- within Coronavirus (COVID-19), Environment and Compliance topic(s)

On October 10, the Federal Trade Commission (FTC) and Department of Justice (DOJ) (the Antitrust Agencies) finalized and released significant updates to the Hart-Scott-Rodino (HSR) premerger notification form. The updates are expected to go into effect on February 10, 2025, 90 days after their publication in the Federal Register, which occurred on November 12, 2024.

These changes represent the most sweeping adjustments to HSR reporting requirements in nearly 50 years and will substantially increase the preparation time and expense for parties engaging in notifiable transactions.

Some of the key changes that are examined below in greater detail include:

- Transaction Rationales and Narrative Descriptions: Parties must provide narratives on the transaction rationale, competition between parties, and supply chain relationships.

- Greater Document Production: Filers must produce most transaction-specific agreements, certain ordinary course business documents, and certain draft documents that have been shared with any board member or the CEO.

- Greater Disclosure of Parties' Agreements and Prior Acquisitions: Parties must disclose all contracts between them, as well disclose all acquisitions worth more than $10 million in overlapping business lines within the past five years.

- More Details about Corporate Structure, Shareholders, and Officers and Directors: Filers must disclose all entities under their control, as well as identify limited partners with certain rights and certain officers and directors.

Background of the HSR Act and the Rulemaking Process

HSR Act

The Hart-Scott-Rodino Antitrust Improvements Act of 1976 is a law that requires parties to mergers, acquisitions, or other transactions that exceed an annually-adjusted threshold – currently set at a minimum of $119.5 million – to file a premerger notification with the FTC and the DOJ.

Failure to comply with the HSR Act can result in steep penalties of up to $51,744 per day (also annually adjusted). The FTC has taken a strong approach to enforcing the HSR rules, and has demonstrated in a recent case against activist investor and GameStop CEO, Ryan Cohen its willingness to impose significant fines even when non-compliance is unintentional

Rulemaking Process

On June 27, 2023, the FTC issued a notice of proposed rulemaking, which introduced sweeping proposed changes to the HSR premerger notification rules. Pursuant to the federal rulemaking process, the proposed changes were subject to a 90-day public comment period, which ended on September 27, 2023. The finalized rules were approved in a 5-0 vote by the FTC, earning unanimous, bipartisan support from both the Democratic and Republican Commissioners.

Impact of the New HSR Form Varies by Type of Transaction

The final rules contain significant changes to the HSR form that are designed to give the FTC and DOJ significantly more information upfront about each transaction. The new HSR rules categorize transactions into three types, each subject to varying disclosure and reporting requirements. Many of the enhanced disclosure obligations under the new rules apply only to specific transaction types. The three categories are:

- Select 801.3 Transactions: These are transactions where the buyer will not gain control over the target, will not have any rights over appointment of board members of the target, and does not have any written agreement with the target. Most open market stock purchases would fall within this category. This category also includes executive compensation transactions (e.g., exercise of stock options or receiving restricted stock units). Select 801.30 transactions have a minimal impact on competition and are exempt from most of the new reporting requirements.

- No Overlap or Supply Relationship Transactions: These include transactions where all of the following is true: (1) there are no NAICS code overlaps reported; (2) there are no competitive overlaps reported in the narrative that is now required; and (3) there are no horizontal overlaps or vertical supply relationships between the acquiring and acquired parties and their competitors. Common examples might include acquisitions by purely financial buyers, such as private equity funds, that do not operate within the same or complementary markets as the target. These transactions are seen as having more limited antitrust risks and are therefore exempt from some of the more detailed new disclosure requirements.

- Overlap or Supply Relationship Transactions: These include transactions where the acquirer and target have overlapping NAICS codes, overlaps revealed in the competition narrative, or relevant supply relationships. This category of transactions is seen as having the most potential for antitrust risk and is subject to the greatest reporting requirements under the new rules.

