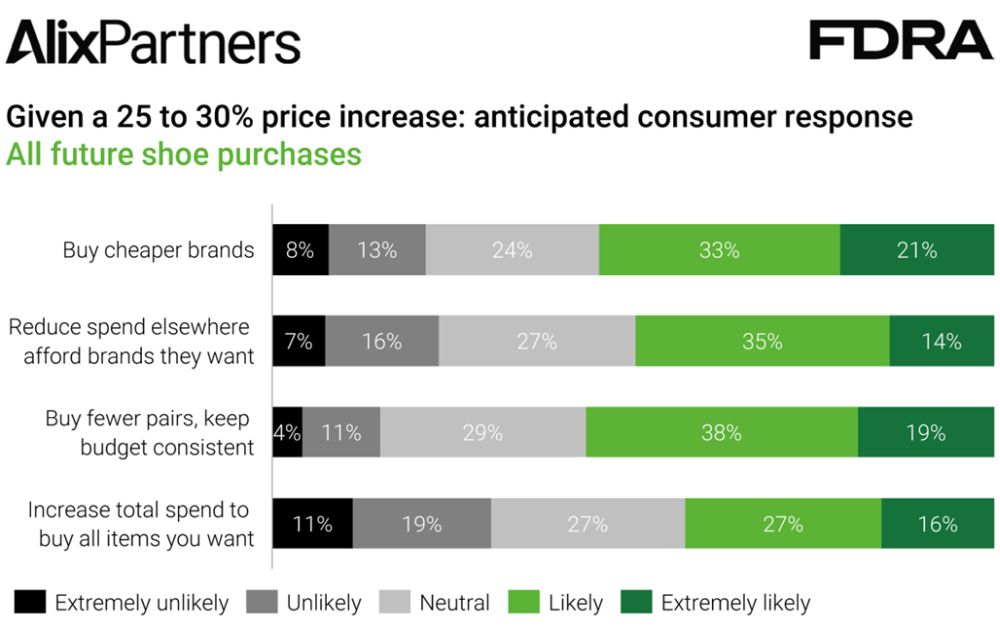

AlixPartners' survey reveals that half of all consumers expect

footwear prices to increase, but that brands and retailers will be

absorbing at least a portion of cost increases. What's more,

consumers are trading down in their footwear purchases and seeking

quality and versatility in fewer purchases. Faced with a

prospective price hike of 25% or more, 21% are "extremely

likely" to buy cheaper brands; over half are

"likely" or "extremely likely" to trade down.

Indeed, 54% of respondents said they were actively switching brands

to manage costs, up from just 39% two years ago. And 3 in 10 are

delaying purchases, hoping for late-season sales to ease the

financial pinch.

"The debt burden is no longer hypothetical," Eshelman noted. "It's shaping how consumers behave in real-time. We're seeing families make trade-offs not just between brands, but between buying shoes and paying bills."

Winners, losers, and wild cards

Brands that offer value without compromising on comfort or

style—particularly in the athletic and casual

categories—are poised to win. Survey respondents showed a

strong preference for retailers offering buy-now-pay-later options,

loyalty rewards, and real-time price comparison tools.

"Footwear retailers are stuck between a rock and a hard place," said Matt Priest, President and CEO of the FDRA. "Tariffs raise wholesale costs across the board, but consumers aren't willing—or able—to absorb those increases. That leaves retailers squeezed on both sides, eroding margins and forcing tough decisions on inventory, pricing, and sourcing."

Meanwhile, luxury brands and fashion-first retailers may be in

for a rude awakening. Among Gen Z and Millennial parents, 73% say

they'll skip trend-driven styles in favor of "durability

and price." Even brand loyalty is under pressure, with only

28% of shoppers saying they'll stick with their usual brands

"no matter what."

"Every footwear brand and retailer is battling for relevance

in a market that's saturated, price-sensitive, and deeply

impacted by geopolitical risk," said Priest.

