About this research

This report summarises the findings of a year-long study into the future of business operating models (BOMs) in insurance. A business model is a blueprint of how functions, divisions and organisations co-operate to capture shareholder value.1 The research primarily addresses the business model challenges of major global insurance companies operating in both life or non-life sectors across multiple markets; although the findings are relevant for all insurers. The report is based on several research methodologies including:

- Face-to-face interviews with senior insurance executives;

- An online questionnaire completed in August 2009 by approximately 20 equity analysts in Europe and North America;

- Analysis of published year-end results (as at May 2009) of 24 international life and non-life insurance companies from Europe, North America and Asia;

- Focus groups of in-house Deloitte insurance practitioners.

Our thanks are due to those senior insurance executives who enabled us to make an in-depth analysis of their business operating models.

Foreword

Over the past two years, many financial services institutions have been working towards one goal – survival. Like many others, insurers have come under great pressure during the financial crisis. Compared to their banking counterparts, most insurers have come through in good shape.2 But 'business as usual' is unlikely in the foreseeable future.

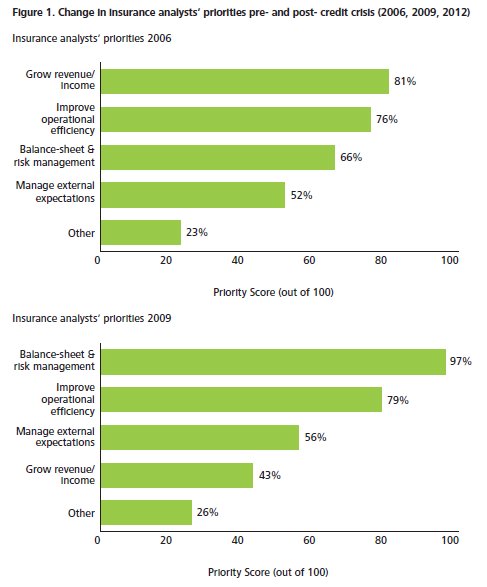

Deloitte's research shows that insurance-industry analysts no longer give top priority to revenue growth as the key driver of shareholder value. Balance-sheet strength and robust risk management are, they say, the most significant drivers of performance.

In the medium-longer term, we consider operational efficiency will become crucial to maintaining profitability, as insurers' prospects for revenue growth are hampered by increasingly saturated and commoditised core markets. Although certain retirement segments and emerging markets offer a bright hope for revenue growth, it will be some time before they are significant enough to shift the current focus away from balance sheets, risk management and operational efficiency.

We argue that insurers' existing business operating models are not designed to achieve these new priorities. The predominantly multi-divisional and decentralised models used by insurance companies have resulted in increased organisational complexity, duplicated infrastructure and localised, difficult-to-scale operations. In addition, the functions that have a direct impact on controlling balance sheets and risk have had a diminished role under the prevailing models. And, as sources of new revenues and customers have continued to shift from west to east, and from north to south, insurers have struggled to put in place business operating models that can translate synergies across both mature and emerging markets.

Insurers should address these fundamental issues now. Building models that foster standardised, enterprise-wide (globally) integrated operations is vital to compete in a market differentiating through operational efficiency. However, local business units in certain markets must also be allowed to be flexible in order to respond to dynamic market conditions. We suggest ways to achieve a balance between these apparently conflicting goals in this highly regulated sector.

Executive summary

Shifting demand causes business model challenges

While banks were, in the main, more severely affected, the financial crisis knocked investors' confidence in insurance, and triggered a radical change in priorities for the industry. Previously focused on revenue growth and return on equity, insurance analysts have placed balance-sheet strength, robust risk management and operational efficiency at the top of their agendas. Such changes in investor demands are likely to remain in place until 2012. At the same time, a changing regulatory landscape is also expected to shift the goal posts for insurers. For example, Solvency II is due to be implemented in the European Union by 2012. Additionally, insurance is in a period of global transition, as major insurers shift strategies to straddle both mature and emerging markets, requiring improved global coordination.

While demands on insurers have shifted substantially, their business operating models have not. Current models have evolved to respond to opportunities for revenue growth across multiple domestic and international markets. These same models are now creating barriers to more efficient operations, effective balance-sheet and risk management and global cooperation. In short, insurance business operating models (BOMs) are often no longer fit for purpose.

Principles for new business operating models

We set out principles for a new business operating model that will bring improvements to the management of balance-sheets & risk and operational efficiency.

1. Globally integrated (or enterprise-wide) operations: Existing models are set up for growth opportunities in local markets, and insurers are working towards creating regional-scale synergies to achieve improved controls and operational efficiencies. They must be more ambitious – driving through fundamental change to go for integrated operations on a global or enterprise-wide scale. The starting point for each insurer is different. But typically insurers should build stronger divisional and group/corporate functions to facilitate such integration.

2. Dual operating model: Moving to a globally integrated (enterprise-wide) solution may not be appropriate for all parts of the business as many insurers are in a period of transition, straddling mature and emerging markets. A dual operating model is needed based on two speeds: accommodating improved control and enterprise-wide scale where possible, while allowing a localised tailored approach for more entrepreneurial parts of the business (or those subject to unique regulatory environments). Being selective is key. Insurers should make a distinction between those operations that should be integrated (standardised and simplified to operate from a globally integrated model) and those operations which need to operate from a more autonomous basis to retain flexibility and responsiveness (e.g. difficult-to-scale or highly tailored processes).

3. The right combination: The dual model is not only applicable for the emerging/mature markets dichotomy. In defining the right mix of businesses to be integrated or operated more autonomously, insurers may choose to distinguish their core business in other terms. Manufacturing versus distribution, commodity versus higher-value business, back-office versus frontoffice, life versus non-life, or indeed protection versus savings and investment management can all be used as a basis on which operations can be selected for integration across the enterprise.