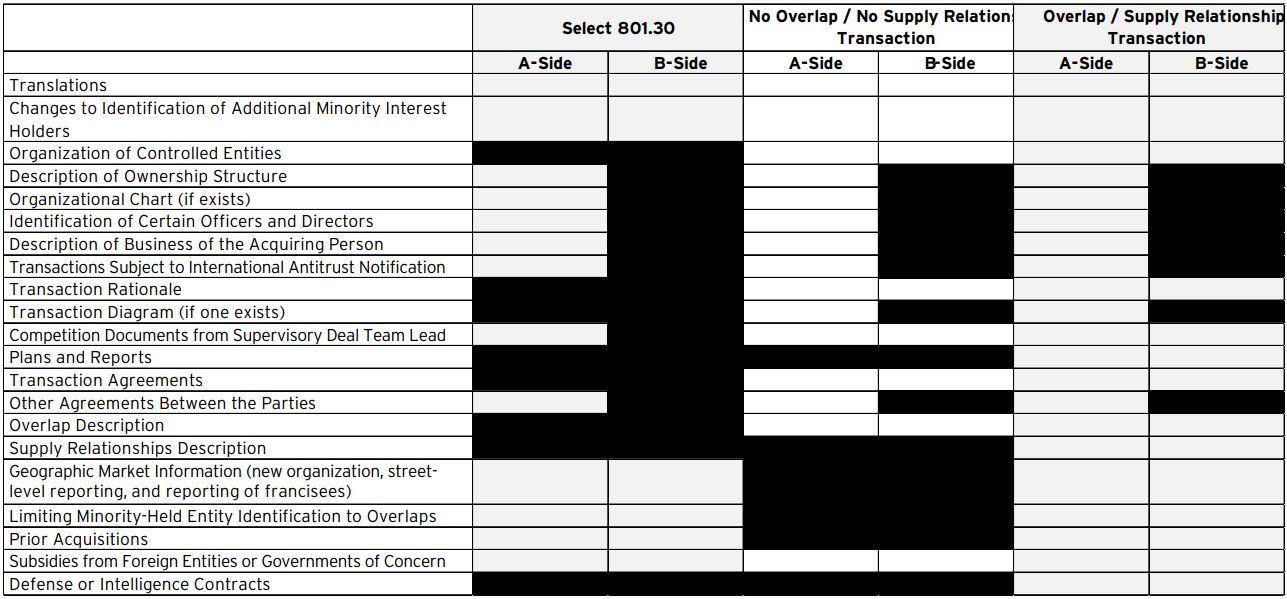

Identifying the correct transaction type for a filing is crucial, as it determines the scope and depth of the disclosures required under the new HSR rules. The information required also depends on whether the party is on the buyer's side (the A-Side) or the seller's side (the B-Side). The chart below shows which new information requirements apply to which transaction categories, and which are required by the A-Side versus the B-Side:

Applicability of Significant Updated and New Information

Requirements By Filer and Transaction Type

New Requirements

The new rules significantly increase the type of information and the level of detail that parties to notifiable transactions must provide in their HSR forms. Below, is a summary of the changes.

Transaction Rationales and Narrative Descriptions

For the first time, parties will be required to draft narratives providing the following: (1) the transaction rationale; (2) descriptions of the parties' products and whether there is any competition between them; and (3) descriptions of supply chain relationships between the parties or their competitors.

Transaction Rationale

Each party must provide a brief narrative describing all strategic rationales for the transaction that have been discussed or contemplated by the party's officers, directors, or employees. These rationales may include things like eliminating competitors, expanding into new markets, acquiring intellectual property, or achieving operational synergies. The rationales stated in the narrative should be consistent with the accompanying documents submitted with the filing; if not, the sufficiency of the filing risks being questioned. If conflicting rationales exist, they must be explained. Additionally, parties must identify specifically where these rationales are mentioned in any documents submitted with the filing.

Overlap Descriptions

Each filer must briefly describe each of its principal categories of products and services and also must describe any current or planned products or services that compete with those of the other party. These descriptions should be consistent with what is reflected in the party's documents created in the ordinary course of business.

