- within Intellectual Property topic(s)

- in United States

- with readers working within the Telecomms industries

- within Cannabis & Hemp, Law Practice Management and Transport topic(s)

Patents Court overview: what are the numbers?

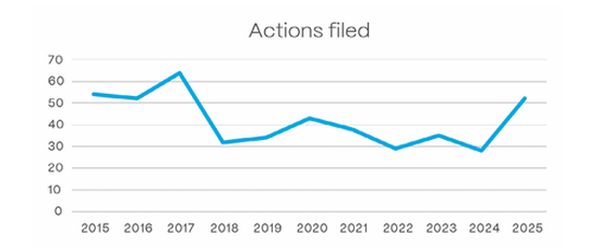

52 actions were filed in the Patents Court in 2025; a material increase over the historic median of 38 proceedings per year (see Figure 1). That spike may, however, be attributable to a cluster of 14 actions by AstraZeneca in April–May 2025, all presumably relating to the dapagliflozin litigation. Stripping out those closely related actions, the volume of new proceedings would be in line with earlier years.

Figure 1: Number of Patents Court proceedings commenced per year

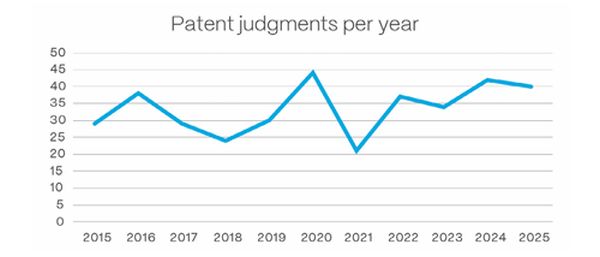

The Patents Court released 41 judgments in 2025, which is higher than the historic median of 34 judgments a year (see Figure 2). Many of these judgments addressed interim relief in SEP and F/RAND cases.

Figure 2: Patents Court judgments per year

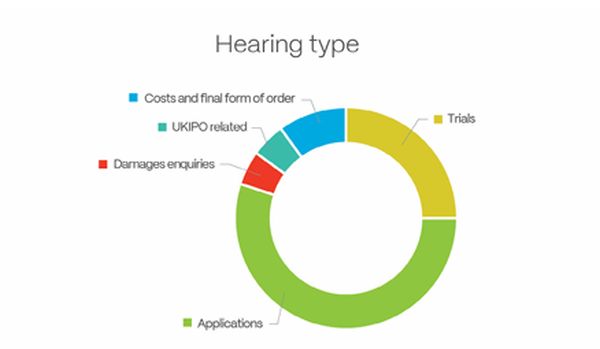

The 41 judgments related to five different hearing categories shown in Figure 3.

Figure 3: Hearing categories by number of hearings in 2025

We address trials in the section below. The damages enquiries were part of the Lufthansa v Astronics dispute where the Court assessed profits and entitlement to interest. Of the 2 UK IPO related decisions, one was an unsuccessful appeal of the (non) patentability of an application for a means for propelling a spacecraft (Nicholas Klemz v Comptroller-General) and in the other the Court struck claims of malice and corruption against the Comptroller-General of Patents (Othman Bin Ahmad v Comptroller-General).

Three decisions awarded costs following trial; with the amounts being sought by the parties ranging from £1.2 million to £6.3 million depending on the case and party (see, for example, Generics (UK) v Astrazeneca and Pfizer Limited v Glaxosmithkline). In all judgments, the successful party's recoverable costs were reduced proportionately to reflect issues at trial upon which they lost, and the successful party was awarded a 60-65% interim payment of costs.

In total, the hearing of applications occupied 31 days of court time, while the hearing of trials took up 62 days.

Patent trials: who heard them, what were they about, and how long did they take?

Probably the most salient metric for litigants is trial success rate. In 2025, the Patents Court released ten patent trial judgments. 7 addressed patent validity and infringement in the usual way. The remaining three addressed an SPC manufacturing waiver (Regeneron Pharmaceuticals v Alvotech), ownership/ entitlement to inventions (Vanessa Hill v Touchlight Genetics), and an application for a FRAND interim licence that was determined to be a trial for final relief (Acer v Nokia).