4. Strategic approach to building models: Initiatives aimed at fixing current business models are often thought up and implemented on a piecemeal basis. This can result in initiatives that fail to gain traction, leading only to incremental improvements or ones that may do more harm than good. Therefore a more strategic approach is required.

Practical steps towards a more strategic approach

Insurers seeking to transform their business models in order to respond to the new demands placed on them should take a more joined up approach to change. Each organisation has its own unique business operating model and starting point to the transformation agenda. However there are common tools and steps to a solution:

- Often initiatives to change business strategy or organisational structure are not strategically analysed or driven in tandem. Insurers should assess the current business operating model strategy and structure so that the two are better aligned.

- Some insurers have struggled to convince shareholders that their balance sheets are sound and that new business is not being written at the expense of disciplined underwriting. Balance-sheet efficiency and risk management should be established as a top priority, and relevant functional specialist teams strengthened.

- Business operating models have become more complex and opaque as the boundaries between insurance companies, intermediaries and distributors become increasingly blurred. Open architecture is also forcing strategic decisions around manufacturing or distribution as a core capability. Defining core activities (and non-core) is key to focussing resources on achieving operational excellence in the essential parts of the business. Non core activities may be outsourced, offshored or delivered through strategic partnership.

- Many business units are accustomed to autonomy, building their own solutions and product-sets tailored to their local markets or jurisdictions. Consequently insurance BOMs have typically become highly complex. For improved operational efficiency and more consistent governance and controls, insurers should simplify and standardise processes, laying the foundations for improved co-operation and scalable operations.

- Complex business operating models, led by autonomous divisions, have caused duplication and inefficiency. Simplified and standardised processes (see above) should be scaled up on an enterprisewide basis where appropriate. Insurance companies can aim for enterprise-wide (globally) integrated operations on a selective basis.

- Operational efficiency is crucial to competitive advantage in commoditised markets. However entrepreneurial units in either high growth products or niche and emerging markets can be crushed by a stifling business operating model. Within limits, insurers' models should allow specialised, autonomous operations in certain parts of the business.

- Some insurers were challenged by the financial crisis partly because they failed to convince shareholders of their financial viability. This was in part caused by a lack of enterprise-wide transparency and difficulty in communicating business models, reporting and accounting. Insurers should clearly articulate the business operating model and strategy to external stakeholders.

Terminology Balance-sheet efficiency and risk management: strategies and structures concerned with capital, liquidity, and the governance and control of risk.

Business models: a blueprint of how functions, divisions and organisations co-operate to capture shareholder value. Throughout this report, the terms 'business model', 'business operating model' (BOM), 'operating model' and 'global operating model' are used interchangeably. However there are small differences in usage. 'Business models' (the most all-encompassing term) typically refers to high level strategy. BOMs are applied versions encompassing strategy and operations. Operating models have a more operational focus.

The crisis: the financial crisis that began in August 2007.

Long term: a medium-to long-term view for investment analysts is defined as between one and three years.

Operational efficiency: variables that have an effect on operating margins, such as cost efficiency, customer acquisition and management costs, tax, claims management.

Revenue growth: includes growth in premium income from new business and customer retention (persistency), policy volume, price realisation, and investment and trading returns.

Divisions: business units organised by customers, products or geographies.

Functions: in contrast to divisions, functions are typically categorised by the competencies of the activities carried out. For example, sales and marketing, tax, risk, finance, IT or underwriting.

The basis of competition has changed

The financial crisis knocked investors' confidence in insurance, triggering a radical change in priorities for the industry. Previously focused on revenue growth and return on equity, insurance analysts have placed balance-sheet strength, robust risk management and operational efficiency at the top of their priorities. These revised priorities will remain in place until at least 2012. We argue that these changes to the basis of competition will require insurers to adjust their business models.

Balance-sheet strength and risk management are top priorities

The financial crisis, beginning in August 2007, triggered a worsening in the performance of insurers. Based on a sample of 24 global firms, insurers' total revenues (including investment and trading net income) slumped by 32 per cent in FY08. The severity of the decline was particularly felt by insurers exposed to investment losses. At the same time, operational efficiency decreased, with the average combined ratio for the sample increasing by two percentage points to 91.8 per cent.3 In addition, some 78 per cent of insurers saw a drop in their capital and solvency levels during FY08, driven primarily by losses on the asset side.

This broad-based deterioration in performance, together with high-profile shocks (such as that experienced by AIG), led to a widespread loss of investor confidence. The industry struggled to convince stakeholders that their businesses were viable, but value was very quickly destroyed. In FY08, the total market capitalisation of our sample of firms plunged 30 per cent (from £630.6 billion to £443.8 billion).4 Embedded value (EV) has also been adversely affected.5

With investor confidence severely knocked, shareholders radically shifted their priorities. Our survey of European and North American insurance analysts shows that shareholder priorities moved markedly between 2006 and 2009 (see Figure 1).

Analysts were asked to rank the medium-to long-term (1-3 years) performance criteria they use to judge insurance firms. In 2009, balance-sheet & risk management scored 97 per cent, compared with just 43 per cent for revenue growth (see Figure 1).6

Is this new priority simply a knee-jerk response to a credit crisis that may already be over?

Some senior executives that we interviewed think so. However, analysts remain sceptical, and balance-sheet efficiency and risk management will remain their central focus until 2011/12. Some 50 per cent of insurance analysts indicated that their concerns over balancesheet and risk management will remain at a high level until at least 2011.