For each product or service listed, parties must provide their sales revenue for the most recent year, a description of all categories of customers that purchase the product, and the names of the top ten customers for each product or service within each of the listed customer categories. For many transactions, this will mean the submission of multiple top-ten customer lists.

Supply Relationship Descriptions

Parties must report vertical supply relationships, identifying products or services that were sold to or purchased from the other party or competitors of the other party. For each such product or service, sales or purchase revenue and lists of top customers or suppliers must be provided.

Greater Document Production

The new HSR rules significantly expand the scope of documents that parties must provide to the FTC and DOJ in a premerger filing. The expanded requirements cover multiple areas, including (1) transaction-specific agreements; (2) expanded Item 4(c) and 4(d) documents; (3) certain ordinary course plans and reports; (4) a modified definition of "draft" documents; and (5) the translation of foreign-language documents.

Transaction-Specific Agreements

Under the new rules, parties are required to submit significantly more documents related to agreements specific to the transaction. Previously, parties were only required to submit some transaction-specific agreements like the purchase agreement and the non-compete agreements that were related to the transaction. Now, parties must submit nearly all documents that are part of transaction-related agreements. This includes exhibits, schedules, side letters, and non-compete or non-solicit agreements, along with any other agreements negotiated in connection with the deal.

Agreements that will not be in effect on or after the closing of the transaction are not required to be produced under the new rules, which exempts certain preliminary agreements and all "clean team" agreements.

Expanded Item 4(c) and 4(d) Requirements

The rules broaden the criteria for so-called Item 4(c) and 4(d) (Item 4) documents. Currently, Item 4c/d documents include transaction-related documents prepared by or for officers or directors that discuss certain issues like competition, market shares, or market entry.

The new rules expand the universe of persons whose documents must be searched to include not only officers or directors, but also the "supervisory deal team lead" – defined as the person with primary responsibility for overseeing the strategic assessment of the transaction but who is not an officer or director. The inclusion of the supervisory deal team lead aims to capture documents prepared by senior, non-executive individuals who are responsible for evaluating the transaction's competitive impact.

Ordinary Course Plans and Reports

Under the new rules, parties will be required to submit certain plans and reports created in the ordinary course of business. Specifically, filers will be required to submit ordinary course business documents that were prepared within the last year and that:

- Discuss competition, competitors, market shares, or markets.

- Relates to any product or service provided by both the acquiring and acquired parties, including products currently in development.

- Were shared with the company's board or the CEO.

If a document meeting this definition was shared with the CEO, and not the board, then it must only be produced if it was part of an annual, semi-annual, or quarterly report or plan provided to the CEO. Any document shared with the board that meets the criteria above must be provided.

This new requirement will sweep in many more documents than are currently included in the HSR filing and is intended to capture the company's candid internal assessment of its market position and its assessment of competitive threats. Notably, this new rule may result in filers being required to produce documents that show a company's board's internal consideration for multiple acquisition targets.

Modified Definition of "Draft" Documents

The new rules introduce a modified definition of "draft" documents, changing the criteria for when drafts of transaction-related materials must be submitted as part of a filing.

Currently, drafts of transaction-related documents are not required to be submitted unless they have been shared with the entire board. Now, under the new definition, drafts must be submitted if they are shared with even a single board member. For any company where a board member is involved in drafting documents that evaluate a transaction – such as companies where the CEO is on the board, and many private equity portfolio companies – this change potentially sweeps in large numbers of documents, as each iteration of a document and each email discussing it could potentially be considered a draft. Given the many practical difficulties involved with submitting drafts, we expect the agencies will issue guidance further clarifying what types of drafts do and do not need to be submitted.

Translation of Documents

The new rules also introduce a requirement that non-English documents submitted as part of the premerger filing be accompanied by a verbatim English translation, which was not previously required.

Expanded Disclosure Requirements

Another major change is that parties will be required to disclose significantly more information on a range of topics under the new rules. These disclosures must include details about: (1) the parties' pre-existing agreements; (2) prior acquisitions; (3) corporate structure; (4) minority shareholders; and (5) the acquirer's officers and directors.