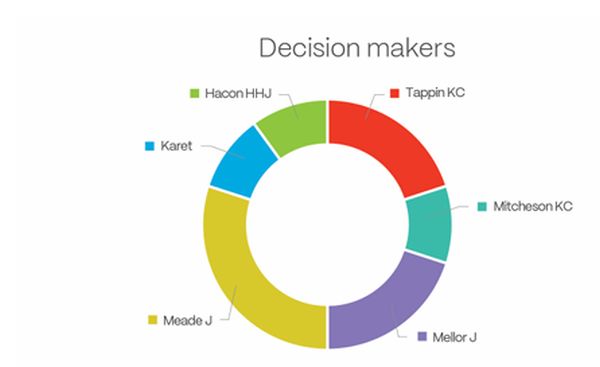

Figure 4 shows the trial decision makers.

Figure 4: Judges hearing Patents Court trials

Not surprisingly, Meade J and Mellor J, as judges of the Patents Court, heard 50% of the patent trials. The remaining 50% were heard by Deputy High Court Judges appointed under the Senior Courts Act 1981. It is common for Deputy High Court Judges to take on some case load of the Patents Courts judges.

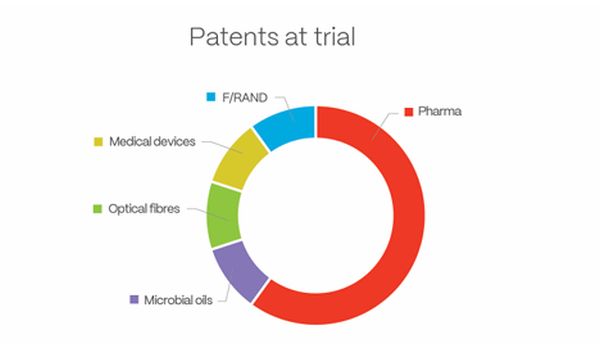

Figure 5 shows the patent subject matter of each of the trials.

Figure 5: Subject matter of substantive patent trials

Pharma dominated the 2025 trial list. The subject matter included omalizumab (Celltrion v Genentech), dapagliflozin (Generics (UK) v AstraZeneca), eculizumab (Samsung Bioepis v Alexion), and aflibercept (Formycon v Regeneron).

Across the ten trials, hearings stretched as long as 11 days (Formycon v Regeneron), but the typical trial lasted 6 days. Judgments often followed swiftly: the quickest was handed down 28 days after the trial hearing (Generics (UK) v AstraZeneca), with a median turnaround of 55 days. These timelines reflect a prodigious work effort by the Court. Later in this report we address the substantive results at trial.

Patent applications: what was the duration and timing and what did they address?

In 2025, 23 application judgments were released. Hearings were focused: the median lasted one day, and the longest ran four days. Decisions often followed quickly, with a median turnaround of seven days from hearing to decision, though the outer limit stretched to 75 days. Judgment was delivered from the bench in four applications.

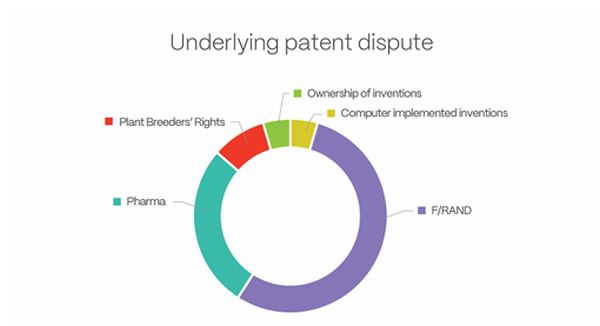

Figure 6 illustrates that F/RAND cases accounted for more than half of the applications, with pharma following second.

Figure 6: Applications in 2025 split by underlying patent dispute

It is not unexpected to see the schedule being dominated by complex F/RAND proceedings because of the extensive body of case law that developed since Unwired Planet (2017-2020), the Courts' willingness to declare global F/RAND licence terms, and the Courts' rate-setting decisions in Interdigital v Lenovo and Optis v Apple. Judgments on Plant Breeders' Rights are not, however, common: the two Nador Cott v Asda Stores judgments in 2025 were the only judgments in the previous 25 years.