Longer-term trends seem to support the analysts' views. Regulations and accounting rules covering capital, liquidity and risk are currently being revised and will keep the balance-sheet agenda in place, for some time:

- In Europe, the EU's Solvency II legislation, which aims to establish more efficient economic capital models, is due to be implemented by 2012. The spirit of the Solvency II Framework Directive may be liberating, allowing businesses to benefit from harmonised regimes on a supranational basis. The principles of Solvency II are also expected to have an impact on insurance players operating in the US and Asian markets as many European firms are active there.

- The capital required to write new business is likely to remain scarce and expensive. This is leading some insurers to more efficiently source capital from internal sources. As many corporate structures are sub-optimal in terms of their capital efficiency, fungibility and diversification, leading insurers have been restructuring their legal frameworks and balance sheets, reducing risk and improving their dynamic capital modelling. For example, several groups over recent years have moved to a single EU carrier (one for life and non-life) operating across Europe through a branch structure.

- Modifications to accounting rules, and frameworks that seek to improve comparability and transparency (such as International Financial Reporting Standards (IFRS) and Market Consistent Embedded Value (MCEV)) are also being implemented over a similar time frame.7

Operational efficiency will be the top priority in the longer term

While capital, liquidity and risk issues have become vital factors, business strategies must also take into account another fundamental shift towards operational efficiency. Among our sample of global insurers, total revenues in 2008 dropped by more than 30 per cent from the preceding year.8 Figure 1 also illustrates insurance analysts' priorities for 2012 and beyond. Revenues will become important once more, but operational efficiency will be king.9

The convergence of several regulatory events is likely to constrain revenue growth going forward:

- Tighter regulation of the distribution of insurance products (such as MIFiD in Europe and the Retail Distribution Review in the United Kingdom) may act as a brake on new business development in these markets, potentially curtailing profitability.10

- Legislation on capital requirements may also hold back growth. Solvency II was heralded as offering opportunities to make capital models more efficient across jurisdictions. However, recent proposals to implement the framework directive may be interpreted in such a way that regulations may inhibit writing new business in certain markets. One way around this potential problem of regulatory capital may be to restructure the group to become a 'mega insurer' with branches in each market.11

- Additionally, as Solvency II and other risk- and capital-based initiatives are being implemented, insurers are achieving greater understanding of the real costs of underwriting risks. Products that are less capital-efficient may be withdrawn as more emphasis is given to disciplined underwriting and sustainability.

Such events suggest capital planning will remain important but also add to the likelihood that the longterm focus on operational efficiency will be the principal source of profitability.

Revenue growth will remain important, but the focus may change

Management in insurers will, of course, focus on both revenue growth and operational efficiency in their medium-term plans, with the balance varying by firm. Figure 1 shows that by 2012 insurance analysts will consider revenue growth as an important driver of shareholder value once more. However, we expect that the focus of revenue-related activities may need to change in the light of developments in mature markets. Our analysis of revenues suggests that, up until the financial crisis, total revenue growth has been sluggish due to dependence on saturated mature markets, and revenues have been supported by investment returns.

We think the focus for revenue-generating activity may shift to improving customer retention ('persistency' in life companies) as new customer acquisition becomes more difficult for the following reasons:

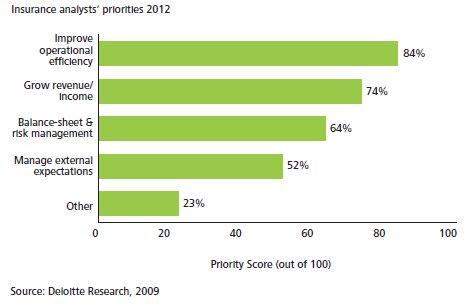

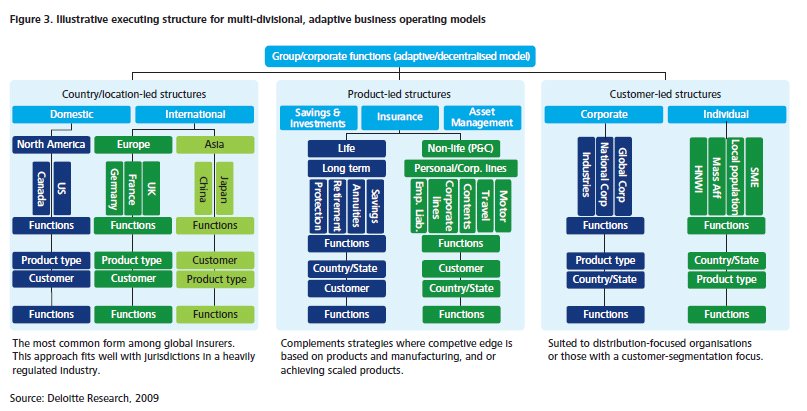

- Long-term total revenue trends indicate sluggish growth. Total revenue growth has been unimpressive over the past five years. Total revenues are calculated from net premiums, reinsurance premiums, and trading & investment income. Over the period between 2005 and 2009, (projecting forward from 2009's first-half results), global insurers achieved total revenue CAGR of just 1.31 per cent (see Figure 2). Separating out net premium growth, insurers achieved a CAGR of just 4.56 per cent over the same period. Both rates are indicative of saturated markets.

- Revenue growth has been supported by investment returns. Net premiums contributed approximately 55 per cent of total revenues in 2005-2007. This indicates that investment and trading income have played significant roles in holding up headline revenue growth. However, heavy investment losses in 2008 ate into total revenue growth even when net premiums remained stable. Many industry commentators do not expect investment income to deliver sufficient returns to maintain total revenue growth and profitability in the coming years.12 In a more risk-averse environment, we think that insurers may revert to average investment returns.

