- within Tax topic(s)

- in United States

- in United States

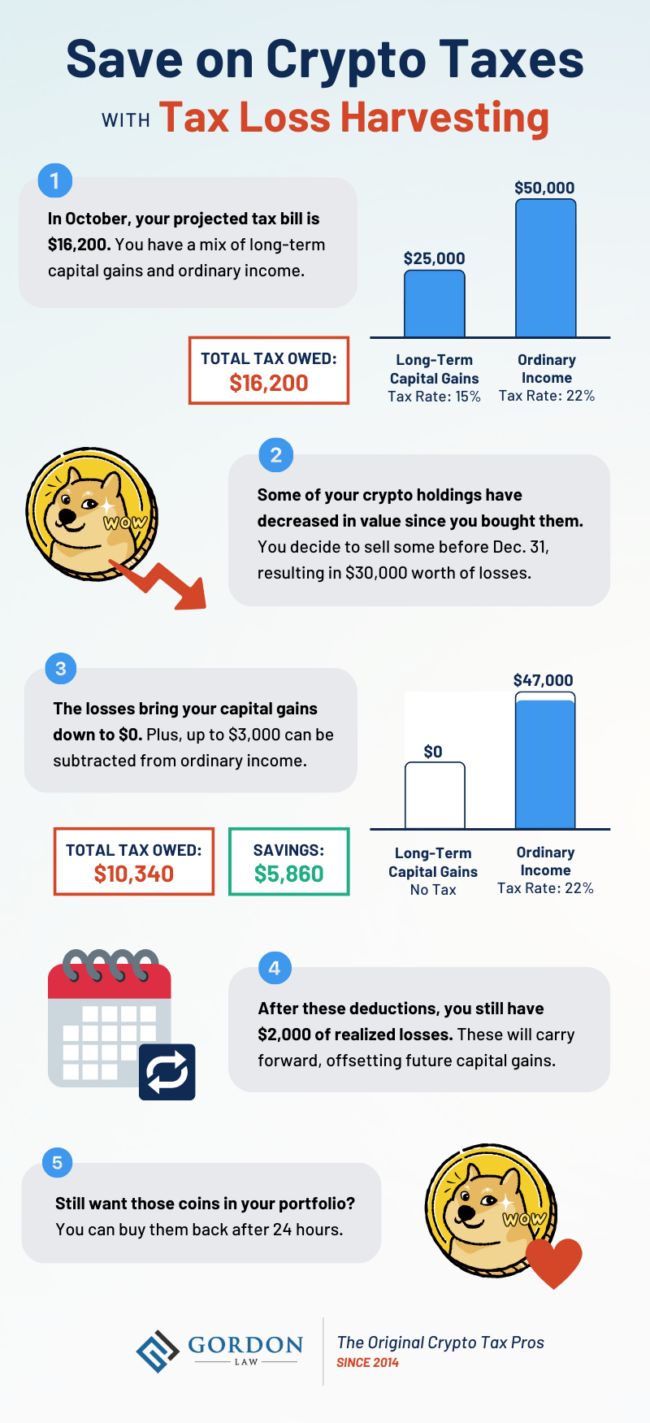

If you've ever invested in crypto, you probably know the harsh reality of watching the market plummet before your eyes. But there may be a silver lining to those market dips: depending on your portfolio, crypto tax loss harvesting may save thousands or even millions of dollars on your tax bill.

Crypto tax loss harvesting is a way to avoid capital gains tax without damaging your portfolio. If you realize enough losses, you can even offset the capital gains earned in future years.

Here's what you need to know about this powerful money-saving strategy!

What is Crypto Tax-Loss Harvesting?

Crypto tax loss harvesting is a powerful way to save money on taxes by offsetting capital gains with crypto losses.

Are you holding onto cryptocurrencies or NFTs that have lost value since you bought them? Then you're sitting on unrealized losses. With crypto tax loss harvesting, you can realize these losses by selling specific assets at a loss to lower your tax bill.

Harvesting crypto losses has multiple advantages when used correctly. Depending on your holdings, you may be able to:

- Lower your crypto capital gains (and the resulting taxes) down to $0

- Offset other income on your tax return by up to $3,000

- Carry losses forward to future years

The best part? Unlike with stocks, you can buy back your crypto assets after 24 hours, so it has a minimal effect on your portfolio.

Pro Tip: If you sell a crypto asset and buy it back, you'll reset the cost basis and acquisition date. If holding long-term is part of your crypto tax savings strategy, keep this in mind!

How Does the Wash Sale Rule Impact Crypto Tax Loss Harvesting?

The wash sale rule (also known as the 30-day rule) limits tax loss harvesting for stocks and securities. The IRS says that you must wait 30 days after selling a stock or security before buying it back, or else you cannot recognize the loss on the sale.

Currently, most digital assets are not legally defined as securities, so they're exempt from the wash sale rule. This means you can sell a crypto asset for a loss, repurchase the same asset within a short time frame, and still recognize the loss on your tax return.

