- with Senior Company Executives, HR and Finance and Tax Executives

- in China

- with readers working within the Accounting & Consultancy and Business & Consumer Services industries

Key Takeaways:

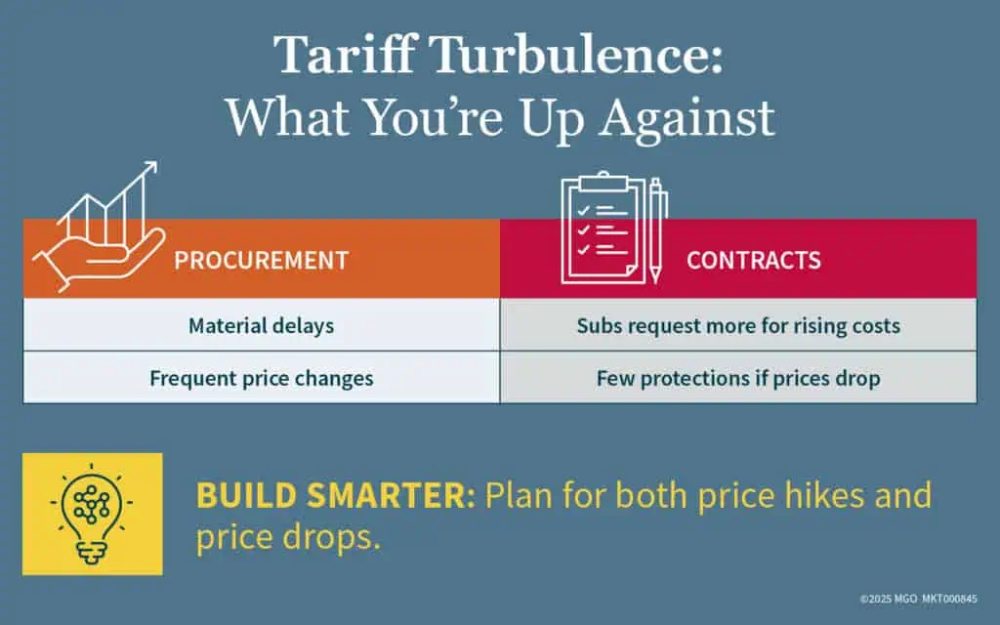

- Tariffs and global uncertainty are driving up construction hard costs and disrupting material sourcing and timelines.

- Developers and contractors are responding by rethinking supplier relationships, stockpiling inputs, and tightening contract language.

- Legal and accounting professionals play a key role in helping you manage financial risk, secure financing, and monitor vendor compliance.

In today's construction market, tariffs change fast — and so do your costs, contracts, and supply chain risks. One week, your project inputs are tariffed at 25%; the next week, that rate drops to 10%. This type of volatility is no longer the exception, it's the new norm.

As of mid-2025, tariff policy remains in flux. While electrical components, steel, and Canadian lumber remain hot-button items, the broader concern is uncertainty.

"Uncertainty causes a hold or freeze in decision making," said Eric Paulsen, chief operating officer of commercial real estate firm Kidder Mathews. "With the fluctuation in pricing, contractors used to provide a quote that was good for months, now it's only good for a week ... if not days."

So, what does this mean for your bottom line — and how can you adapt your contracts, purchasing, and financial planning to respond?

How Tariffs Are Hitting You on the Developer Side

Tariffs are directly affecting hard costs and disrupting the procurement process, especially when it comes to internationally sourced materials like steel and electrical equipment. According to Paulsen, delivery delays for items like electrical transformers and panels have become more severe. Even before recent escalations, delays were stretching out to 12 months or greater — meaning materials had to be ordered before final plans were approved just to stay on schedule.

Paulsen added that uncertainty is now adding "an extra layer of scrutiny" to every purchasing decision.

Practical Steps Developers Are Taking

To mitigate the risk of tariffs, some developers are taking proactive steps, such as:

- Buying in advance or keeping materials on hand: While this can be "brutal for smaller shops," it's a practical move to hedge against volatility.

- Seeking out new sourcing options: Paulsen noted that smaller countries like Cambodia are trying to modernize and enter the manufacturing game, though that's still a longer-term shift.

- Preparing to shift suppliers: "Long-time relationships between contractor and supplier are now at risk," he said. For some firms, the current environment is "a great time to usurp a previous relationship."

Ultimately, Paulsen warned that "development at its core has to pencil or the development won't happen." Unless it's a government or public-use project or a user-driven build-to-suit, many speculative projects are currently on hold.

Best-Case Versus Worst-Case Scenario

Moving forward, Paulsen describes the best-case scenario as "stability or at least a sense that the worst is over, so people can make some decisions." The worst-case scenario? Basically, more of the same: "Flip flopping, start/stop, or anything that causes uncertainty."

For developers to fully participate in the market, they need to have a sense of where things stand.

"We need the rules of the road," Paulsen said. "With some final stability, people will figure out the new market measures and re-engage. Until then people who can wait, will."

On the Legal Side: Modernizing Your Contracts

If you haven't revisited your contracts in the last few years, now's the time.

Derek Weisbender, a construction partner at Allen Matkins, a law firm with deep roots in real estate, noted that it's typical for certain contracts to allow contractors to request more money when there's an unanticipated change in law (such as a new tariff) that makes performance more expensive. The burden is on vendors to support their claims.

He said there is an "obligation on vendors [to] show baseline costs as of the contract date." That serves as support to validate future price fluctuations. Without that transparency, disputes are more likely. But if the backup is built in, you're better positioned to make your case — whether costs go up or down. But what's newer, and not often considered, is a reciprocal clause that protects an owner or developer when the opposite occurs (such as when a tariff is rescinded).

"Sophisticated owners are using the baseline tariff cost to claw back savings when tariffs are avoided," Weisbender noted. In other words, if tariff costs are ultimately avoided, the owner or developer can negotiate a partial refund or cost adjustment. Some contractors may disagree. But, as Weisbender explained, "it seems fair that if an owner should bear the burden of a tariff increase, they should likewise enjoy the savings of a tariff decrease."

The Role of Your Accounting and Finance Team

Adapting to volatility isn't just a legal or operational issue. It's a financial one, too.

If you're considering strategies like prepayment, early ordering, or warehousing materials, you may need short-term capital — and that requires careful planning and documentation. Accountants can help you:

- Model out cash flow scenarios to support big-ticket pre-buys

- Prepare the financial reporting needed for loan applications, especially if you're approaching lenders outside your primary bank

- Support compliance monitoring for tariff-related contract provisions, validating vendor costs and identifying irregularities

While accountants can't give legal advice, they can offer critical support when it comes to making your financial strategy align with your contract protections.

Your Next Move: Reassess Your Risk and Recheck Your Language

Tariff policy is beyond your control. But how you plan, purchase, and protect your interests isn't.

If you're a developer or general contractor:

- Talk to your lawyer about updating your contracts to include cost claw-back provisions

- Evaluate whether you need to shift suppliers or purchase materials in advance

- Engage your accounting team to model cash flow, validate vendor inputs, and support financing conversations

If you're relying on old contract templates or handshakes, you could be leaving money on the table, or absorbing unnecessary risks.

In today's market, your success depends on staying agile, informed, and well-supported.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.