- Insurers are often reliant on core markets that are saturated. An analysis of income generation (see Figure 2) and the location and value of assets indicates that insurers have reached saturation in many core markets. Among our sample of 24 global insurance companies, an average 88 per cent of group assets was based in mature markets in 2008. At the same time, macro-economic expectations are downbeat about growth potential in mature economies. This means that net premium income is unlikely to grow at a rapid rate in the coming years.13

- Emerging markets are expected to grow at twice the pace of developed markets.14 Emerging markets offer a bright hope as a source of revenue. However, with a few notable exceptions, emerging-market operations make a much less significant contribution to overall group performance compared with mature markets. For instance, among our sample of 24 insurers, the emerging markets' share of total revenues stood at 19.1 per cent in FY 2008. Their share of total assets was just 12.1 per cent in the same year. Emerging markets are likely to remain a minor contributor to revenues, compared to mature markets, for some time to come.

Insurers' scope for revenue generation in mature highly saturated markets may be limited. In their life business, they may rely on achieving growth in the value of their current assets under management (AUM) as growth through new business becomes difficult. The need to refocus efforts on retaining customers may take precedence over new business acquisition and revenue growth. For these reasons, our sample of insurance analysts identified 'minimising lapses/surrender rates' and 'growing the value of AUM' as the main areas of insurers' customer focus over the next few years.

Business operating models struggle to deliver in the new environment

While demands on insurers have shifted substantially, their business operating models have not. Current models have evolved to respond to opportunities for revenue growth in a variety of markets. These same models are now creating barriers to more efficient operations and effective balance-sheet & risk management.

Based on in-depth interviews with senior insurance executives and in-house focus groups of Deloitte practitioners, many insurance BOMs are struggling to be fit for their purpose.

'Adaptive' multi-divisional models dominate

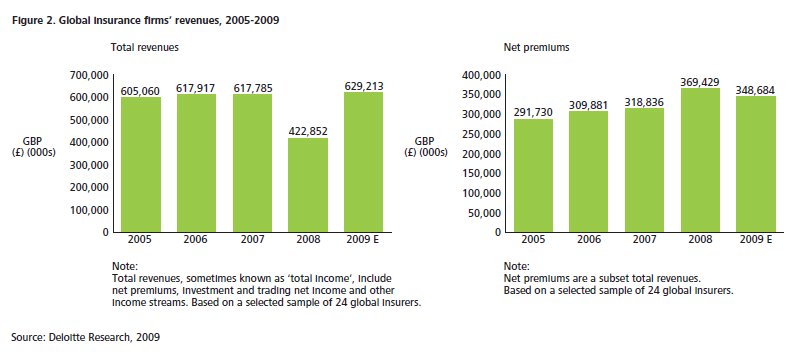

No two BOMs are the same, and distilling complex business strategies into summaries can be misleading. However, our research suggests that insurers' business strategies are typically 'adaptive'.16 This means that they seek competitive advantage through the slick entry into, and exit from, markets. They rely on speed, timing and the flexibility of the model to respond to growth opportunities at the local level. Within parameters set at group/corporate level, each business unit typically sets its own strategy and tactics to respond to local market conditions.

To execute adaptive strategies, insurers' organisational structures are typically based on highly autonomous revenue-generating units that are operated discretely within a decentralised decision-making framework. Their characteristics include:

- Divisional decision-making. Divisions typically take responsibility for their own profit-and-loss account and set their own agendas. As they are operated discretely, each division has a significant support infrastructure of its own. Divisional heads (of product lines, countries, or customer segments) hold key decision-making rights rather than the heads of functions (such as claims, actuarial, marketing, underwriting or loss adjusting). There are, typically, many layers of geographic, product and customerbased divisions within one reporting structure.

- Divisions operate discretely from each other. Unintegrated divisions facilitate the bolting on or unbolting of individual business units, acquisitions or disposals. This allows insurers to grow or shrink according to revenue opportunities.

- Decentralised operating structures. Insurers typically favour lean group or corporate functions. Such functions manage business units on a portfolio basis. They set financial performance metrics but do not become strategically, tactically or operationally involved with the running of the business units. There are differences in different regions. In the United States, corporate (group) functions may be sub-divided into domestic and international divisions. In Europe, this layer is rarely present.

"We have literally thousands of IT systems that are not linked together."

Global life insurer

"This industry is littered with unconsummated M&A."

Global general insurer

Figure 3 illustrates the multi-layered operating structure of adaptive multi-divisional models and the functions required to support each sub division. In a recent US-based Deloitte survey, 600 insurers were asked to describe their global business operating models and, specifically, which divisions typically lead decision-making. Some 93 per cent said they are led by country-, product- or customer-led structures rather than by functions. Of these, 32 per cent use a hybrid mix of all three, becoming complex multi-divisional organisations.17

Advantages of 'adaptive' multi-divisional models

Based on the feedback during our interviews, the advantages of such models include:

1. Flexibility: Divisions without shared infrastructure or functions can be easily bolted on or unbolted from the operating model. Aquisitions and disposals can be undertaken relatively quickly without integration issues. Adaptive, multi-divisional models are good for complex and dynamic environments.

2. Adapting to local conditions and regulatory context: Multi-divisional approaches are suited to industries where the regulatory context for each market is material, or where distribution networks need to be tailored to local circumstances.

3. Accountability: Divisional-based profit-and-loss statements can improve accountability.

4. Cost: Decentralised management may be less costly in the short – medium term at the group/corporate level.

"Marketing was a case in point. It was the least mature of our functions, lacking the basic tools and programs and was organised on a countryby- country (local) basis. It was on an individual and basic level. No segmentation and proposition strategies had been developed. This was banking 15 years ago – with no functional expertise. But it was tackled by banks back then. It is still a big issue in insurance."

