- within Corporate/Commercial Law topic(s)

- within Transport, Media, Telecoms, IT, Entertainment and Family and Matrimonial topic(s)

- with Inhouse Counsel

- with readers working within the Law Firm industries

In December 2025, there were three Rule 2.7 announcements made across the UK public M&A market and three further possible offers announced.

Firm Offers announced this month:

- Recommended cash offer by Luke Johnson and Ian Livingstone for Inspecs Group plc – £85.4 million – public to private – cash and unlisted securities alternatives

- Recommended cash offer by Jiangxi Copper Company Limited for SolGold plc – £867 million

- Recommended cash offer by BasePoint Capital LLC for

International Personal Finance plc – £543 million

Possible Offers announced this month:

- Possible offer by DBAY Advisors Limited for TT Electronics plc – cash consideration (withdrawn)

- Possible offer by VertiGIS Ltd for 1Spatial plc – £87.1 million – cash consideration

- Possible offer for First Class Metals plc

Year to date breakdown:

December 2025 Updates:

Takeover Code changes on companies with a dual class

share structure, IPOs and share buybacks

The Takeover Panel has published changes to the Takeover Code (RS 2025/1) on how the Code applies to

companies with a dual class share structure (DCSS), the disclosures

required under the Code on an IPO, and how the Code applies on a

share buyback.

The changes, which are in line with the Panel's proposals in PCP 2025/1 (subject to some minor changes), will come into force on 4 February 2026.

The key rule changes include:

- Companies with a DCSS – A DCSS company typically has both ordinary voting shares and a class of shares with an enhanced level of voting rights or control, held for example by a founder of the company. The Code provisions that are being introduced primarily apply to a structure where the 'founder' shares carry multiple votes per share and then are extinguished or converted to ordinary shares on particular trigger events, such as a "time sunset" a specified number of years after the company's IPO or the retirement/resignation of the founder shareholder. The new rules set out a framework for how the Takeover Code applies to DCSS companies, including how the mandatory bid requirement applies when a shareholder's percentage of voting rights is increased as a result of the conversion or extinction of the founder shares, and how the acceptance condition on a contractual offer for a DCSS company should work.

- IPOs – On an IPO that would result in a company becoming subject to the Code, the company will have to disclose any controlling shareholders (and their concert parties) and describe the mandatory offer requirement under the Code in its prospectus/admission document. The ability of the Panel to grant a "Rule 9 dispensation by disclosure" has also been codified – meaning that the Panel will be able to grant a dispensation from a potential future obligation for a shareholder to make a mandatory offer (for example upon the conversion or extinction of founder shares in a DCSS company, or the conversion of convertible securities), if certain criteria are met.

- Share buybacks – The rules around share buybacks have been made clearer, in particular in relation to when an obligation to make a mandatory offer may be triggered by a buyback that takes a shareholder's interests through 30%.

FCA consultation on listing application process and other minor changes

The Financial Conduct Authority (FCA) has published its Quarterly Consultation Paper 50 (CP 25/35), which includes proposals that aim to simplify the listing application process and minor changes to the UK Listing Rules (UKLRs).

Ahead of the implementation of the new Public Offers and Admissions to Trading (POATRs) regime on 19 January 2026, the FCA is proposing amendments to UKLR 20 to reflect the fact that, under the new regime, a listing application will only be required for admissions of new securities. Further issuances of securities already listed will be automatically admitted without a new application. For further information about the new regime, see our blog posts here and here.

The FCA is also proposing other minor changes to the UKLRs, the new Prospectus Rules: Admission to Trading on a Regulated Market sourcebook, the Disclosure Guidance and Transparency Rules and the FCA Handbook's glossary of definitions. The changes include:

- confirming that, on a significant transaction, the information that has to be disclosed can be included in a shareholder circular where one is being published;

- adding guidance to make it clear that, on a related party transaction, the sponsor may take into account, but not rely on, the directors' commercial assessments, and that the requirement to make a supplementary notification ends when the transaction completes;

- clarifying how to calculate free float when some of the shares are subject to a lock-up; and

- clarifying the scope of certain prospectus exemptions.

The consultation on these points closes on 19 January 2026.