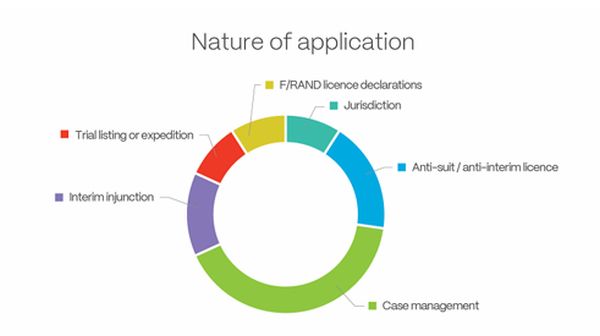

Figure 7 sets out the substantive nature of the applications; which covered a broad range in 2025. The largest category, not surprisingly, addressed case management matters such as pleading amendments and striking, evidence at trial, security for costs, document disclosure, breaches of orders, stays, and so on.

Figure 7: Subject matter of applications in 2025

The interim injunction judgments related to empagliflozin (Boehringer Ingelheim v Dr. Reddy's) or dapagliflozin (Astrazeneca v Glenmark). Regarding the applications to expedite trials, both were granted, one in a pharma case (Regeneron v Alvotech) and one in a F/RAND case (Samsung v ZTE). All three jurisdiction challenges were within F/RAND disputes: MediaTek v Huawei, Acer v Nokia, and Amazon v Interdigital.

Patent trials: what happened on infringement and validity?

This section of the report focuses on trial decisions addressing validity and infringement issues and therefore excludes the SPC waiver, ownership/ entitlement, and F/RAND interim licence trials referred to above.

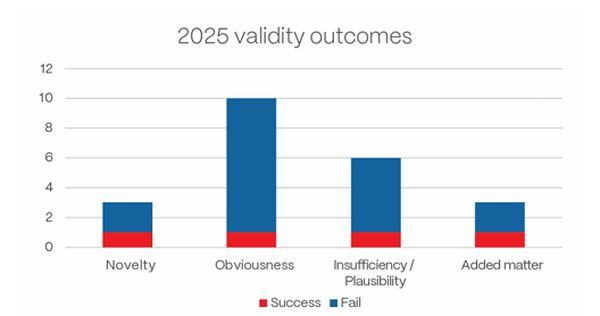

Figure 8 sets out the results of the key validity attacks in 2025 (novelty, obviousness, insufficiency/plausibility, and added matter) and highlights the low success rate for invalidity challenges in 2025.

