- with readers working within the Retail & Leisure industries

When visiting CES' one thing that struck me was the number of companies demonstrating LiDAR technology. LiDAR has been around since the 1960s and was originally developed for aerospace use, but has since found application in a wide variety of fields such as surface mapping, glacial monitoring, and forestry analysis to name a few. The biggest potential commercial application of LiDAR is the development of autonomous vehicles. Other technologies such as vision (camera) and radar, allow a vehicle to 'see' its environment, but without the precision distance measurement offered by LiDAR. Luminar Technologies aimed to demonstrate the need for precision distance measurement by staging a demonstration at CES involving a Tesla running over, thankfully fake, kids with the aim of trying to convince automotive companies that vision and radar systems alone are not sufficient.

One of the biggest challenges facing the commercial growth of LiDAR systems has traditionally been cost, although companies such as Cepton Technologies (a CES 2022 honouree) are aiming to produce LiDAR units at <$100 price point.

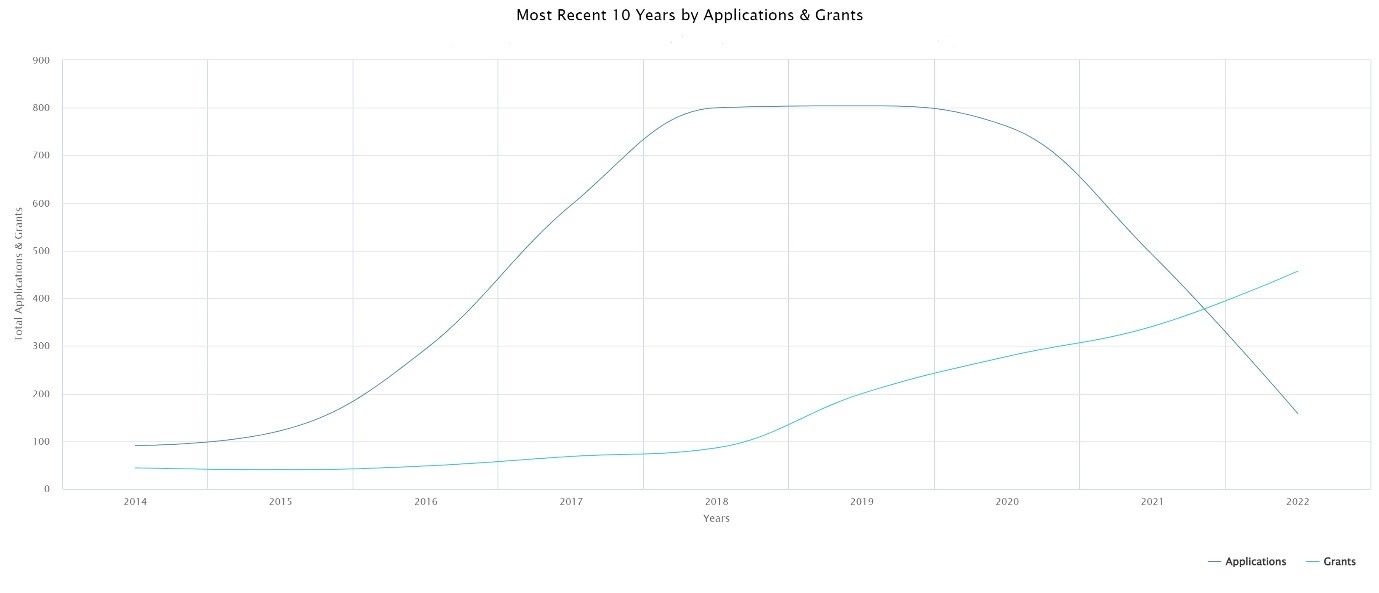

Looking at vehicle-related patent filings for LiDAR technology, we can see a massive growth in filings from 2015. Other key characteristics of filings in this field are that over 80% of all applications filed are still alive (likely due to the recently filed nature of most applications) and that number of granted applications is only beginning to pick up. This means that many patent applications for vehicle-related LiDAR technology are still pending, making this a difficult market for a new entrant with respect to freedom to operate.

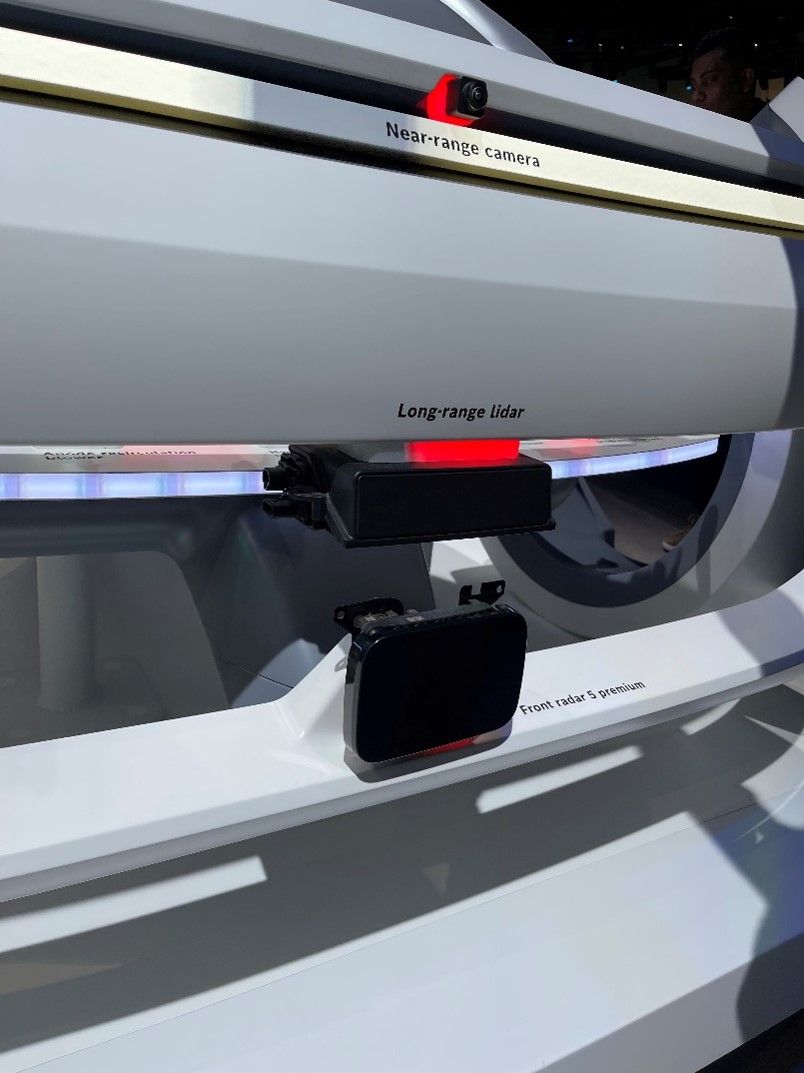

The key patent filer for vehicle-related LiDAR applications is tier 1 supplier Robert Bosch GmbH. A LiDAR system displayed on Bosch's stand at CES 2023 is shown below. Of note is that LiDAR is shown as being used in a suite of sensors including cameras and radar.

Beyond Bosch, the main patent holders in the field are a combination of other automotive component suppliers, including Valeo, traditional automotive manufacturers such as Daimler, GM and Ford, to name a few, alongside more recent automotive entrants such as Waymo and Zoox. However it unusually appears that relatively few applications in this field are filed by Chinese applicants. Given the large number of pending applications in this technical field, entering the LiDAR market for a new supplier e.g. trying to offer lower-cost units may be more problematic without significant freedom to operate efforts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.