Global composite insurer

Disadvantages of 'adaptive' multi-divisional models

Five specific issues can be created by these models:

1. Limited governance and controls: The consistent management of risk and capital can be weakened within divisional decentralised models. Without a strong group function (or strong functional specialist teams), the influence of subordinated control functions – such as risk, compliance, underwriting and finance – can be diluted. Specialist knowledge in these areas can be lost.

2. Duplication of infrastructure: Autonomous divisions with their own independent infrastructures can produce significant duplication of IT, processes and functions in a decentralised, adaptive multi-divisional organisation. Few incentives exist for divisions to work together to create common processes. Large acquisitions can create significant issues if not properly integrated.

3. Limited co-operation due to 'divisional bargaining': Strong divisions combined with weak functional teams can lead to poor co-operation. Divisions that must 'bargain' with each other can create barriers to co-operation leading to inconsistent (non-standardised) processes. This can lead to IT systems that struggle to be integrated and that have no common language, which can negatively impact operational efficiency.18 It can also lead to a lack of cooperation in serving shared customers. Without centralised functions to facilitate such co-operation, insurance companies can fail to utilise shared services (across divisions or functions) in order to achieve economies of scale or other synergies. Insurers have significantly greater IT and M&A legacy issues than other industries.19

4. Lack of mobility of staff, skills and innovation: Divisions acting autonomously can stifle the global movement of skills, ideas and leading practices. Specialists in one part of the business may struggle to share their functional specialist skills if there are barriers to mobility.

5. Added complexity: In the face of weak centralised governance, insurance companies have put in place various forms of matrix management to forge greater co-operation between divisions. This has improved co- operation across divisions. But it has also led to confusion over roles and responsibilities, competing strategies, further costs and issues falling between the gaps.

'Regional 'planned' models have emerged

Our research suggests that some insurers have evolved beyond the adaptive, multi-divisional model. These companies remain multi-d ivisional, but they adopt a 'planned' business strategy. To execute planned strategies, insurers need more centralised control and strengthened functions that are scaled to national or regional size.

In add ition to the business-based imperatives to regionally integrate (i.e. to gain scale and eff iciency); regulatory, financial and tax-based initiatives are also facilitating a drive to regionalise business operating models. For instance, legal frameworks in Europe are working to facilitate corporates in their move to a region-wide business model through harmonising legislation. Such legal and taxbased developments impacting corporate legal structures can facilitate simplified and standardised processes.20

We have found that global insurers based in Europe are typically more internationally d iversified and further down the road in using planned strategies than Anglo-American insurers. However, regardless of location, most insurers we interviewed are moving slowly towards more planned business operating models.21

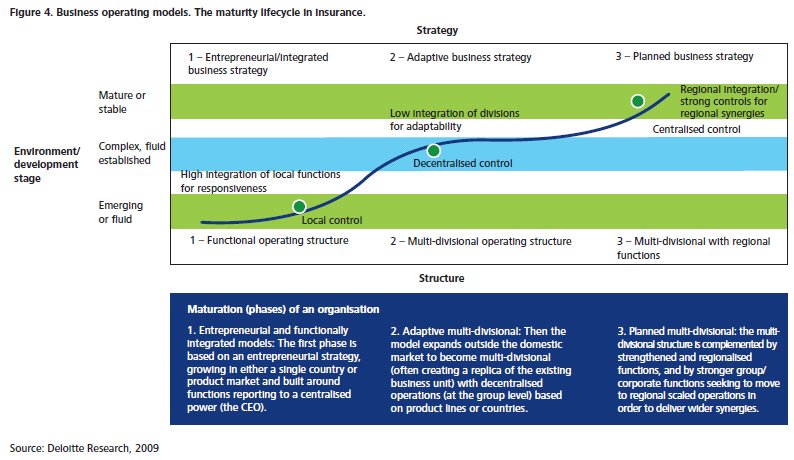

Figure 4 illustrates how some insurance business models have moved into this development phase, with regionally integrated operations, stronger centralisation and a planned strategy.

Although insurers may suffer increased short-term management costs and bureaucracy, moving to a regional model has several advantages. It allows for cooperation among divisions at the continental level enabling standardised approaches and regional-sized economies of scale. Many insurers are de-duplicating localised infrastructure moving towards regional hubs of shared services. Regional models can also give regionwide representation of functions and controls.

Are insurers being radical enough in re-designing their BOMs? Simply regionalising their existing operations is not enough. To respond to the new shareholder demands for balance-sheet strength, global enterprise-wide controls are required, functions should have greater influence over divisions, and group control should be stronger.

Principles for a new business operating model

Insurers seeking a strong early position coming out of the crisis will need to meet the challenges posed by their business operating models. This section sets out principles for a new business operating model that will bring improvements to the management of balance-sheets & risk and operational efficiency.

1 Globally integrated (or enterprise-wide) operations: Existing models are set up for growth opportunities in local markets, and insurers are working towards creating regionalscale synergies to achieve improved controls and operational efficiencies. They must be more ambitious – driving through fundamental change to go for integrated operations on a global or enterprise-wide scale. The starting point for each insurer is different. But typically insurers should build stronger divisional and group/corporate functions to facilitate such integration.

