- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United Kingdom

- with readers working within the Pharmaceuticals & BioTech and Law Firm industries

On 4 January 2022, after approximately four years from the UK government's first attempt to reform the UK national security screening regime, the National Security and Investment Act 2021 (NSIA) became operational. The NSIA represents a radical overhaul to investment screening in the UK as it introduces for the first time a mandatory and suspensory filing obligation for transactions in 17 sectors considered as particularly sensitive (among which are Synthetic Biology and Artificial Intelligence).

Alongside a mandatory and suspensory regime for certain transactions, parties are also encouraged to notify transactions voluntarily if-regardless of the sector concerned-the transaction might have national security implications based on (i) nature/identity of the acquirer, (ii) target's activities, and/or (iii) nature and degree of control acquired. Unlike the mandatory filing obligation which only captures acquisition of entities, the voluntary regime also captures the acquisition of tangible and intangible assets-thereby including the acquisition, assignment and/or licensing of IP rights over e.g. molecules, compounds, methods or technologies.

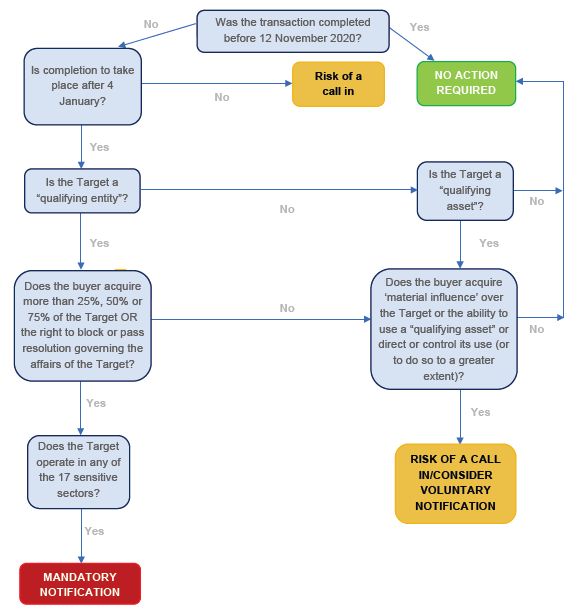

The flowchart below summarises the main considerations relevant to a decision as to whether a filing under the NSIA is to be made:

The new regime (Regime) has significant implications for investments in the life sciences sector. Due to, among others, the breath of its scope, the low equity/control right thresholds required to trigger a filing, the potential consequences for missing a mandatory filing (which include criminal sanctions), as well as the UK government's power to "call in"-for a period up to 5 years from closing-transactions subject to a voluntary filing, the Regime is likely to cause increased burden, costs, uncertainty and timing for deals in life sciences.

In our recent advisory (available at here), we analyse the most relevant features and practical considerations of the Regime, also in light of our experience so far and our intelligence of how the Regime has operated in its first six months of life.

The following are among the points worth flagging:

- The UK government's first report (Report) covering the Regime's first three months of operation up to 31 March 2022, suggests the number of notifications (222 in total, among which 196 were mandatory), as well as the number of cases called in for in-depth review (17 cases so far), is slightly below the initial estimates at the time the NSIA was enacted.

- The UK government has proven to be open to discussion and has also generally been rather swift in responding to informal outreaches as well as publishing more formal guidance.

- The process to grant clearance in no-issue cases has equally been rather swift: according to the Report, the average time to accept filings as complete (which is not subject to any set statutory time-limits) has so far been 3 working days, with formal clearance issued on average within 23 working days from accepting a filing-therefore below the 30 working-day statutory limit.

- On the downside, the general lack of communication throughout the review process, the absence of any reasoning in the government's decisions, as well as the general lack of public information and transparency concerning past deals, is likely to represent a challenge for businesses wishing to achieve legal certainty.

- In terms of practical steps, going forward companies investing in life sciences will need to consider whether deal documentation may need to cater for both merger control and the NSIA processes, allowing appropriate long-stop dates for regulatory reviews, as well as including risk mitigation and appropriate conditionality clauses; where a transaction is likely to raise national security concerns, parties should also carry out remedy planning at an early stage of the process.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.