December 2025 Insights:

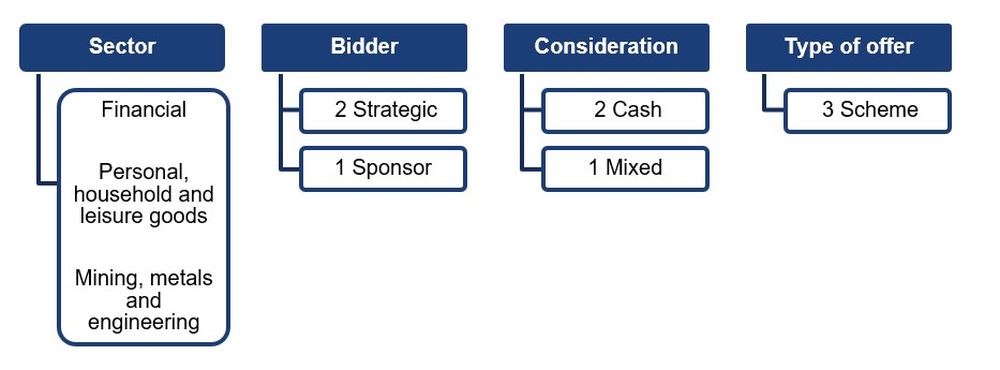

December saw a dip in activity compared to the same period in 2024. There was a decline in number of firm offers, down from eight to three. There was also a slight downtick in possible offers compared to 2024, with three announced (compared to four in 2024). Two of the three firm offers – Jiangxi Copper Company Limited offer for SolGold plc and BasePoint Capital LLC offer for International Personal Finance plc – were strategics, reinforcing the strong presence of strategic bidders this year.

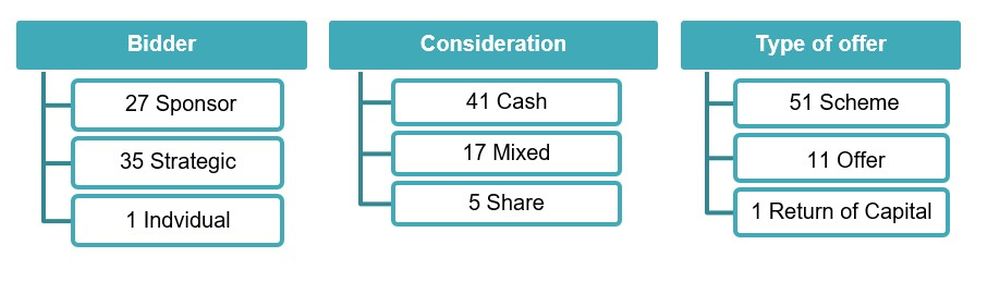

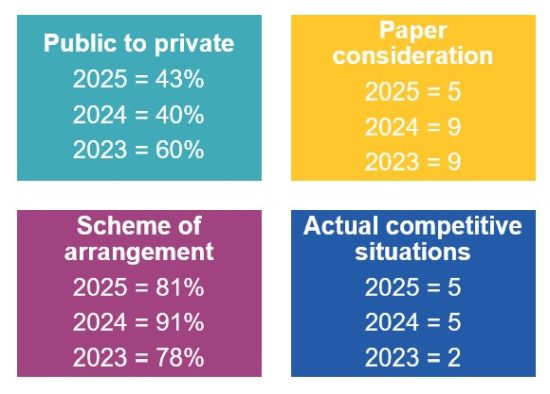

Public M&A activity remained fairly consistent throughout 2025, peaking in Q2 with 30 firm offers being announced. Overall, 2025 saw 63 firm offers which is slightly higher than in 2024 which saw 57 firm offers. This is a positive outcome amidst political and economic instability with heightened tariff volatility, expanding FDI and export-control regimes and deglobalisation pressures. Despite H2 moderation, consistent activity and strategic drivers point to a busy 2026.

In 2025, only 18% of firm offers exceeded £1 billion, down from 30% in 2024. There were several notable £1 billion plus deals taking place including DoorDash Inc. offer for Deliveroo plc (£2.9 billion) and Kohlberg Kravis Roberts & Co. L.P offer for Spectris plc (£4.2 billion). Additionally, there were a higher number of bids valued at £250 million or less with 33 offers compared to 27 in 2024. The average deal value also decreased in 2025, with the average value being £607 million, which falls short of the 2024 average of £977 million.

The number of deals involving paper consideration decreased from numbers seen in 2024, with five firm offers involving paper consideration. We have continued to see a number of competitive situations, with competing bids for five targets (two in 2023 and five in 2024). Targets of competing bids were Spectris plc, Inspired plc, Warehouse REIT plc, Assura plc and Harmony Energy Income Trust plc. The sustained level of competitive situations may be driven by the high number of strategic bidders in the market and the activity of private equity sponsors, particularly large US firms identifying value opportunities in the UK.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.