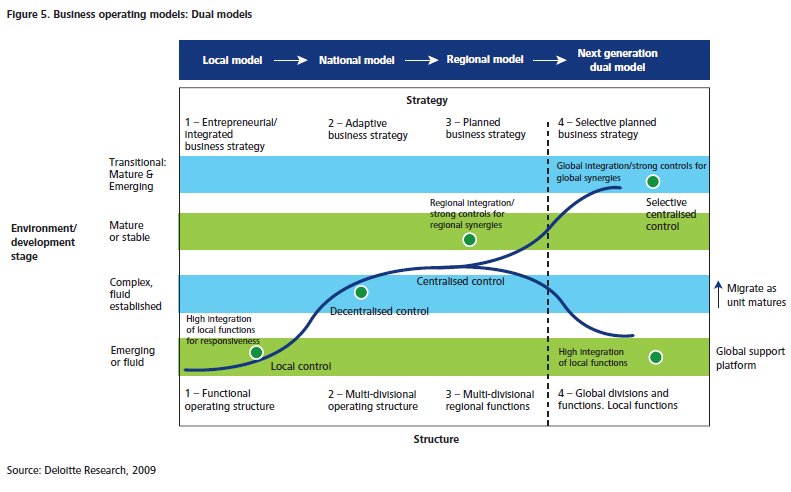

2 Dual operating model: Moving to a global integrated (enterprise-wide) solution may not be appropriate for all parts of the business as many insurers are in a period of transition, straddling mature and emerging markets. A dual operating model is needed based on two speeds: accommodating improved control and global scale where possible, while allowing a localised focus for more entrepreneurial parts of the business (or those subject to unique regulatory environments). Being selective is key. Insurers should make distinctions between those operations that should be integrated (standardised and simplified to operate from a globally integrated model) and those operations which need to operate from a more autonomous basis to retain flexibility and responsiveness (e.g. difficult-to-scale or highly tailored processes).

3 The right combination: The dual model is not only applicable for the emerging/mature markets dichotomy. In defining the right mix of businesses to be integrated or operated more autonomously, insurers may choose to distinguish their core business in other terms. Manufacturing versus distribution, commodity versus higher-value business, back-office versus front-office, life versus non-life, or indeed protection versus savings and investment management can all be used as a basis on which operations can be selected for integration across the enterprise.

4 Strategic approach to building models: Initiatives aimed at fixing current business models are often thought up and implemented on a piecemeal basis. This can result in initiatives that fail to gain traction, leading only to incremental improvements or ones that may do more harm than good. Therefore a more strategic approach is required.

1. Globally integrated (or enterprise-wide) operations: choose your markets and globalise Progressing towards global integration (rather than national or regional integration) makes sense for a host of reasons. For instance, improved balance-sheet and risk management requires centralised and globally integrated functions to create a consistent global view of risk and capital. Regional views are helpful – especially as legislation is beginning to converge at the regional level, as with Solvency II. But only global integration will suffice if multinational insurers are to achieve enterprise-wide control. Capital and risk models should be congruent with operations. Leading insurers, seizing their chances while the landscape settles, are aggressively scaling up their operations.

They are picking their markets, and seeking to win with the advantage of global scale. For instance, some leading manufacturers are seeking to develop a single manufacturing platform on a continent-wide basis.

To overcome business-model barriers and move to a more globally integrated operating principle, three steps need to be taken:

- Create a stronger group/corporate centre to counterbalance divisional power. Strengthened global financial control and risk governance require group-led functional communities with the power to influence practices in divisions. A more centralised approach should also facilitate co-operation between traditionally autonomous divisions.

- Led by the group/corporate-level functions, insurers should seek to further 'industrialise' (that is, to simplify and standardise) processes within divisions and functions, leading to potential shared services.

- Then they must integrate divisions and functions at both the regional and global level in order to achieve scale.

2. Dual operating model: allow flexibility for a tailored response

The guiding principle of global (enterprise-wide) integration must not be implemented at the expense of flexibility. Insurers require gains in efficiency and customer retention in mature markets while they need revenue growth in emerging markets. As global operating models mature, insurers should seek to move from their adaptive multi-divisional models to an acceptance of a new structure based on a dual model.

It is not practical for some business units to be subject to prescriptive organisational structures or to initiatives designed to create scale efficiencies at regional or global levels. For instance, business units competing in emerging markets, where the customer/client base may be unfamiliar, often need to spend time and resources in building relationships with new customer segments and developing appropriate underwriting and pricing policies. In new markets, sales, claims, actuarial and underwriting teams need to work together to establish customer segments, risks and pricing. Only once they have matured should they be separated out to join regional or global shared-service platforms.

Other operations may also need to be treated differently. Business units in mature markets seeking to place new products, for example, or those subject to highly nuanced local regulation may also suffer under a globally integrated regime.

Insurers spanning markets that require these different kinds of approach need a BOM that fosters global operations where possible but that also helps entrepreneurial units to reach maturity.

Such a dual operating model should be based on three principles:

- Selectivity: Insurers should be selective as to which operations go into regionally and globally industrialised models. These decisions should be based on objectives, legislative requirements (including tax) and the maturity of each business unit.

- No compromise on enterprise-wide control: Categorising specific units as entrepreneurial is not a 'get-out-of-jail-free' card for the local business unit. The need for global capital allocation remains. Localised divisions and functions should be set minimum standards, but be free to organise according to specific market conditions. As they mature, these units should be brought into the global operating model.

- Global (group or corporate level) support for local units: Entrepreneurial units may still tap into global manufacturing capabilities. Providing platform support for local units will work if the platform allows such units to be responsive to local conditions and customers. It is necessary to understand which processes should be common across business units and which need to be tailored. As insurers regionalise, these business units should be increasingly supported and managed by regional hubs.

Figure 5 plots the next phase for global operating models – progressing from a regional business operating model to a dual model.

3. The right combination. Dual models are not just about emerging markets

The dual model approach is not only applicable in thinking about the emerging market/mature market dichotomy.

The principle can be applied to manufacturing and distribution.22 Leading insurers who have decided that manufacturing is a core competence are seeking to globalise their manufacturing processes. Due to the multi-divisional approach taken by most insurers, global manufacturing may be combined with global distribution only for certain commoditised personal lines. For instance, creating global direct motor operations may be possible. Those who deem their distribution to be 'core' may seek advantage in disintermediating brokers and aggregators from their distribution processes as a way to preserve margins.23

Another way to categorise activities is based on the back, middle and front offices within business units.24 Insurers' back-office, support and control functions have often been structured around the front office. This has led to a lack of control and a lack of standardised processes within middle and back offices. At the same time, a wholesale move to standardised controls in every office, and in all functions and divisions, may be costly and impractical.