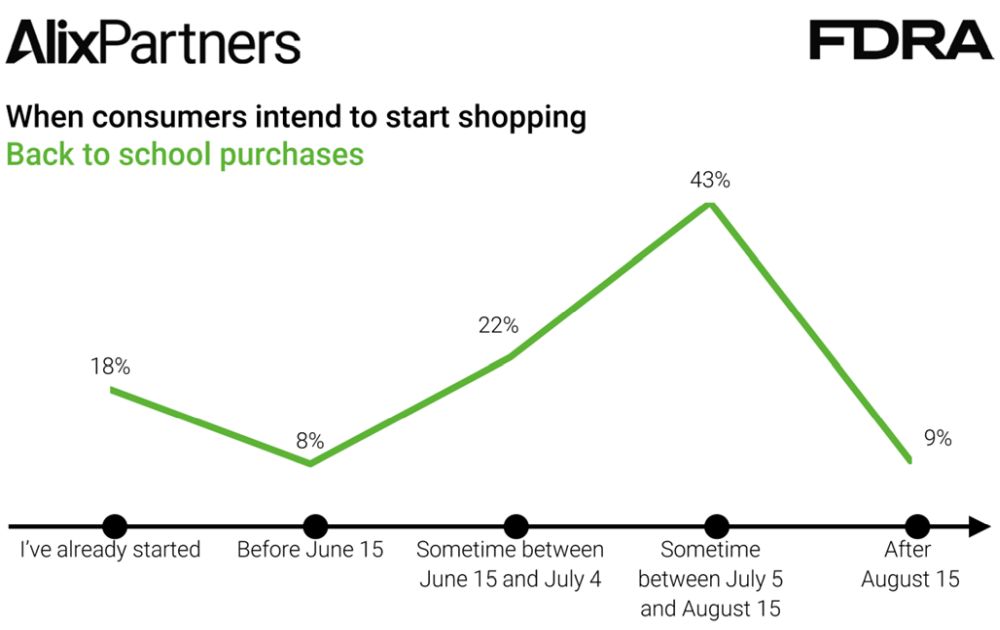

Consumers shopped back-to-school early, spooked by tariffs and inventory gaps

Nearly half of respondents planned to finish BTS footwear shopping before July 4. This represents an early kick-off to school shopping, typically thought to peak in July and August, driven by concerns over rising prices.

That spending pulled forward could in turn cut into holiday spend. Concern over budgets was evident: price showed up as the top driver of a purchase (and the only factor to see an increase in interest over last year) as well as one of the top determining factors for where consumers will shop. Seventy-seven percent of respondents said "absolute lowest prices" was a major factor in their choice of store (online or in person), up from 74% in 2024.

The China question and looming

uncertainty

Driving much of this volatility is the uncertain global trade

environment, with imports accounting for 99% of U.S. footwear

sales. Recent escalations in U.S.-China trade tensions have revived

fears of new tariffs—particularly on categories like

footwear, which remain heavily reliant on Chinese manufacturing.

Currently, over 70% of shoes sold in the U.S. are imported from

Asia, and more than 40% still come from China alone.

Retailers must adapt—or fall behind

AlixPartners' Eshelman concludes that adaptability is key:

"Retailers must get smarter about promotions, inventory

management, and personalization. The days of one-size-fits-all

seasonal

marketing are over. To thrive in this back-to-school season, brands

must operate with surgical precision.

"Given the potential shortage of inventory, it will be important to retailers to have accurate and timely inventory visibility to fulfil consumer needs through omnichannel methods—store to store transfer, ship from store, ship from distribution center to customer. Otherwise, they risk disappointing the customer which can have a lasting impact. As retailers think about pricing and promotional strategies, it will be important that they have a view of what their competitors are doing to avoid standing out in a negative way from a pricing perspective."

About the AlixPartners U.S. Consumer Footwear Survey

Conducted in June 2025, the survey polled more than 1,000 U.S. consumers (ages 15 and above) across regions, age groups, and income levels.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.