The United States Department of Treasury's Office of Financial Research (OFR) conducted a pilot survey to determine why primary dealers prefer trading in the noncentrally cleared bilateral repurchase agreement (NCCBR) market segment of the United States repurchase agreement (repo) market. Primary dealers serve as the trading counterparties for the Federal Reserve's open market operations. The OFR Brief suggests primary dealers prefer to trade in NCCBR over other repo market segments because it provides them with much greater flexibility.

U.S. Repo Market Segments

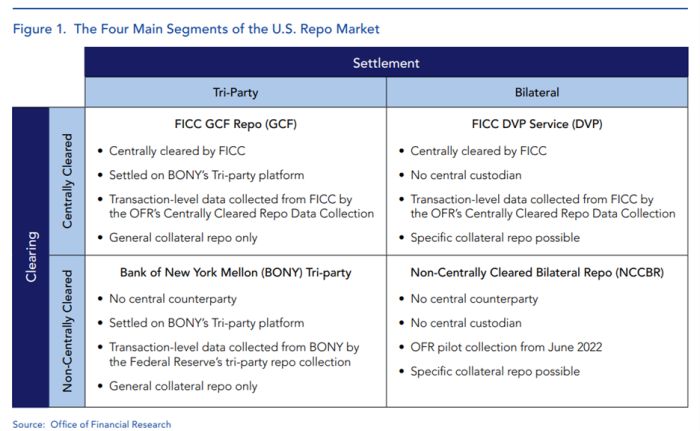

The OFR Brief includes the following table dividing the U.S. repo market into four segments:

The OFR concludes that "the NCCBR segment [is] the largest of the four segments of the repo market in terms of gross repo exposure by primary dealers." The large volume of trades in the NCCBR is puzzling not only because of the market segment's opacity but also because the centrally cleared market segments offer compelling benefits to repo market participants such as reducing counterparty risk and balance sheet netting. With the goal of acquiring a better understanding of the market segment, the OFR analyzed pilot data on NCCBR trades from nine dealers over three reporting dates in June 2022.

Netted Packages Drive Zero Haircut Transactions

The most significant finding from the OFR's survey is that the absence of haircuts and use of "netted packages" are the primary drivers of large NCCBR trade volumes. In a "netted package" a primary dealer and hedge fund enter into a repo and reverse repo with the same tenor but different Treasury securities. For example, a hedge fund could enter into a repo in which it sells a Treasury security with a market value of $102 to the primary dealer for a price of $100 and then use the $100 to acquire a different Treasury security with a market value of $102 in a reverse repo with the same dealer. If the hedge fund sells this second Treasury security short, then it will profit if the price of this Treasury security falls and the price of the first Treasury security increases, remains unchanged, or does not fall by as much. The overall return from the netted package will be positive if this profit exceeds the spread of the repo rate charged by the dealer over the reverse repo rate paid by the dealer.

The $2 difference between the market value of the Treasury securities and the price represents the standard 2% "haircut" applied to market values in Treasury repos. In a netted package, the haircuts cancel out so that the return of the $102 Treasury security in the reverse repo is effectively secured by the $102 Treasury security delivered to the dealer in the repo. Insofar as the haircut would not result in either party being overcollateralized (i.e., holding a security with a market value greater than the security it is owed) the parties forgo the haircut entirely. Data from the OFR's survey suggest the use of netted packages contributes to the prevalence of zero haircut transactions in the NCCBR as nearly three-quarters of repo with hedge funds occurring at zero haircut do net.

Although the OFR suggests netted packages drive the large trading volumes in the NCCBR, they are not unique to the market segment. Netted packages are "naturally" netted for balance sheet purposes and are also a benefit of central clearing. However, because netted packages occur in NCCBR, the OFR posits that there are limited balance sheet benefits to moving trades from NCCBR to centrally cleared market segments. Therefore, dealers continue to trade in the NCCBR market segment because they benefit from netted packages in addition to having greater flexibility in contract terms, discussed below.

Other Reasons Dealers May Prefer NCCBR to Other Market Segments

The OFR's survey suggests other factors may also contribute to primary dealers' preference to trade in NCCBR over the other U.S. repo market segments. One factor is that a wider variety of collaterals are available for use in NCCBR compared to centrally cleared market segments. Virtually any security can serve as collateral in the NCCBR whereas centrally cleared market segments are limited to Treasury and non-mortgage-backed agency securities. Another factor is that the segment allows dealers to enter into repos with longer-tenors than centrally cleared repos.

*The authors wish to acknowledge the contributions of summer associate Stephanie Flynn.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.