Commodity areas such as protection and motor may benefit from a focus on achieving scale. By contrast, in higher-value areas (such as global commercial lines) the key is to have appropriate client-related datasharing, risk management and control. The gain or loss from the underwriting decision in such cases can swamp any operational efficiencies. Globally integrated scalable models should not be adopted by business units where they result in diseconomies of scale

Insurance (that is, protection) or savings and investment management is another basis for distinction. As some life insurers' businesses move more towards investment management, the control of investment performance (providing downside protection), grows in importance. That magnifies the significance of controlling hedging and investment in illiquid instruments. A variety of measures can be adopted – from merely setting policies (around risk appetite, for example, or the level and return of investment spend) to more active control of decisions (as with large catastrophe risks).

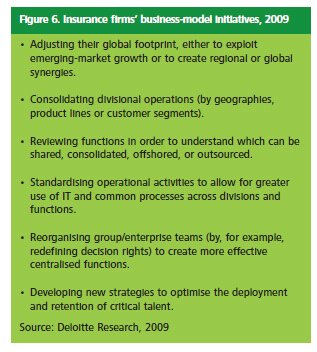

4. Piecemeal change to make way for strategy

Insurers have recognised that their current BOMs are struggling to deliver operational efficiency and effective control. Many are working feverishly to fix some of the problems. But change has been piecemeal and the impact only incremental and may, in some cases have done more harm than good. Based on our interviews with senior insurance executives, the sidebar highlights some of the initiatives currently underway in leading institutions.

There are many and various skill-sets involved in BOM changes. Risk and actuarial teams need to help create dynamic capital models that work efficiently; HR, IT and operations are required to work together for a cultural change in operations both within and across divisions; while legal and tax teams have to facilitate changes to the underlying structure of BOMs.

Few insurers have a co-ordinated strategy for these initiatives. And this can cause problems. For instance, it is possible to implement an extensive and costly IT programme that fails to put in place the people strategy that is required to execute and embed the programme. Such initiatives can also fail to achieve the necessary commitment from business units due to the weak influence of group functions.

Practical steps towards a strategic approach

Insurers should take a more co-ordinated approach to change and re-appraise current BOM change programmes. Moving away from uncoordinated piecemeal initiatives to a more strategic approach is required. Globalising and industrialising operations designed to gain scale must be carried out on a selective basis. With this selective principle in mind, insurers should take the following steps to transform their business operating models:

1. Assess the current business operating model strategy and structure

Often initiatives to change the business operating model are not strategically analysed or driven in tandem. This can result in business strategies that are misaligned with the organisational structure. Articulating the strategy and then making decisions about the BOM requires several stages:

- Assess the insurance value chain. Which parts are most valuable? Open business models are becoming crucial for strategic positioning.25 For instance, decisions made about the role of intermediaries, the use of aggregator sites and product sourcing through open architecture all have consequences for the business model.

- Business strategy and the operating structures required to execute it should be aligned – for instance, corporate strategy should reflect the growth prospects of markets and the need to focus on customer retention (persistency) in mature markets.26

- Assess if the current business operating model is appropriate. Many insurers struggle to define the BOMs they currently have, let alone in the future. They should check their existing model for gaps in its ability to deliver the new strategy.

2. Address balance-sheet efficiency and risk management as a priority

Some insurance firms are struggling to convince shareholders that their balance sheets are sound and that writing new business is not being done at the expense of disciplined underwriting and pricing. Insurers should:

- Raise the priority of balance-sheet & risk management, and efficiency in operations, on the corporate agenda at both the group/corporate and divisional levels.

- Strengthen the functions that affect these priorities (such as tax, finance and controls, actuarial, risk management and compliance, IT and internal audit) at both divisional and group level in order to exert more influence over autonomous divisions.

- Build functional specialist teams in these areas at the local, national and regional/global levels so they can share leading practice.

- Consider a transformation programme for the finance function, including management-information solutions to improve the measurement and management of capital allocation.

- Review the product base to understand its capital efficiency.

3. Define the core business

BOMs have become more complex and opaque as the boundaries between insurance companies, intermediaries and distributors have become increasingly blurred. Open architecture is also forcing strategic decisions about whether manufacturing and/or distribution is a core capability. At the same time, insurers are facing choices over the role of mature and emerging markets in driving strategy. Without a clear definition of core and non-core operations, diversified insurance companies can become unfocused. Insurers should:

- Define their core and non-core operations.27

- Simplify core operations and processes for scale and efficiency (see Sub-section four). Seek functional excellence in these areas.

- Offshore or outsource non-core back- and mid-office processes. And/or create an affinity relationship

4. Simplify and standardise processes

Insurance BOMs have become highly complex. Many business units are accustomed to autonomy. And product sets vary enormously, from complex life products tailored to individual jurisdictions to commoditised general insurance that can span the globe. Attempts at reducing complexity have worked to a degree. But as insurers have streamlined processes or adopted new technologies, further complexity has often arisen.

Divisions and functions seeking to differentiate themselves on operational efficiency should look to industrialise their operations. They should:

- Strengthen the group role in facilitating divisional bargaining.

- Seek greater commonality in technology and operational infrastructure, especially around support and back-office functions. Working towards a common language for IT and other processes involving management information (MI) should be an initial goal.

- Develop a common global footprint. This should be geared for operational efficiency in mature markets (where, our research suggests, most of insurers' assets are still held), and for growth in emerging markets.

