- with Senior Company Executives and HR

Quarter in review

2.1 Pensions Regulator publishes consultation on the new DB funding code

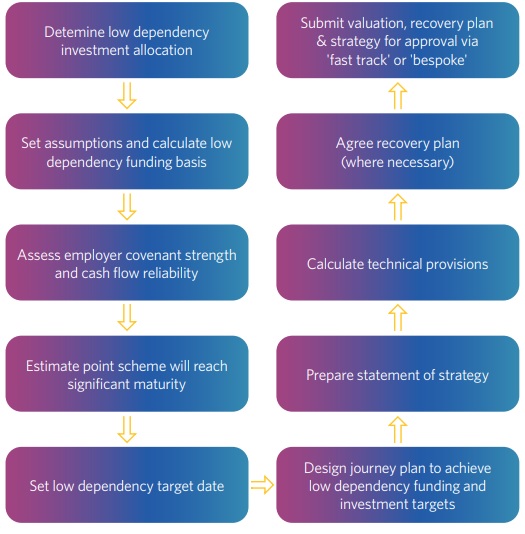

The Pensions Regulator has launched its long awaited consultation on the draft new funding code of practice for defined benefit (DB) pension schemes. The draft Code sets out the Regulator's views on how the new statutory requirements for trustees to put in place a long-term funding and investment strategy for their scheme are intended to interact with the existing statutory funding regime.

In particular, the draft code details the Regulator's expectations in relation to:

- trustees agreeing a low dependency funding target and a low dependency asset allocation with their scheme's employer

- setting a journey plan to reach that point by the time a scheme reaches "significant maturity"

- assessing the employer covenant and the level of risk it can support

- assessing reasonable affordability when determining the appropriateness of a scheme's recovery plans

- how the new regime will apply to open schemes.

Alongside the draft Code, the Regulator has also set out the parameters schemes would need to meet to be deemed acceptable under the new light touch fast-track assessment route. Schemes that cannot, or that choose not to, meet these parameters will be required to justify the approach they have taken via the 'bespoke' approval process.

The current intention is for the new funding requirements and code to apply to valuations with an effective date on or after 1 October 2023. To deliver on this timetable, the draft Code has, unusually, been published for consultation before the relevant regulations have been finalised. However, this timetable may still slip. Some aspects of the draft Code may also need to be updated to reflect any changes contained in the final regulations. Once the new code is in force, it will replace the existing funding code which was introduced in 2014.

Both consultations close on 24 March 2023.

To find out more about what the new Code might mean for your scheme or organisation read our recent blog

Comment: Encouragingly, the draft Code indicates there will be more flexibility under the new regime than had been indicated in previous consultations. However, it is not always clear how to reconcile the approach outlined in the Code with the draft Regulations.

There are so many elements to the new regime (and how it interacts with the current statutory funding requirements) that the full implications will only become apparent as schemes begin to apply this in the context of a valuation process.

Approach to carrying out a valuation under the new funding regime

2.2 Government unveils raft of DC pensions reforms

On 30 January, the Government unveiled a range of measures which are designed to reduce the inequality between defined benefit (DB) and defined contribution (DC) pensions by delivering better value for DC savers and boosting fairness, predictability, and adequacy across the private pensions sector. The measures include:

- a call for evidence on addressing the challenge of deferred small pots;

- the Government's response to its consultation on broadening the investment opportunities of defined contribution pension schemes;

- a consultation on a new Value for Money framework, including metrics, standards and disclosures; and

- a consultation on extending the opportunities for Collective Defined Contribution Pension Schemes

Announcing these initiatives, the Minster for Pensions, Laura Trott MP MBE, said:

"There is a pension inequality gap between those who had secure retirements thanks to DB, to much more uncertainty now. Since 2012, Automatic Enrolment has transformed the pensions landscape in the UK for the better, but we know there's more to be done to ensure a fairer future for savers.

Being in an underperforming pension scheme can lead to someone missing out on thousands of pounds. The Value for Money framework and our new measures will improve security and create better returns for savers, so they can enjoy the retirement they've worked so hard for."

The proposals announced include:

- plans for schemes to disclose their investment performance, costs and charges, and quality of service via clear and comparable metrics;

- confirmation that the Government plans to reform the DC charge cap to exclude "well designed" performance fees which it hopes will give schemes more flexibility to invest in illiquid assets such as start-up companies, renewables and infrastructure;

- potential solutions to tackle the issue of small pots; and

- an extension of Collective Defined Contribution (CDC) schemes, most significantly to include multi-employer models.

Alongside these proposals, the Government also published the findings from qualitative research on member engagement. The findings cover pension understanding among members and decision-making influences, responses towards pension charges and potential standardisation of charging, current member behaviour towards small and deferred pension pots and recommendations to aid member engagement.

Comment: These measures are designed to ensure that individuals get the most out of their DC savings. While these reforms should improve DC pensions, at some point the Government will need to grasp the nettle on contribution rates if it is serious about closing the gap between DB and DC pensions.

2.3 DC trustees urged to respond to diverse risks faced by DC members

The Pensions Regulator has published guidance for trustees of defined contribution (DC) schemes (including master trusts) on Supporting DC Savers in the Current Economic Climate. It follows on from its previous statement issued in the immediate aftermath of the bond market crisis in September/October 2022. Although DC schemes are not directly impacted by the issues affecting LDI, DC savers are not immune to market events. Significant market volatility from both equities and falling bond values, along with increases in inflation and interest rates, has affected those accessing their pension savings.

The guidance is timely, coming on the same day that the Pensions and Lifetime Savings Association updated their Retirement Living Standards and warned that retirees seeking to achieve a basic standard of living will need to save significantly more to cover an anticipated increase in their expenditure of nearly 20% due to high inflation.

Diverse impact

Trustees are reminded that the impact of the fall in bond prices will be diverse - depending upon individual DC savers allocation to bonds, where they are in their retirement journey, and how they plan to access their savings. The impact could be more significant for those closer to retirement, depending on their investment strategy and when and how they intend to access their savings.

Trustees are encouraged to support savers closer to retirement, so they understand the implications of their decisions and are cautioned against making hasty decisions which could crystallise losses, leading to poorer outcomes. Unsupported members may also be more vulnerable to scammers.

Action plan

Trustees are urged to develop their own action plan to respond to the risks faced by DC savers. This needs to include a review of their:

- governance and investment arrangements; and

- the support they provide to their members.

To find out more about the actions the Regulator expects trustees of DC schemes to be taking check out our blog.

Comment: Little in this statement is new and much of it is relevant at any time, not just during a period of economic uncertainty. But it serves as a reminder that DC schemes require careful management and it continues the Regulator's calls for smaller DC schemes to consider whether consolidation into a master trust would be the best option for their members.

Click here to continue reading . . .

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.