- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

Telco tower companies (TowerCos)—those that build, manage, and lease the cellular towers and infrastructure that network operators rely on—have enjoyed more than a decade of favorable conditions driven by low interest rates and advantageous M&A activity. But in this current economic climate, value creation and enhanced efficiency are growing in importance.

Cost improvements are crucial from a valuation perspective. Depending on location, an EBITDA uplift of $1M can lead to industry multiples of 15-25x. By achieving cost leadership through operational effectiveness and footprint optimization, companies can offer unmatchable prices. American Tower Corporation is already using this strategy to gain customers in Latin America and Africa.

The typical cost structure of a TowerCo depends on its scope of activities, but in general, AlixPartners has identified typical ranges as follows:

- Rent: 50-60%

- Maintenance: 8-12% (total maintenance costs, including external labor)

- Labor: 10-20%

- Power: 10-15%

- Other third-party costs: 8-12%

Given the criticality of cost leadership to position TowerCos in both the commercial and capital markets, companies must embrace all opportunities to enhance their value and improve efficiency. Below, we lay out how they can do so across their cost structures through organizational and technological advances.

Rent optimization

Rent is typically the largest cost category for TowerCos. While footprint optimization offers a few possibilities to reduce rental costs, Ground Lease Buyouts (GLBOs) present a much more significant opportunity.

Through GLBOs, companies can either acquire ownership of property and avoid leases or acquire the right-of-use (RoU) and thereby secure long-term leases, reduce administrative costs, and capitalize the cost of rent as an asset over an extended period. TowerCos (including Phoenix Tower International, Cellnex, and Vantage Towers) have applied both models and each has proven effective. The attractiveness of a GLBO depends on a variety of factors, including:

- Attractiveness of location to other TowerCos

- Attractiveness of location to customers (in particular for exclusive use)

- Risk of rental increases

- Risk of losing the location due to contract termination

- Financial strength of the seller

Cellnex provides a strong example of how GLBOs can impact company financials. The company is targeting around 10,000 GLBOs across its footprint to improve its EBITDA margin after leases by 5% by 2027. This would imply an increase from 61% to 66% based on its last reported FY24 EBITDA after-leases margin.

However, across the globe, TowerCos face landlords creating their own measures to offset new tactics as well as increased competition from market players such as APWireless or Tower Lease Partners that specialize in lease buyouts. As such, TowerCos must adequately prepare for the negotiation process—to avoid overpayment, they must perform a comprehensive due diligence per location, which they can support by utilizing digital twins in network planning.

Digital-twin technology—through which TowerCos can create virtual replicas of their physical assets—can help find the best locations for GLBOs. Constructing digital models comes at a hefty cost though, so beyond rent savings, companies should aim to use the data analysis and simulations they provide for further measures like maintenance savings and upselling.

Maintenance costs

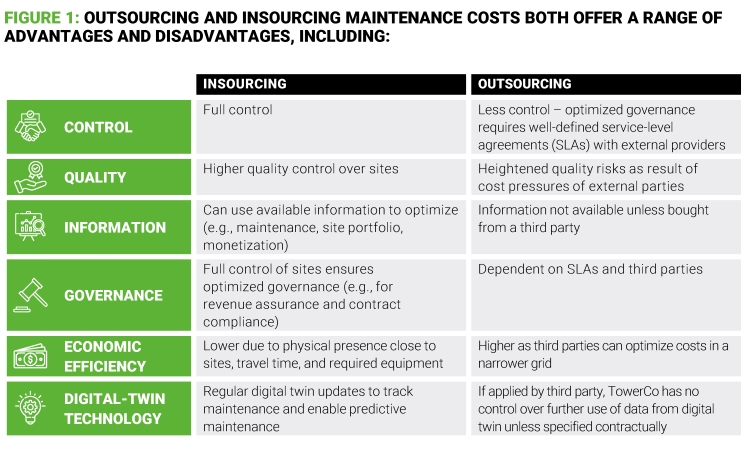

When comparing maintenance costs, TowerCos must consider both operating expenses (OpEx) and capital expenditures (CapEx) due to varying accounting standards and applications. Effective maintenance strategies, such as ensuring regulatory compliance, can significantly impact a TowerCo's overall cost structure and operational efficiency.

Outsourcing maintenance tasks is a cost-effective solution that also provides access to specialized skills. U.S. public TowerCos like American Tower Corporation, Crown Castle, and SBA Communications spend 2-3% of their annual revenue on maintenance, figures that rise to 6-7% for European counterparts. The difference is a result of geographical and regulatory differences. Nevertheless, given these substantial expenditures, accurate expense tracking is critical for business efficiency.

Empiric evidence shows that outsourcing is economically beneficial. Among the typical outsourced maintenance activities, our cases show that TowerCos can save up to one-third of their maintenance costs if service providers can reduce their travel distances and ensure high quality maintenance to minimize attempts.

Energy costs

Energy costs are generally around 30 cents per kilowatt-hour (kWh), which TowerCos tend to pass onto consumers. There is an opportunity for cheaper energy generation that also grows revenue, but it is unclear whether renewable production is a viable cost-saving option that offers ROI. At this stage, only TowerCos that operate in states that offer subsidies for such production may find it worthwhile from an economic perspective.

Vantage Towers, for example, has initiated trials to enhance sustainability by generating its own energy on-site. This approach creates an efficient and maintenance-friendly solution, reducing energy costs for customers while boosting service reliability. Gaining control over energy costs enables TowerCos to both lower their production costs and also expand into adjacent business opportunities, such as powering data centers—the new energy drain on the grid. Digital twins are useful here to simulate different usage scenarios and find cost savings.

In regions with unstable energy supplies, many sites are dependent on local fossil-fuel-based generators. This raises the risk of energy theft, which TowerCos can help prevent by implementing surveillance systems. In emerging markets, energy prices are especially important as they are factored into customer pricing; volatile energy costs or theft can severely damage tower profitability.

AlixPartners has helped one TowerCo to improve its EBITDA margin by 200 base points through theft prevention measures. The client deployed advanced metering infrastructure and real-time monitoring to detect and prevent energy theft.

Shared service centers

TowerCos must utilize shared service centers for support and general administrative (G&A) functions to achieve significant cost savings. Some service centers should be strategically located in regional hubs, like those that answer local field service questions. The majority of services, such as billing and customer service operations, can be centralized and placed offshore. Outsourcing non-core activities further lowers costs and allows TowerCos to focus on their core competencies, such as tower and asset management.

When assessing international TowerCos, we found opportunities for companies to lower SG&A expenses by 15% through labor optimization initiatives. For TowerCos to reduce costs by implementing shared service centers in low-cost countries, they must ensure:

- Standardized and automatized of contracts, documentation, and processing information.

- Clearly defined roles and responsibilities in the service center and in the local company / office

- Unified IT infrastructure

- Avoidance of language barriers, especially if contacting external parties

- Time zone management

The road ahead

We believe TowerCos have significant opportunities to enhance their value and efficiency by embracing organizational changes and new technologies. By focusing on areas such as rent optimization, maintenance costs, and energy management, TowerCos can boost their bottom lines and generate long-term value for stakeholders.

Beyond reducing costs, these measures will also improve service reliability and sustainability. Combined, this positions TowerCos to meet the evolving demands of the telecommunications industry moving forward.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.