UK pensions should embrace private equity to diversify, adapt, and secure retirees' futures in a changing world.

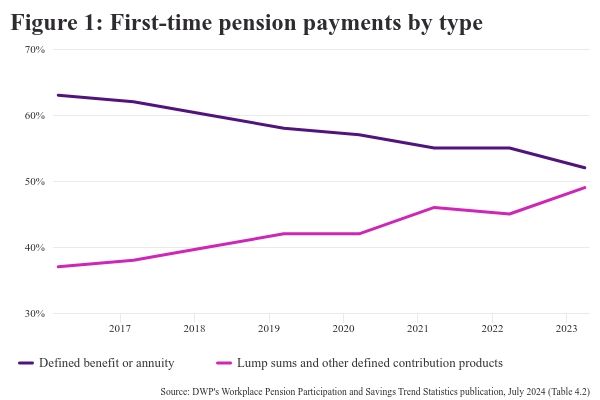

WTW's analysis of FTSE 350-listed companies found that they paid a total of £6.6 billion into UK defined contribution (DC) schemes last year, exceeding the £5.1 billion paid to defined benefit (DB) schemes during the year1. Meaning, we are on the cusp of more first-time payments from pensions being paid from DC schemes than from DB schemes. This tipping point underscores a growing urgency: DC schemes, now representing a larger share of retirement assets, must work harder to secure members' financial futures. As DB pensions market share decreases, the financial responsibility increasingly falls on the member, who must rely on their savings and the effectiveness of the investment strategies chosen for them.

The growing importance of DC investment strategies

DC pensions place risk squarely on the member rather than a sponsoring employer. Unlike DB schemes, which guarantee payouts even during economic downturns, DC schemes expose members to the full impact of market performance. And with average contribution rates in DC plans often lower than those in DB, there is heightened pressure on DC strategies to achieve strong returns over the long term.

This requires a paradigm shift in investment thinking, one that aligns strategies with members' timeframes and pulls every lever available to maximize long-term value. Some members beginning retirement today may still have decades of financial needs ahead, while newer members have even longer time horizons. Both groups demand robust, adaptable investment solutions.

Why DC schemes need to embrace private equity

DC schemes are increasingly in need of assets that not only aim for high returns but also exhibit adaptability over time. Private equity (PE) stands out as an asset class that can potentially meet these requirements by offering diversification and uncorrelated returns relative to traditional equities and bonds. Over the past 20 years, PE has consistently outperformed listed equities by 4 to 6 percent annually2, after fees, benefiting from both an activism premium—where managers drive value creation in portfolio companies—and an illiquidity premium, which compensates for the limited liquidity of these assets . Given the long investment horizon of DC schemes, these illiquidity advantages become especially relevant.

Prospective PE investors should remain mindful of fees, as net performance is crucial for realizing long-term gains. Despite this, the potential for excess returns underscores the significant role PE can play in DC schemes' portfolios, aiming to support growth, job creation, and innovation that can benefit society over time.

A changing world requires diverse asset classes

As technology, climate change and societal structures evolve, the future will demand more from investment portfolios. Private equity is uniquely positioned to capitalize on such changes, often providing key capital injections into growing companies in sectors undergoing rapid transformation—such as renewable energy, digital infrastructure and biotech. This dynamism aligns with the long-term goals of DC schemes, ensuring that assets are not only prepared for change but can also be part of the growth journey.

Though other asset classes also play a crucial role in the genesis and growth of new technologies which will shape our future, these strategies participate in different ways. Private credit might provide a loan to businesses, possibly secured by the assets of the business and subject to a certain borrowing rate and term; allowing investors to benefit from income-like characteristics through the repayment of these loans. Another example could be an infrastructure investment into a solar or windfarm development project, these assets provide revenue generating characteristics, have a tangible environment impact and form part of the energy transition journey which will materially shape the future of retirees. Private Equity is perhaps therefore a purer expression of investing in growing companies at the front line of innovation, with returns being driven by the successes of these businesses in proving their growth potential and longevity.

Other private market strategies such as real estate, infrastructure, and private credit, further bolster portfolios by enhancing risk-adjusted and distributing return sources and behaviours e.g. providing income/yield type cash flows to investors. Yet, many DC schemes are hesitant to adopt these less liquid assets, with allocation rates ranging dramatically across regions—from nearly 20% in Australia to less than 1% in the UK3. Regulators are beginning to encourage more balanced allocations to these assets, as seen with the UK's Mansion House Compact, which has prompted several large DC providers to pledge investments in unlisted equities.

