Speedread

The Government has introduced a new inheritance tax ("IHT") relief for individuals leaving at least 10% of their net free estate on death to charity ("the 10% Test").1

As has always been the case, the gift to charity is completely free of IHT. However the effect of the new relief ("the Relief") where it applies is that the remainder of the deceased's net free estate going to the testator's non-charitable beneficiaries bears IHT at the lower rate of 36%, instead of at the normal IHT rate of 40%.

The Relief applies to deaths on or after 6 April 2012.

The Relief will be mainly relevant to the deceased's free estate, that is the part of his estate that he is free to leave by will. However, in certain circumstances (explained below) the Relief might also be relevant to other "components" of the deceased's estate, such as trust property in which he had a so-called "qualifying" interest in possession (ie broadly speaking, a trust from which the deceased had the right to receive the income and which – usually – will have been established before 22 March 2006 or under a will).

How the relief works

The 10% Test (for determining whether the Relief applies) and the Relief itself apply separately to each of three components of a person's estate on death. The component to which the Relief will in practice most often be relevant is a person's free estate (referred to in the legislation as "the general component") because it is from the free estate that gifts are most likely to be made to charities.

The second component of a person's estate to which the Relief can in principle apply is his/her jointly owned estate which on his/her death automatically passes by survivorship to the other joint owner(s). In this case the relief can apply if the surviving joint owners redirect some or all of the property to a charity by way of a deed of variation.

The third component of the deceased's estate to which the Relief can in principle apply is to property in which the deceased had a qualifying interest in possession at death (that is the right to receive the income) which will usually be under a pre-22 March 2006 lifetime trust, or under a will trust qualifying as an "immediate post death interest". In such cases, the Relief could apply if all or part of the trust fund passes to charity on the death of the individual life tenant in question.

If the 10% Test is satisfied for one component by reason of charitable gifts made from it, then the basic position is that the Relief applies only to that component. In other words the 10% Test is applied and the Relief is received for each component separately (although this is subject to the possibility of electing for one or more components to be "merged" if the charitable gift is large enough – see further below.) In determining the value ("the Baseline Amount") of the relevant component of the deceased's estate for the purpose of working out whether the 10% test is satisfied in relation to that component the following deductions are made from the component in question

(a) any part of the component in question which qualifies for IHT exemptions (such as the spouse exemption) or reliefs (such as business property relief and agricultural property relief) applicable to the component in question.

(b) the deceased's nil rate band. Where the deceased's estate comprises more than one component the nil rate band is allocated pro rata between the different components. If fully available, the nil rate band is currently £325,000. Sometimes it will be more – up to £650,000 if the deceased has "inherited" a so-called transferable nil rate band from a pre-deceased spouse or civil partner. However, a deceased person's available nil rate band is reduced by lifetime chargeable gifts (mainly gifts into trusts) or potentially exempt transfers ("PETs") which become chargeable. (PETs are lifetime gifts to individuals or which benefit individuals. They become chargeable if the deceased's death occurs within seven years of making the gift.)

The Baseline Amount for the component (including the value of the gift to charity) is then compared with the amount going to charity and if the charitable gift is at least 10% of the Baseline Amount then the Relief will apply to the component in question with the result that the IHT rate on the remainder of that component (ie the part not going to charity) will be 36% instead of 40%. Note that in working out whether the 10% Test is satisfied in relation to the component in question only gifts to charity from the component on the deceased's death are counted. Lifetime gifts to charity from the component are not counted.

In the (relatively rare) cases where IHT is deferred on death, for example under the socalled conditional exemption for certain kinds of heritage property, but later comes into charge, say on a subsequent sale of that property, any of the Relief which is unused at the death (ie where the charitable gift was more than 10% of the Baseline Amount) is not available in relation to the deferred IHT, which will therefore be chargeable at the full rate.

The 10% Test is all or nothing – if the share of the component in question is just under 10% there is no taper or similar mechanism to allow reduced Relief.

The relief applies automatically and without the need to make an election – although it is possible to "opt-out" of the relief – see below.