Parties' Agreements

Acquiring parties will now be required to disclose all contractual agreements with the target that were executed or effective within the last year. This disclosure includes agreements such as non-competes, non-solicits, leases, licensing arrangements, master service agreements, operating and supply agreements, and any other relevant contractual arrangements negotiated in conjunction with the transaction.

Importantly, filers are not required to produce the actual agreements themselves. Instead, they will only need to indicate the existence of these agreements through a checkbox format.

Prior Acquisitions

Both the acquiring and acquired parties must now disclose all acquisitions of entities with more than $10 million in sales or assets in overlapping business lines (as defined by NAICS codes or Overlap Descriptions) made within the five years preceding the filing. Currently, information regarding prior acquisitions is required only from the acquiring party.

The rules will now also treat prior acquisitions structured as asset purchases in the same way as acquisitions of voting securities or non-corporate interests. This is a significant change from the previous rules, under which transactions structured as asset purchases were exempt from disclosure unless they met the HSR size of transaction threshold in effect at the time of the acquisition. The inclusion of more prior acquisitions aims to identify serial acquisitions and roll-up strategies, which the Antitrust Agencies have increasingly scrutinized in recent years.

Corporate Structure

All filers, with the exception of those filing for Select 801.30 Transactions, must now provide detailed information about their entity structure. This includes identifying all entities within or controlled by the acquiring and acquired parties, as well as any "doing business as" names under which these entities operate.

Additionally, for transactions where a fund or master limited partnership is the A-Side, acquirers will now be required to submit an organizational chart, to the extent one exists, outlining the ownership structure of the acquiring entity and its relationship to any entities that are affiliates or associates.

Minority Shareholders

Filers have long had to identify certain minority shareholders, but currently, entities that are structured as limited partnerships are not required to disclose their limited partners. This is changing. Now, filers structured as limited partnerships will be required to disclose limited partners who have certain rights, such as the right to serve as a board member on or significantly influence the board of any covered entity.

Acquirer's Officers and Directors

The new rules will require filers to disclose the identities of all current, recent, and prospective officers and directors of the acquiring entity who fall under the following categories:

- Individuals responsible for the development, marketing, or sales of any overlap product or service as identified in the Overlap Description or Supply Relationship Description.

- Individuals serving on the boards of other entities generating revenue in the same NAICS codes or industries as the target.

This rule also extends to the officers and directors of entities that are either controlled by or in control of the acquirer. There are exceptions to this obligation relating to officers and directors of religious or political nonprofit organizations. Many companies do not currently track this information, but should begin doing so if M&A is an important part of their business strategy.

Changes to Letter of Intent (LOI) Filings and Foreign Subsidy Disclosures

Short Form LOIs No Longer Accepted

Under the new HSR rules, so-called "short form" LOIs will no longer be accepted. LOIs now need to contain specific details, such as the principal terms of the transaction, to be deemed sufficient for an HSR filing. This change is expected to have a limited impact on most transactions, as standard LOIs and term sheets generally include the required level of detail.

New Foreign Subsidy Disclosures and Defense/Intelligence Contract Requirements

The updated rules also introduce new disclosure requirements for foreign subsidies and certain government contracts. Both buyers and sellers must disclose certain subsidies from foreign governments or entities that may raise economic security or national security concerns. Specifically, the new disclosures focus on subsidies received within the two years prior to filing, as well as commitments for future subsidies, from countries of concern; currently, these countries include Iran, China, North Korea, and Russia.

Additionally, filers will be required to identify contracts held with U.S. defense or intelligence agencies (as well as any contract proposals that have been submitted and are still pending) if the contract is valued at more than $100 million and the contract involves a product, service, or supply relationship where the buyer and seller have an overlap.