Investment strategies for today's DC members

To meet the needs of today's DC members, investment strategies must be tailored to specific member profiles, including age, time to retirement and risk preferences.

The 50 year-old-member

For instance, a 50-year-old member may typically favour assets that balance growth and stability, narrowing risk profiles before drawing their pension down. However, assuming a further 15 years of working life, for a 65 year-old retiree, there is still substantial opportunity to participate in diversified and return seeking asset classes such as private equity. True, growth and venture capital may carry higher risk or frontier technology exposures, potentially making these strategies less appealing. However, mid-market buyouts of proven, growing businesses present a compelling alpha opportunity, with potential to far outperform other private and traditional equities. opportunity capable of generating returns far in excess of other private market asset classes or traditional exposures such as listed equities and bonds represents a compelling investment opportunity.

The 20 year-old member

At the beginning of a pension contribution journey, a 20-year-old member may well tolerate higher risk in pursuit of longer-term returns and desire to build their pot size quickly and efficiently. Less sensitive to illiquidity of their assets, given their potential approximate 45-year horizon before retirement, these individuals rightly want their money to work harder for them. For what might be their first foray into private market exposures, private equity has historically delivered compelling returns vs traditional assets, adequately compensating investors for the illiquidity they take investing in these structures.

By adopting a member-first approach, schemes identify the synergies that different asset classes have across their members and better align investment outcomes with individual retirement goals in an efficient manner.

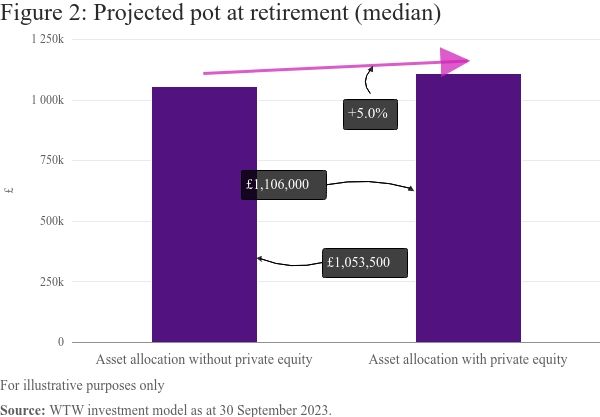

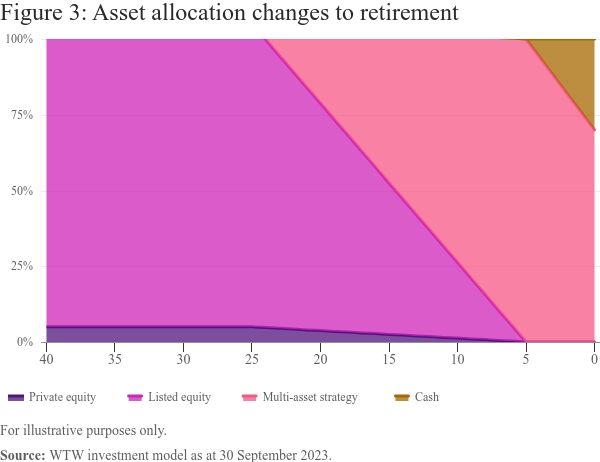

We recently conducted some modelling which estimates that a young professional earning £25,000 per year could increase the value of their pension pot at retirement (aged 65) by 5% or over £50,000 by allocating as little as 5% to private equity (Figures 2 and 3).

The same analysis also highlighted that increasing this proposed allocation to 10% in private equity makes for an effective value increase of roughly 10%, making a very compelling case for private equity exposures at the outset of one's pension saving journey.

Sustainability as a core component of risk management

With sustainability now at the forefront, DC schemes can no longer ignore environmental, social, and governance (ESG) factors. To support goals like the Paris Agreement and net-zero emissions by 2050, significant investments in sustainable assets are needed. Integrating ESG considerations not only addresses regulatory demands but also enhances long-term member value by mitigating future risks associated with climate and societal shifts.

Conclusion: The long-term view for DC pension strategies shifts from important to urgent

DC pensions are more important than ever for the retirement security of millions, requiring immediate and proactive investment decisions that serve member interests first. The strategy is clear: investment decisions today must reflect the long horizons of DC members, leverage private equity's unique benefits, and incorporate a balanced, sustainable approach. This approach ensures that DC pensions not only keep pace with change but also place members on a path to financial security for years to come.

Footnotes

1. WTW Analysis, June 2024.

2. Preqin Quarterly Index, June 2024.

3. WTW Analysis, June 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.