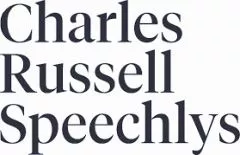

Two simple examples of how the relief works, assuming the deceased left only free estate, are as follows:

Extending the relief to other parts of the estate on death

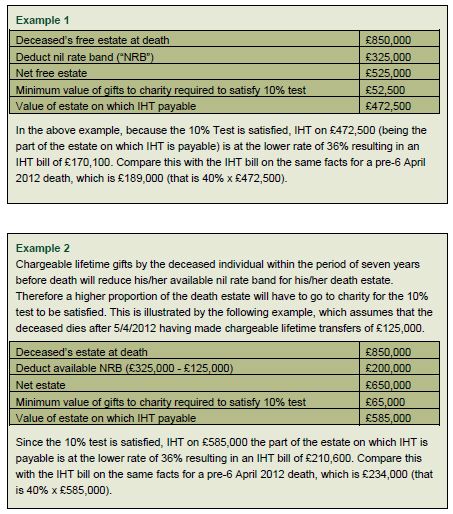

Situations may arise in which the gift to charity from one component is large enough potentially to satisfy the 10% Test not only for that component, but also for one or more of the other components of the deceased's estate from which there are no gifts to charity, or from which any charitable gifts fail to satisfy the 10% Test. In such cases the deceased's personal representatives and the "appropriate persons" in relation to the other "eligible" component(s) may elect to merge the component(s) to enable the Relief to apply to both or all of them.

A simple example of how this would work is set out below:

Where the deceased died having made a gift with reservation of benefit during his lifetime (for example by giving a holiday cottage to his children but continuing to stay there) the property subject to the reservation ("GROB property") is treated as remaining within his estate for IHT purposes. Similarly to the manner in which an election may be made to merge different components of the deceased's estate, an election can also be made to merge one or more components for which the 10% Test is satisfied with any GROB property deemed to be comprised in the deceased's IHT estate. If the charitable gift is large enough this would enable the Relief to apply to the GROB property as well.2

The persons (defined in the legislation as "the appropriate persons") who may make an election to merge different parts of the estate are, for the free estate, the deceased's personal representatives, for GROB property, the person in whom the property is vested, for property passing by survivorship the person(s) to whom it passes and for property in which the deceased had an interest in possession, the trustees of the trust in question.

Deeds of variation to procure the relief

In practice the deceased will not generally know in advance the value of his/her net death estate. Therefore there might be some cases in which a gift left by will, contrary to the testator's intentions, turns out to be insufficient to satisfy the 10% Test. Or the beneficiaries might in any event decide that they would like to vary their entitlements under the will in favour of charities whilst also reducing the IHT rate on the remainder of the estate going to non-charitable beneficiaries. In such cases it is in principle possible for the affected beneficiaries (provided they are all adults with full capacity) and personal representatives to enter into a deed of variation in favour of charities in order to ensure that the 10% Test is satisfied. The deed of variation must, however, be notified to the charities in question in order for it to be effective for IHT purposes.

Disclaiming the relief

The Relief is available for gifts to charity of any kind of property. In some cases, however, the gifted property might be difficult to value (for the purpose of working out whether the Relief is available) or there might be other administrative expenses associated with the gift. Such expenses might outweigh the benefit of the Relief. An election may therefore be made under the legislation to "opt out" of the Relief. The election is made separately in relation to each component and is made by the same "appropriate persons" for the component in question as would make a merger election, as explained above. Any opt out election must be made within two years of the death and is revocable within the period of two years and one month from the death.

Non-domiciliaries

Non-UK assets belonging to non-UK domiciled individuals, or held in a trust established by a non-domiciliary, are outside the UK IHT net. These assets are left out of account in working out whether the 10% Test is satisfied so that non-UK domiciliaries can receive the relief on their UK estates, provided they leave at least 10% of their net UK estate to charities (In other words, a non-UK domiciliary's non-UK estate is left out of account in determining the Baseline Amount).

