- within Accounting and Audit topic(s)

Over half of US Fortune 1000 companies face class action claims each year. Corporate legal defence costs in the USA were estimated to exceed $3.6 billion in 2022 alone.

Class actions have been a feature of the litigation landscape in the USA for decades. Claimant-friendly procedures combined with an aggressive and well-funded plaintiffs' bar have created fertile ground for these large, long-running and often high-profile cases.

These trends are no longer confined to the USA. The growth of group litigation in the UK and Europe over recent years has been exponential, and its significance to businesses as a key corporate risk will only continue to increase.

This growth is partly driven by a greater legislative and judicial openness to mass claims, including in particular the broader acceptance of so-called "opt out" mass claims, where claimants can bring a representative action on behalf of a "class" of potential claimants, without seeking the consent of all claimants.

In parallel, the litigation funding market is booming in the UK and Europe. Funders and claimant law firms are working together to pursue novel claims that previously would not have been economically feasible.

UK litigation funder assets have increased from just under £200 million in 2011 /2012 to £2.2 billion in 2020/2021.

The value of the litigation funding market in the EU was estimated to be €1 billion in 2019, with this projected to reach €1.6 billion in 2025.

As a result, mass claims are now affecting almost every industry sector, and claimant law firms continue to develop innovative case theories to impose liability in new areas.

WHO IS AT RISK?

Claims are being brought against businesses across all sectors, for a wide variety of alleged wrongdoing—no longer is the focus on defective products or catastrophic events.

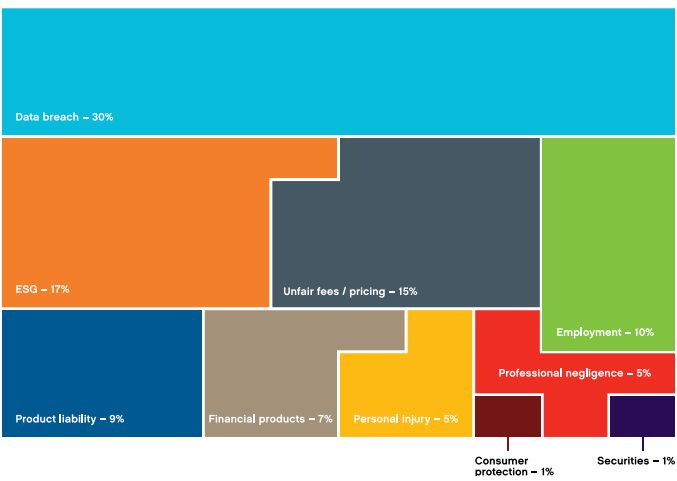

A survey of the claims being advertised by the most prominent claimant law firms in the UK as of August 2023 shows the types of claims—both actual and anticipated—which are currently being targeted.

Claims relating to employment, product liability, financial products, antitrust and personal injury continue to be mainstays of group litigation. But in recent years we have seen a significant growth in both data-related and ESG-related class actions. This trend looks set to continue.

We are seeing a wave of claims based on alleged breaches of obligations relating to the use, processing and storage of personal data. Many companies are "data controllers" for GDPR purposes—and therefore subject to stricter processing requirements—without necessarily realising it, which makes the threat of this litigation even more pronounced. Cyberattacks often give rise to compensation claims in the UK, such as the recent group action against British Airways by 16,000 claimants following an incident in 2018 in which personal data belonging to over 420,000 customers and employees was unlawfully accessed1.

Similar trends are being seen across Europe. In the Netherlands, for instance, claims relating to the alleged misuse of personal data (often in contravention of GDPR obligations) have been, or are being, brought against Meta2, TikTok3, Google and Oracle4.

Environmental incidents are an obvious source of ESG-related group litigation risk. For example, the UK courts are already handling a claim from hundreds of thousands of claimants arising out of the collapse of the Fundao Dam, in one of the largest group claims in English legal history5. The "S" in ESG is also giving rise to group litigation, with the Dyson Group facing claims of forced labour and dangerous working conditions brought by a group of Malaysian factory workers6, and Tesco plc defending a claim brought by a group of workers in its Thai factory7. Allegations of greenwashing in market statements, or share price falls following revelations about environmental performance, may also form the basis of claims by groups of investors or shareholders that they relied on untrue or misleading statements.

The same pattern is apparent in Europe. The Dutch courts have also recently dealt with high-profile group actions against Shell8 (in which six NGOs, alongside 17,000 individuals, successfully obtained a ruling at first instance requiring the oil and gas giant to reduce its worldwide aggregate carbon emissions by net 45% by 2030, relative to 2019 levels) and KLM9 (for alleged greenwashing).

Click here to continue reading . . .

Footnotes

1. Case no. QB-2020-000208.

2. Court of Amsterdam, 15 March 2023, ECLI:NL:RBAMS:2023:1407.

3. Court of Amsterdam, 9 November 2022, ECLI:NL:RBAMS:2022:6488.

4. Court of Amsterdam, 29 December 2021, ECLI:NL:RBAMS:2021:7647.

5. Municipio de Mariana and others v BHP Group plc and another [2022] EWCA Civ 951.

6. Case no. QB-2022-001698.

7. Case no. QB-2022-000220.

8. Court of The Hague in first instance, 26 May 2021, ECLI:RBDHA :2021:5339.

9. Court of Amsterdam, 7 June 2023, ECLI:NL:RBAMS:2023:3499.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.