These disclosures are intended to help the Antitrust Agencies assess potential national security implications related to foreign influence or sensitive government relationships. These disclosure requirements are on top of, and in addition to, any required filings under Committee on Foreign Investment in the United States (CFIUS) regulations.

Implications for Dealmakers

Dealmakers should consider the following implications of the new HSR form.

Substantially Longer Preparation Time

Preparing HSR filings will be more time-intensive to prepare due to the expanded scope of required disclosures and documentation. This will be especially true for filings of transactions that fall into the category of Overlap/ Supply Relationship Transactions, which the FTC estimates will be roughly 45% of all filings.

The FTC predicts that the new rules will result in an average increase of 68 hours per filing (and up to 121 hours for more complex filings). However, we believe this estimate is likely to be low, and filings will likely take even longer in practice – especially in the first year when parties and counsel are adjusting to the new form requirements. Dealmakers will need to consider the additional resources, time, and expenses that will be required for these filings.

Planning Ahead and Early Antitrust Counsel Involvement

The complexity of the new rules means that antitrust counsel should be engaged earlier in the deal process. If M&A is an important part of a business's strategy, parties should consider having antitrust counsel review certain materials – including transaction-related documents and ordinary course documents discussing competition issues – before they are shared with board members or the CEO.

Additionally, antitrust counsel will need to work with deal teams to begin gathering information required for filings and identify relevant documents earlier in the deal process. Deal teams will need to implement document management systems to identify and retain HSR-required documents proactively or face additional time and expense associated with identifying those documents on the back end.

Adjusted Transaction Timelines

To account for longer HSR filing preparation times, merger agreements may require flexible deadlines for submission. Additionally, for deals likely to involve foreign-language documents, dealmakers will need to consider the time required for translating non-English documents. Filing within 5-10 business days of signing, which is the current standard that transaction agreements typically require, likely will not be possible. It is also likely that the increased complexity and subjectivity associated with the new HSR form will result in more rejected HSR filings (and thus a delay in the start of the HSR waiting period), especially in the first few months the rule is in effect. Parties should prepare contingency plans that account for such delays.

Document Creation

All deal team members should also be informed about the risks associated with sharing "draft" documents with any board member or the CEO, as this could trigger additional submission requirements under the new rules. Team members should also be conscious that ordinary course reports and plans that are currently being drafted may be produced in the future. Dealmakers should prepare all components of purchase agreements with the understanding that exhibits, schedules, and other details will likely be submitted to regulators

Designate a Supervisory Team Lead

Because the new rules expand Item 4 documents to include those prepared by or for the "supervisory deal team lead," parties should designate a supervisory team lead early in the deal process and ensure that this person is appropriately maintaining their documents and is aware that their documents may be produced.

Return of Early Termination

In addition to announcing the finalized rules, the FTC also announced that it will resume early termination for some transactions. Early termination allows for certain low-risk transactions to be granted clearance prior to the end of the 30-day waiting period imposed by the HSR Act. The Antitrust Agencies stopped granting early termination in February 2021, but will now resume the practice.

However, it is unclear how much impact this will have on dealmakers, as the Antitrust Agencies will now have significantly more information to review before deciding whether to grant early termination and may decide to only grant early termination for a narrow set of transactions (such as Select 801.30 transactions). Complex transactions, or those that involve overlaps or supply relationships, will likely still require longer review times.

Takeaways for Dealmakers and Transactional Attorneys

The new HSR rules represent the most comprehensive changes since the HSR Act's inception. The new requirements reflect the Antitrust Agencies' rigorous enforcement attitude and show that the Antitrust Agencies are particularly concerned about the risks posed by serial transactions and roll-up strategies.

Dealmakers will need to account for longer preparation times, additional document productions, and expanded disclosure requirements when planning deal timelines and calculating anticipated expenses. Proactive planning, early legal involvement, and clear communication with deal teams will be crucial to complying with these expanded requirements.

Additionally, dealmakers and transactional attorneys alike should anticipate a possible rush of deals over the next several months as companies may try to get deals signed and submit their HSR filings before the new rules take effect in 2025.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.