- within Real Estate and Construction topic(s)

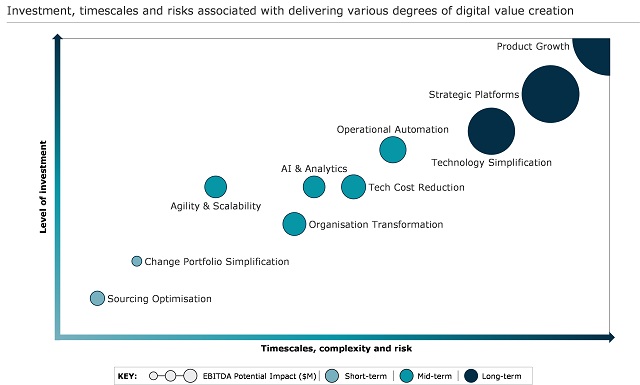

s outlined in our previous article, there is a wide-range of digital value-creation opportunities available for Private Equity portfolio companies, from cost reduction initiatives (e.g., application consolidation) to a long list of opportunities aimed at driving top-line growth (e.g., new platforms and products enabling entry to new markets and segments, faster product delivery reducing time to market, and increased scalability to support growing sales volumes).

Whilst cost reduction opportunities are typically well understood and regularly adopted by Private Equity firms looking to optimise operating costs, they are limited in scale to the existing cost base. In comparison, the potential for digitally-enabled EBITDA improvements is uncapped, driving top-line growth and delivering a significant increase to exit valuation.

Importantly, both types of value creation afford PE firms the chance to unlock significantly greater returns from their investments by addressing the immense digital opportunity in front of them.

Understanding the hurdles to digital value creation

The key considerations for PE firms with the inclination to invest in digitally-enabled value creation are two-fold:

‘What will give me the greatest return on my investment?'

“Where to start” is often the key challenge for PE firms looking to leverage technology. With so many potential options available, prioritisation becomes critical. We recommend defining the size of the opportunity – what would the EBITDA impact of delivering this initiative be? This should provide you with the filter required to generate a long list of initiatives based on their potential to impact your exit valuation.

‘What will it take to achieve?'

The first consideration is only half the story, of course. Further prioritisation is required to create a shortlist of opportunities that can deliver in line with your investment thesis i.e., the timescales and level of investment accounted for. Leveraging data points and previous experience in similar situations is critical to sizing timescales and the one-off investment required. Depending on the maturity of the Portfolio company (e.g., existing technology estate and IT organisation capabilities) certain opportunities may be too expensive/protracted to deliver. Therefore, opportunities that align best to your investment thesis should be prioritised highest, even if they may not necessarily have the greatest EBITDA impact.

Figure 1. Example of the Digital opportunity matrix (figures are indicative only)

Three steps to ensuring the success of digital value creation

To dramatically increase the chances of success, we suggest three key steps to develop a prioritised Digital Transformation roadmap for digital value creation, the investment required and the tangible benefits. We regularly leverage this approach with PE clients via our post-close Tech QuickStrike®:

- Assess the state of technology – What is the maturity of the technology estate? The major areas of investigation here are the modernity, reliability, and flexibility / scalability of existing platforms and infrastructure – can they support secure growth? The other area of focus is the IT organisations' capabilties to deliver change and operate the estate effectively – does it have the people, skills, and processes in place to deliver your digital value creation agenda?

- Map out your digital opportunities

– Once you understand your starting point (Step 1.) you can

start to map out the opportunities available to you.

AlixPartners' Tech Quickstrike® rapidly assesses the

current state of an organisation and the opportunities on offer,

building a long list of potential initiatives. Whilst not

exhaustive, this could include:

- Sourcing Optimisation – Reduction in the number of suppliers used, moving to a small number of strategic partnerships that can support business objectives (e.g. Carve-outs and Post Merger Integration), can lead to run-rate savings in the region of 5-10% of total IT spend.

- Change Portfolio Simplification – Prioritisation of the change portfolio to focus investment and resources on the critical projects that will deliver EBITDA improvements and enable long-term growth, halting misaligned initiatives and reducing one-off costs by 10-15%.

- Agility and Scalability – Migrating legacy infrastructure to the cloud and increasing the businesses' ability to innovate and scale to meet new customer demand helped a $3.5bn data company achieve a $17m in OPEX savings.

- Organisation Transformation – Streamlining the IT organisation to ensure it is right-sized and has the capabilities required to deliver digital value creation initiatives can deliver savings in the region of 15-20%.

- AI and Analytics – Harnessing data and analytics solutions across the business to inform management decisions on cost reduction and growth enabled a $150m manufacturer to deliver a gross margin increase of 7% in four months, adding $1m per month to EBITDA.

- Tech Cost Reduction – Holistic review and execution of cost savings programme across all possible focus areas can achieve OPEX savings of up to 40%.

- Operational Efficiency – Leveraging automation tools to transform end-to-end customer journeys, significantly increasing output and quality whilst reducing costs allowed a $5bn software business to achieve a $30m EBITDA impact.

- Technology Simplification – Consolidating the technology estate to a small number of strategic platforms, removing legacy applications to improve business agility and meet changing customer needs helped a €1bn business generate €20m EBITDA impact in revenue and cost savings on a 17x multiple valuation.

- Strategic Platforms – Building new or renovating a small number of critical applications that can deliver all the capabilities required to deliver the strategic product portfolio enabled $12m in growth for a $1bn payments business.

- Product Growth – Transforming the business to align commercial, operational, and technology resources to products, increasing collaboration, and reducing time to market for delivery of new products and services allowed a $200m data business to achieve $16m EBITDA impact (15% growth).

- Build your Digital Value Creation

roadmap – Once the options are clear, it is

time to prioritise based on size of the opportunity (EBITDA

impact), level of one-off investment required, and timescales (see

figure 1 example above):

- Size of the opportunity – Build an unconstrained view of the value creation opportunity on offer. Size initiatives based on their ability to drive cost savings or revenue growth. Leverage current state analysis combined with experience and reference performance metrics / benchmarks to gauge the scale of the opportunity available.

- Timescales – Time to deliver is a critical factor in the success of digital value creation initiatives – taking too long can add significant one-off costs that eat into EBITDA improvements. Define delivery duration considering impact on the technology estate, the IT organisations' capability to deliver and the wider businesses ability to handle the change.

- Investment – One-off investment required to deliver target improvements will partially be determined by the type of organisation you are dealing with – the greater the maturity of the technology estate and organisation, the lower the barrier to achieving value creation. It is critical to consider the different types of cost that will be incurred including project management, licensing, cloud, and capitalized product development costs.

For the right business, digital initiatives can offer rapid acceleration of value creation, helping PE firms to achieve increased returns. With so many options available, choosing where to start is often the biggest challenge in this space, requiring careful consideration of the three steps laid out above to ensure your final approach delivers on your ambition to unlock the true potential of technology.

At AlixPartners, we regularly partner with Private Equity investment and portfolio teams to identify the opportunities available through our pre-close Tech Due Diligence and post-close Tech QuickStrike®, quantifying and prioritising value creation opportunities that can drive performance improvements aligned to the deal thesis – get in touch to learn more about our work.

In the next article in this series, we'll drill into value protection, and look at the range of initiatives that can secure a company's existing revenues and business model.