Figure 8: Success rates of patent validity challenges in 2025

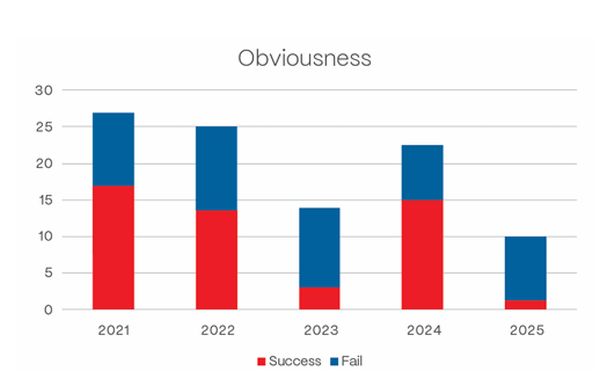

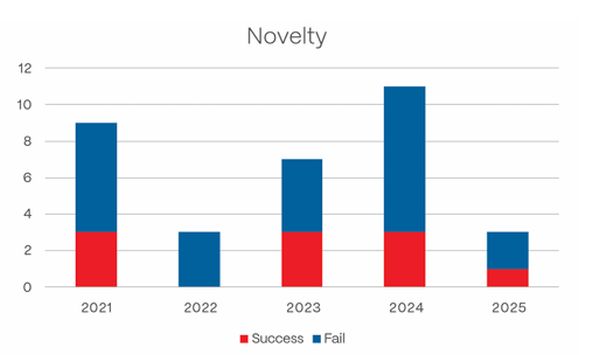

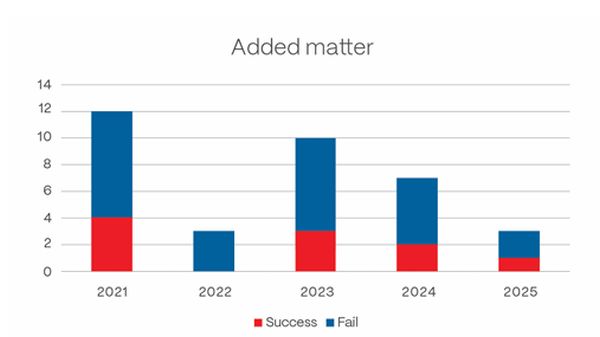

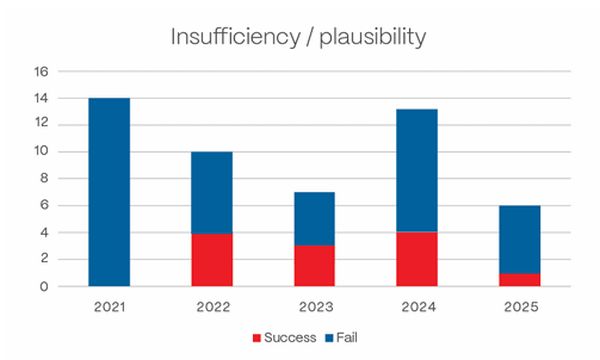

Contrasting 2025 with historic data (see Figures 9-12), 2025 appears to have been a disappointing year for defendants and a successful year for patentees. However, the data set for 2025 is small so it may be unreasonable to draw meaningful conclusions for the future.

Figure 9: Success rates of obviousness challenges from 2021-2025

Figure 10: Success rates of novelty challenges from 2021-2025

Figure 11: Success rates of added matter challenges from 2021-2025

Figure 12: Success rates of insufficiency / plausibility challenges from 2021-2025

More often than not the validity challenge failed. In five trials at least one patent was found valid and infringed: Celltrion v Genentech, Salts Healthcare v Pelican Healthcare, DSM v Algal Omega 3, Samsung Bioepis v Alexion, and Fujikura v Sterlite. The only notable success for defendants came in Formycon v Regeneron where a valid patent was held not to be infringed (and another patent was invalidated and also not infringed). The defendants in DSM v Algal Omega 3 did invalidate 2 of the 3 patents at issue, but overall were found to infringe a valid patent.

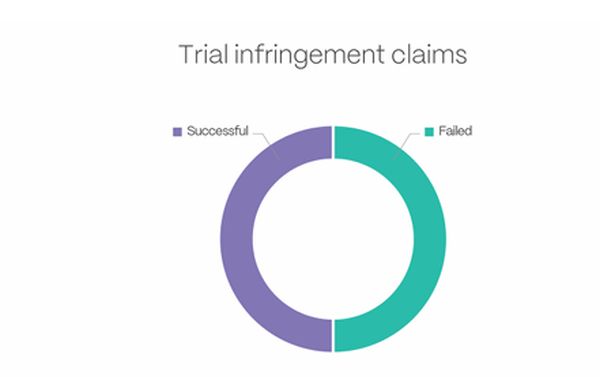

It is also interesting to look at the success rate of infringement claims in 2025, which showed an even split (see Figure 13). Combining this with the lower success of invalidity counterclaims, re-affirms that 2025 was a strong year for patentees.

Figure 13: Success rate of infringement claims in 2025

The Court found infringement in the following cases: Celltrion v Genentech, Salts Healthcare v Pelican Healthcare, DSM v Algal Omega 3, Samsung Bioepis v Alexion, and Fujikura v Sterlite.

Court of Appeal: how busy was it and what were the outcomes?

The Court of Appeal released 15 judgments in 2025, which is higher than the historic median of nine and the highest number in ten years. Arnold LJ heard 13 of the hearings and Sir Colin Birss C. heard five. Therefore, at least one patent specialist judge sat on every patent appeal in 2025. The historical trend of patent appeal judgments is set out in Figure 14.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]