The property insurance market is growing after years of hardening, with insurers adopting strategic selectivity, seeking new business, focusing on desirable risks, and prioritizing retention.

Insurers are adopting a more commercially driven approach, characterized by strategic selectivity. There's a strong appetite for new business, especially for well-defined and desirable risks, while maintaining high retention rates remains pivotal for achieving growth objectives.

Key takeaways

The property insurance market continues to evolve, with carriers actively targeting growth by investing in the mid-market segment and focusing on selected geographies to meet their performance objectives.

Property

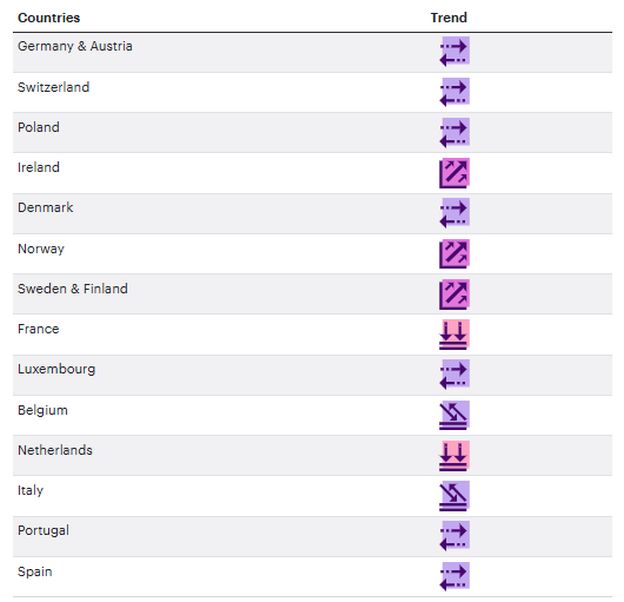

Europe rate trends: Property

- Insurers are showing a growing readiness to cover large and complex risks. However, for specific exposures like catastrophe events, Contingent Business Interruption (CBI) stemming from supply chain disruptions, and Strikes, Riots, and Civil Commotions (SRCC) amid escalating geopolitical tensions, the associated premium costs are generally higher, particularly for loss leading accounts.

- The reinsurance market is seeing a stable supply of capital, which has led to less focus on capacity constraints compared to previous quarters. This stability is enabling greater flexibility in structuring reinsurance programs.

- Additionally, we're witnessing the return of Long-Term Agreements (LTAs) in certain markets, which provide clients with greater predictability and stability. Roll-over agreements, where terms from expiring contracts are extended with minor adjustments, are also becoming a viable option in some regions.

- The quality of data in submissions is critical, encompassing risk engineering, loss runs—both frequency and severity, inflation with accurate valuations, and clear terms and conditions.

- Demonstrating progress on risk quality recommendations and availability of survey reports important for the market.

- Underwriting is driven by risk selection and a disciplined approach to capacity deployment, emphasizing the importance of quality submissions and a clear placement strategy for success.

- As economic environment changes it remains important to consider alternative ways to achieve client objectives such as the use of analytics captives, tailored coverage, deductible levels, limits and sub-limits to reflect true exposure as well as alternative risk transfer solutions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.