How should my will be drafted to secure the new relief for gifts to charity?

Since it will be impossible to know in advance the size and value of your net estate at death it will also be impossible to know in advance the size of the gift to be left to charity in order to secure the Relief. The best way therefore to ensure that the Relief will apply is by providing for a formula based gift to charity in your will. Rather than stipulating a fixed amount, the gift would specify the percentage of your net estate (at least 10% to secure the Relief) that is to go to charity.

It may also be desirable that the gift should be in the form of a specific legacy in your will, rather than being expressed as a share of residue. Expressing the gift as a share of residue can give rise to complications. In particular in some cases it would be necessary to "gross up" other chargeable parts of the estate (specific legacies or share of residue) going to non-exempt beneficiaries such as children, which would in turn increase the IHT on those chargeable parts.

Another option would be to include in your will a discretionary trust with a letter of wishes to your will trustees requesting that following your death they make an appointment from the trust to charity of such an amount as will ensure that the Relief will apply. The discretionary trust can be in the form of a specific legacy or a share of residue. This might be appropriate for someone who wants to give just enough to qualify for the lower tax rate. The disadvantages are that even the discretionary trust fund itself might not be large enough to qualify for the relief (for example, if the discretionary trust is of residue and the will contains large specific gifts to non-charitable beneficiaries.) There could also be conflicts of interest if the will trustees are also beneficiaries who might be unwilling to give up part of their benefit under the will to charity.

A further option might be to leave a legacy of a specific amount or asset which is likely to meet the 10% Test. This ensures that the charity will get the gift but of course does not guarantee that the 10% Test will be met. It might on the other hand mean that the gift is larger than necessary for purposes of the Relief, which might in turn give rise to a risk of claims against the estate by non-charitable beneficiaries.

Finally, the testator might leave a legacy to a non-charitable beneficiary (such as his/her spouse or child, or the executors of his/her will) with a letter of wishes requesting that all or part of the legacy be redirected to charity so as to secure the Relief. This ensures that only the amount needed to secure the Relief passes to charity. It also means that the testator can change the ultimate charitable recipient if desired simply by writing a new letter of wishes. On the other hand there is still the problem that the 10% Test is not certain to be satisfied. Moreover, there is no legal obligation for the beneficiary named in the will to pass the amount of the gift on to the charity.

Points to consider when making your will

Points to consider in connection with the Relief when making your will include the following:

- do you want the gift to result in the Relief applying only to your free estate? Or, if you also have jointly owned property passing by survivorship, or a qualifying interest in possession in a trust, or a reservation of benefit in previously gifted property, would you want the gift to be large enough to allow elections to be available for those other elements of your estate so as to enable the Relief to apply to them as well?

- do you want the gift to charity to have a minimum or maximum value?

- do you want the gift to charity only to take effect on the death of your spouse or civil partner?

- do you want the gift to charity to take priority over other legacies (in the event that for any reason your estate were to prove insufficient to satisfy all legacies)?

- do you wish the gift to charity to take effect in any event, even if the Relief does not apply?

Conclusion

The Relief is a relatively modest proposal to incentivise charitable giving by will. There is a particular advantage for some testators; those who have already made gifts to charity in their wills representing at least 4% of their net estate should be able to increase the charitable legacy up to 10% of their net estate without reducing the share of the estate passing to the other (non-charitable) beneficiaries. However, whatever your reasons for wishing to make gifts that bring the Relief into play, it is clear that some thought needs to be given in individual cases to the best way of achieving this.

Footnotes

1 This follows on from the Government consultation published in June 2011 – see further our briefing note dated 30 June 2011 entitled "Government proposes new incentive for charitable gifts at death". The provisions as enacted and which we explain in this briefing note, differ in certain respects from the original consultation proposals on which our previous briefing note was based

2 The 10% Relief cannot apply to the GROB property in its own right because this is property that has been gifted by the deceased in his lifetime and is not available for charitable giving on his death – it is only deemed for IHT purposes to be comprised in his estate at death.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.