Keith Jelinek’s articles from Ankura Consulting Group LLC are most popular:

- with Finance and Tax Executives

- with readers working within the Advertising & Public Relations and Healthcare industries

Summary

- Consumer debt reached a new high in Q1 –

passing $17 trillion for the first time ever, despite a slowdown in

new mortgage loan originations

- Over the last year, rate of loans moving to delinquency (30+ days) has increased for auto, credit card, and mortgage loans

- Revolving credit debt continues to climb, increasing 14.1% vs. last year

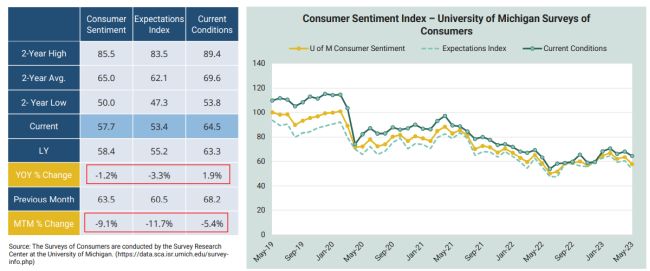

- Consumer sentiment took a nosedive in May, dropping over 9% MTM, hitting its worst level since the historic low last June; consumers are worried about the economy amid a rash of negative news – especially concerning the standoff regarding the debt crisis standoff

- Retail sales were again disappointing –

April sales increased 4.3%, well below core inflation rate of 5.5%

and MTM sales increased just .6%

- Food services and drinking places were up 9.4%

- Other than non-discretionary categories and e-commerce, most key retail segments experienced YOY sales declines in April

- The Consumer Price Index increased 4.9% YOY,

with Core CPI up 5.5%. The index for shelter was again a large

contributor to the monthly all items increase, as was price

inflation for food at and away from home

- Retail gas prices continue to decline, down 18% YOY to $3.64 / gallon nationally through mid-May vs. $4.43 last year

- Air travel continues to increase among U.S.

travelers; year-to-date, TSA checkpoint numbers are up 16.6%

- The cost of air travel declined 2.4% MTM, and was nearly 1% lower than last year

- 30-year FRM rate of 6.35%, above last year's rate of 5.3%; 15-year rate at 5.75%

- Global supply chain pressures decreased in April, with significant downward impact from Euro delivery times, stocks of purchases, and Korean delivery times; recent downward trend has been driven by improvements in Euro Area delivery times

- Inventories for March were 8.2% above 2022;

companies continue to work thru excess, cutting outstanding orders

with a meager outlook to the balance of the year

- With poor April sales, retailers must examine 2nd half of the year receipt and sales plans to ensure they align with current sales trends and account for the impact of increasingly cautious consumers

- The current economic environment and low consumer sentiment is impacting how much consumers are willing to spend on non-essentials; retailers will need to sharpen their promotional focus, optimize inventory allocation, and closely manage expenses

Key Consumer Metrics

Consumer Sentiment Index

Consumer sentiment dropped over 9% MTM, hitting worst level since the historic low last June; consumers are worried about the economy amid a rash of negative news – especially concerning the debt crisis standoff

To view the full article click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.