The way digital assets are classified could change in the future as regulations continue to develop, so reach out to one of our crypto tax lawyers if you have any questions.

What Are the Limits to Tax Harvesting Crypto?

Unfortunately, there are some limits to how much of a loss you can claim on your tax return from your crypto tax loss harvesting.

The extent that your crypto losses exceed your capital gains is your net capital loss for the tax year. The IRS only lets you offset $3,000 of your capital losses ($1,500 for married filing separate) against other income on your tax return. However, crypto losses that exceed $3,000 are carried forward to future years to offset future gains.

Who Can Benefit from Crypto Tax Loss Harvesting?

Any crypto investor with unrealized losses can take advantage of tax loss harvesting crypto, but this strategy primarily helps investors in higher tax brackets.

Depending on your total income, you may already have a 0% tax rate on long-term capital gains. If your 2024 taxable income is less than the following amounts based on your filing status, then harvesting crypto losses may not actually save you any money:

- Single Filer or Married Filing Separately: Up to $44,625

- Married Filing Jointly: Up to $89,250

- Head of Household: Up to $59,750

However, the effectiveness of crypto tax loss harvesting depends on several factors, including your total income and the mix of short-term vs long-term gains. We recommend working with a crypto tax professional for a custom analysis of your situation.

Story Time: Crypto Tax Loss Harvesting Examples

To help understand the benefits of tax loss harvesting for cryptocurrency investors, let's look at some examples.

Scenario 1: Multi-Year Tax Savings Uncovered

One of our clients, "Jane," asked us to check her tax loss harvesting opportunities in the fall of 2023. She had $10,000 in capital gains so far. Although her gains were relatively small, Jane had a high amount of total income, putting her in one of the highest tax brackets. She wanted to reduce her bill as much as possible.

Using our tax loss harvesting tool, Gordon Law identified $287,000 in potential losses. We helped Jane identify exactly which coins to sell in which amounts to maximize her savings.

Not only did Jane eliminate her capital gains taxes for the year, but she also offset $3,000 of other income (the maximum amount you can take per year). Better yet, her losses will carry forward, reducing taxes on any future gains!

After 24 hours, Jane was able to buy back the crypto she wanted to keep in her portfolio, so she didn't damage her long-term investment strategy.

Scenario 2: He Missed Out on $120,000 in Savings

Another client, "Brian," was holding onto coins that had lost $600,000 in value since he bought them. Our accountants shared how Brian could harvest his losses and save $120,000 on capital gains tax.

But Brian waited too long... He didn't pull the trigger by December 31. He paid an extra $120,000 in taxes that he could have avoided.

Don't be like Brian. Start early, consult with a qualified crypto CPA, and take advantage of tax loss harvesting before it's too late!

When Should I Use Crypto Tax Loss Harvesting?

The tax loss harvesting deadline is December 31 of each year. Most crypto investors wait until the last minute to harvest crypto losses, but we recommend starting in September or October.

If you want to pursue more aggressive tax savings, you can harvest crypto losses throughout the year, taking advantage of market dips. However, to maximize your crypto tax loss harvesting opportunities, you need to stay on top of your crypto tax reporting.

The hardest part for crypto investors is identifying which coin has the highest cost basis compared to the current market price. Without this information, it's nearly impossible to use tax loss harvesting effectively.

By staying on top of your crypto tax reporting, you can track the amount of gains you've accumulated during the year so you can decide how much crypto tax harvesting is necessary to lower your tax bill. Our team can advise if you have carryover losses from previous tax years to give you a better idea of how much crypto harvesting you need to do.

Need help figuring it out? Reach out to our experienced cryptocurrency accounting team.

Pro Tip: Get a head start on your taxes and create an initial crypto tax report by September or October of each year. This way, you'll know which crypto assets to sell for the greatest tax benefits. Plus, it will make your April tax filing a breeze!

NFT Tax Loss Harvesting

NFTs create excellent opportunities for tax loss harvesting. Perhaps your NFTs have become worthless due to a rug pull, or maybe they've simply lost value in a bear market. Either way, selling your NFTs to harvest the losses is a smart move to consider.

With some "worthless" NFTs, you might find it challenging to sell the asset. What can you do when there are no buyers for your NFTs?

Tools like Unsellable NFTs and NFT Loss Harvestooor allow you to sell illiquid NFTs to realize a loss and lower your capital gains.

Be sure to avoid selling to yourself or to people in your social circle, as you may not be able to legally claim your losses. Look for buyers whohave been audited and verified; and, ideally, talk to your tax professional to optimize your tax loss harvesting strategy! Read our NFT Tax Guide to learn more.

Pro Tip: With cryptocurrencies, it's easy to sell off assets and buy them back later. But since NFTs are unique, you run a greater risk of losing the asset for good. Keep this in mind when considering tax loss harvesting for NFTs.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.