- within Corporate/Commercial Law topic(s)

- within Environment, Privacy and Tax topic(s)

What we learnt from 2025

- Notifications on the rise: with 90 notifications lodged in 2025 this represented an increase of 9.76% on 2024 figures (82 notifications), this represented a 32% increase from 2023 (68 notifications).

- Average review times reflect the rise in notifications: The average working days for a non-extended phase I Determination in 2025 was 17.5, representing a slight increase on 2024 average of 16.32 days but less than the 2023 average of 18.8 days.

- Decrease in SNMP Determinations issued: In 2025, 67% of Determinations were made under the Simplified Merger Notification Procedure ("SMNP"), compared with 71% in 2024 and 52% in 2023. SNMP Determinations in 2025 cleared within an average of 12.47% days, demonstrating a clear downward trend from 2024 (at 13.29) and 2023 (at 15 days).

- No of Phase II Determinations remained unchanged from 2024.

- Slight fall in issue of Requirements for Information 2025, with only 29 issued compared to 35 in 2024.

- Call-In-Power remains untested: The CCPC has not availed of its ability to 'Call-in' below-threshold transactions since receiving the power on 27 September 2023. Although the CCPC noted that it considered a number of below-threshold transactions with a view potentially to calling them in, including issuing Requirements for Information in some instances.

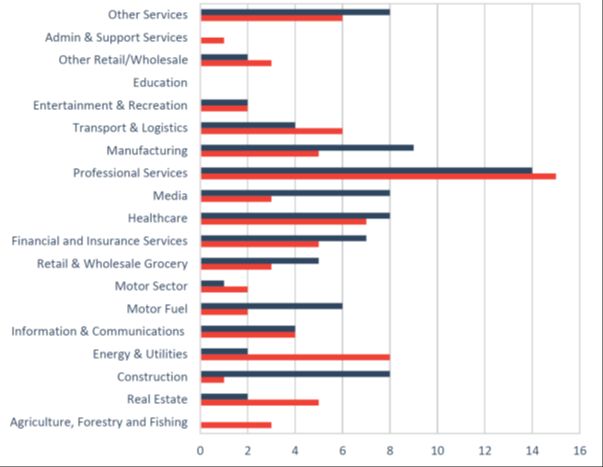

- There are notable year-on-year changes in the sectoral breakdown of notifications, with the construction sector seeing increases from one to eight along with other key areas like retail and grocery sectors also trending upwards. There has been a decline notifications in energy and utilities sector falling from eight to two.

We can anticipate at least two consultations during 2026:

- One from the Department of Enterprise, Tourism and Employment relating to an increase in the financial thresholds for mandatory notification, following the CCPC's recommendations made during 2025:

- One from the CCPC on its updated 'Guidelines for Merger Analysis' which is to take into consideration stakeholder feedback from its 2024 consultation process.

For more information and to read the Report see: https://www.ccpc.ie/business/wp-content/uploads/sites/3/2026/01/Mergers-and-Acquisitions-Report-2025.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.