- in Turkey

- within Antitrust/Competition Law and Compliance topic(s)

The "Trigger Issue"

This article is the first of a series on accounting fraud and follows on from a previous article, "The current economic climate - a golden age for fraud?",1 where we explained why challenging economic environments can create pressures to commit accounting fraud, with employees forced to come up with creative accounting techniques — such as padding the financial results in response to what they may consider a temporary downturn — in the hope that better times will return.

We will provide a short "how-to guide" for committing accounting fraud, covering some of the mechanics behind the creative accounting techniques employed by fraudsters to distort financial performance.

So, How Can It Be Done?

There are many ways of manipulating financial performance, and we have seen numerous practical examples in high-profile cases that have come to light, including:

- Patisserie Valerie: Debt hidden off the balance sheet and forgery of documents2

- Wirecard: Falsified sales justified by cash held in trustee accounts that ultimately did not exist3

But however complex the schemes are, they all have some basic similarities:

- Overstatement of revenue and assets; and/or

- Understatement of costs and liabilities

To explain how that translates into practice, we will take a simplified example of a company that we will call Quantum Scheme Ltd, which develops software and sells licences for its use.

Quantum Scheme had been trading successfully for over ten years, building on the success of the first software product they developed — a widely used image editor. Since then, they have developed a diversified range of software that they license to customers.

However, Quantum Scheme has recently been struggling, as a new competitor entering the market has led to a stall in sales — and with the upcoming renewal of a major bank loan, the company is under pressure to improve its performance to secure financing.

Step 1: Set Up the Scheme

During a discussion with the financial controller, the finance director reiterated the need to improve sales in the next months, not just for the organisation, but also because their bonuses will be heavily impacted if the company does not meet its ambitious targets, one of which is year-on-year revenue growth of 20%. Both decided to temporarily help the company with some "creative accounting" until the underlying business improves.

Their plan, from the outset, is simple: The company already sells over 100 different software licences, so they will just make up some additional sales and hide them amongst the sales generated from legitimate customers. As these additional licence sales incur no cost, they will be at a 100% gross margin, providing a significant boost to the profit just in time for the bank loan renewal.

A fake sale, however, also requires a fake customer. The finance director and financial controller agree to set up a shell company, Oyster Ltd. The financial controller speaks to their cousin, who owns a small business, Little Ltd, and they agree to set up Oyster under Little's address and ownership.

The scheme is now in place: They can start recording sales to Oyster, invoice them, and record fake debtors against the sales, boosting revenue, profit, assets, and, therefore, the equity value.

Step 2: Operate the Scheme

Year 1

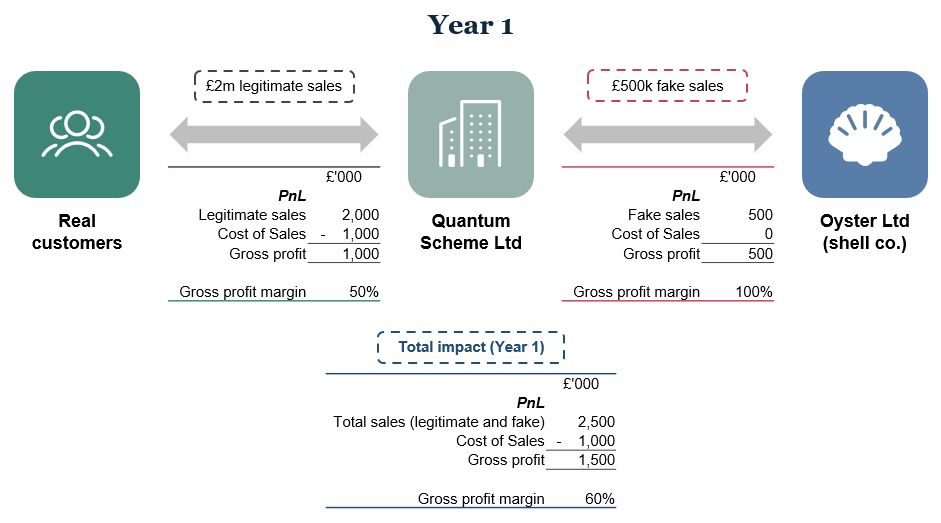

Let us assume that without the fraud, Quantum Scheme is set to make £2 million of legitimate sales (representing a small drop from the prior year's sales) and incur £1 million of cost of sales.

