- within Energy and Natural Resources topic(s)

- with readers working within the Oil & Gas and Utilities industries

- within Energy and Natural Resources, Transport and Antitrust/Competition Law topic(s)

Background

The UK CBAM has been under development since the UK Government announced its intention to introduce a CBAM in December 2023.

In April 2025, the UK Government published draft primary legislation for the UK CBAM (for more detail on this, see our blog post here). This was reviewed in a technical consultation which closed in July 2025, and to which a response was published on 26 November 2025 (the Consultation Response). As part of the Government's 2025 Budget announcement, it confirmed that it will legislate in the Finance Bill 2025-2026 to implement the UK CBAM on 1 January 2027. For more detail on the Budget and its overall impact on infrastructure investment, read our update here.

In this briefing, we summarise the latest updates to the UK CBAM that came out of the Consultation Response.

Delay to inclusion of indirect emissions in UK CBAM

The Government confirmed that indirect emissions will only start being included in UK CBAM from 2029 at the earliest, in light of concerns around the complexity and administrative challenges associated with reporting on indirect emissions. Indirect emissions include electricity used in producing UK CBAM goods, whether it is generated on-site or off-site. The exclusion of indirect emissions is a different approach to that taken in the EU CBAM, which currently includes indirect emissions for cement and fertilisers.

Approach to calculating CBAM rate

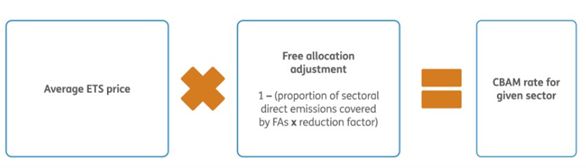

The Government has made some updates to the calculation of the CBAM rate. Previously, the CBAM rate was based on the UK ETS carbon price, which was multiplied by embedded emissions. However, the original calculation contained no adjustments for free allowances. Based on consultation responses, the Government decided to amend this approach and take free allowances into account when calculating the CBAM rate. This "Free Allocation Adjustment" will be on a sectoral basis, according to the free allowances available to each sector each year. This aims to prevent entities from receiving double-protection in respect of carbon leakage, which would weaken the carbon price.

In parallel, the UK ETS Authority has announced the gradual phase out (over a 9-year period) of free allowances for sectors covered by UK CBAM (for more information, read our update here). In light of this, the CBAM rate calculation will also include a sectoral "reduction factor", adjusted annually to reflect the gradual phase out of free allowances.

Source: Factsheet: Carbon Border Adjustment Mechanism

Recognition of the role of refineries in energy security

In the 2025 Budget, the UK Government recognised the importance of refineries for the UK's industrial base, as well as for its energy security. Whilst refineries are not currently included in CBAM, the Government has committed to publish a Call for Evidence for the fuel sector in due course.

Other technical changes to the legislation

As part of the consultation response, the following technical changes have also been introduced.

- Exemption for UK-produced precursor goods imported back into the UK: This amendment prevents the UK CBAM price being applied twice, and reduces the administrative burden for businesses.

- Extension of carbon price relief: The extension will enable the recognition of carbon prices incurred under other CBAMs. The draft Finance Bill grants HMRC authority to regulate carbon price relief by way of future regulations. Therefore, while the specifics remain unclear for now, further details on price relief are expected as UK CBAM implementation progresses and additional government guidance is published.

- Extended repayment window: Customers who have erroneously overpaid the UK CBAM charge will now have three years to claim back any overpayment.

- Temporary admission exemption: CBAM goods admitted to the UK temporarily (usually for a maximum of 24 months) will be relieved from customs duties, ensuring that CBAM only applies to goods which represent a genuine carbon leakage risk. However, such goods must not be altered while being in "temporary admission" but can be preserved to maintain their condition.

- Removal of group treatment provision: Each separate legal entity that imports CBAM goods and meets the £50,000 threshold must submit their own individual return. This is a change from earlier rules, which would have allowed multiple companies in the same group to file one return for the whole group. Consultation responses showed that group treatment provided limited benefits to businesses.

What is next for uk CBAM?

Legislation on UK CBAM was introduced in the Finance Bill 2025-2026 which is currently making its way through parliament, and will apply from April 2026.

HMRC will publish draft secondary legislation, which will be subject to review through further technical consultations in early 2026.

The UK CBAM will come into force from 1 January 2027. Ahead of this date, the UK Government has confirmed its intention to work closely with stakeholders to ensure that guidance is clear and comprehensive before it is published.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.