Adding the fake sales, the company increases its revenue by £500,000 to £2.5 million (just achieving the 20% revenue growth target) and is able to record a 60% gross profit margin overall. So far, so good.

Financial Performance (Years 1-3)

Year 2

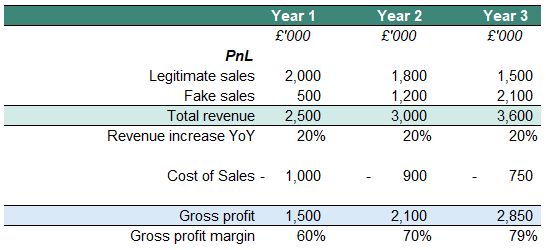

In Year 2, in order to maintain the same level of revenue growth (20% target still in place), the company would need to have total sales of at least £3 million. If we assume that, due to the competitive market environment, genuine sales have fallen further to £1.8 million, the financial controller will now need to record £1.2 million of fake sales.

This would lead to an increased gross profit of £2.1 million and a gross profit margin of 70% (Year 1: 60%), as the high-margin fake sales now make up a higher proportion of the overall sales.

Year 3

By Year 3, the company is now in a difficult position as it has become heavily reliant on reported fake sales, and any unwinding of these would have significant consequences. They have no choice but to keep the fraud going in Year 3.

This year, legitimate sales fell further again to £1.5 million, with the same proportion of costs incurred. To maintain the 20% increase in revenue per the company's target, the finance director now generates £2.1 million in fake sales.

Again, this would lead to an increased gross profit of £2.85 million and a gross profit margin of 79%.

Cash Position

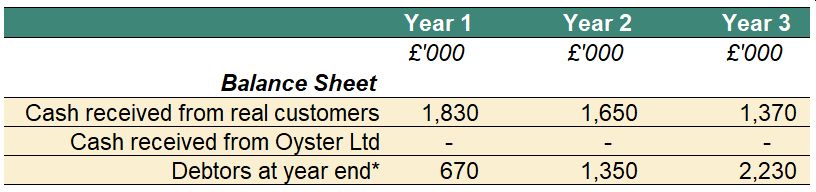

This simplified example has shown how a company can artificially increase its revenues and profits. However, these fake sales are not actually generating any real cash. So, by Year 3, the fraud scheme would leave the company with an ever-increasing debtor balance of the fake sales owed to it from Oyster.

Financial Position (Years 1-3)

*Outstanding debts largely made up of fake sales, for which no cash was received. Outstanding debts from legitimate sales are calculated based on assumed credit terms of one month.

The increasing debtor balance is obviously not a sustainable position and would become increasingly difficult to conceal. Further, the only real cash being generated is from the dwindling genuine sales, which would now barely cover the operating expenses of the business.

In the next article of this series, we will explore a number of techniques that fraudsters can employ to conceal the growing debtor position and generate fake cash to keep these types of schemes going.

Other Recent Articles

For further information, please also see recent articles on major fraud events that occurred in 20244 and the practicalities of the Patisserie Valerie accounting scandal, where the company overstated its monetary position by £94 million and concealed £10 million in debts from its investors and creditors by keeping these off the balance sheet.5

Footnotes

1. The Current Economic Climate - A Golden Age for Fraud? | Ankura

2. Patisserie Valerie: Four face fraud charges over collapse - BBC News

3. Ex-Wirecard CEO arrested on suspicion of falsifying accounts | Technology sector | The Guardian

4. 2024 in Review: Major Fraud Events and What We Can Learn from Them | Ankura

5. Patisserie Valerie: How the Allegations Unfolded | Ankura

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.