- Tailor the footprint to reflect the company's lines of business or customer segments. For instance, non-life personal lines is increasingly a commodity business with similar features in most mature markets, implying there is capacity to further develop common processes.

- Adopt simplicity and standardisation wherever possible throughout the value chain.

- Communicate internally, to promote internal understanding of current business operating models and to foster a common vision and rationale behind proposed changes and the future model.

5. Scale up where appropriate

Insurers do not always maximise their potential scale advantages – for the same reasons they have not simplified their BOMs: Organisations led by autonomous divisions have caused duplication and inefficiency. They need to:

- Define what is globally scalable and what is not. Local sales/distribution is often based on prevailing broker/distribution networks and national jurisdictions. While distribution may be difficult to globalise, a global/regional manufacturing (and product development) capability may be created.

- Enable offshoring and set up centres of excellence for selected functions. Give these functions an opportunity to scale up on a regional or global basis.28

- Seek scale opportunities in negotiating with volume distributors. For instance, in sharing data across markets, disseminating best practices around claims and other core processes, and creating regional programmes around risk classes. Also, scarce technical skills (for example, in investment, underwriting or actuarial) can become trapped in one country when they could be serving several.

6. Allow functionally integrated, autonomous operations where necessary

Operational efficiency is critical to gaining competitive advantage in commoditised markets where revenue growth remains difficult. However, it is important that entrepreneurial units, often carrying out a revenue-growth agenda, are not crushed by a stifling business operating model based solely on the mature-market ethos.

- Functions such as product development, underwriting & claims, and sales & marketing will have to work closely together to achieve specific customer and product knowledge in unfamiliar territories. Such territories may be emerging markets or business units in mature markets seeking to sell innovative new products. Reliance on regional or global scaled operations may stifle such co-operation.

- However, opting out of balance-sheet and risk management processes is not acceptable. Although operational efficiency at the local level may be compromised as entrepreneurial units rely on their own infrastructure rather than shared services, entrepreneurial units must be subject to standardised functions relating to capital management and risk. Dynamic economic capital modelling requires risks to be measured on a like-for-like basis across the entire business.

7. Communicate about the BOM to the external world

Insurers are not banks. However, the financial crisis has had a substantial impact on them, partly because they failed to convince shareholders of their financial viability. This was in part caused by a lack of enterprise-wide transparency and suspicion about insurers' reporting and accounting procedures. It was also caused by a failure to communicate adequately with the market. Shareholders, insurance analysts and customers are demanding greater transparency. Insurers should:

- Revamp their financial and risk reporting to aid transparency for all stakeholders. Be at the forefront of compliance with globally trusted accounting and risk measures, and with regulations and accounting rules (such as IFRS, MCEV and Solvency II).

- Be in a position to explain their business goals and strategy, and how the business model will achieve those goals.

- Improve their investor relations, giving transparency over capital requirements and new business growth, attempting to foster a greater degree of trust.

Conclusion

Shifts in the shareholder agenda, regulatory change and the recent financial crisis have highlighted organisational issues and constraints with current business operating models.

At the same time, a number of financial issues (ranging from optimising tax domicile to risk governance and capital allocation) have become hot topics, affecting business operating models.

Finally, changes to the competitive landscape are forcing insurers to redefine their markets, core competencies and their own relationship to the insurance value chain. These factors are demanding insurers rethink the principles behind business operating models.

Most insurers are responding by moving to scaled operations at the national and regional level. It is now time for insurers to aspire to global integration. This calls for a rebalancing of powers. Functional heads need more influence, especially over areas concerning risk and balance sheet management, and centralised control is required to drive co-operation and synergies between divisions (in charge of products, customer segments and/or countries).

Yet driving towards greater centralisation and functional control must be tempered with the need to give local autonomy, where justified by market requirements. Insurance is in transition requiring flexibility in the globally scaled operating model. This is particularly true in response to most global insurers' expansion into emerging markets. The mantra of "globalise and industrialise" must be refined. It should only be followed on a selective and pragmatic basis. This does not mean that initiatives to improve the business operating model should be piecemeal. Work streams must be put in place that are aligned to the strategy, coherent with the increase focused on balance sheet management and operational efficiency and easily, persuasively communicated both internally and externally.

Footnotes

1 Allan Afuah, Business Models, (University of Michigan, Irwin, 2004).

2 Considerable variation in performance exists. For instance, P&C providers have performed above trend for the sector.

3 Combined ratios among our sample of top global insurers increased by two percentage points to 91.8 per cent in 2008. It is acknowledged that the combined ratio is not entirely reflective of operational efficiency, taking into account underwriting performance also. The loss ratio and expense ratio for our sample of 24 insurers both increased by 2.2 percentage points in 2008. However, over the period 2005-2008, the combined ratio and loss ratio dropped by 6.5 and 5.2 percentage points respectively whereas the expense ratio remained flat.

4 This drop in share price was not restricted to the Deloitte sample of 24 insurers. The Dow Jones STOXX 600 insurance index dropped nearly 32 per cent over a similar time frame.

5 A recent study by Deloitte on European insurers' EV performance calculated an average fall in EV of 9 per cent in FY08, with only a few notable exceptions showing an increase. Deloitte LLP, Market Confused Embedded Value? The Deloitte View on Year-End Value Results, (UK), 2009.

6 In our view, revenue growth may have been accepted by investors on the grounds that they could estimate EV contribution to profit that new business could have generated. With the realisation that profit could be unreliable, as suspected for some time before the crisis, the shift of focus was a way to analyse the insurance sector more effectively.

7 Deloitte Research, The IFRS Journey in Insurance: a Look Beyond the Accounting Changes, Deloitte LLP, 2008.

8 Total revenues include: premium income; reinsurance income; investment and trading income.

9 From our sample of insurers, combined ratios dropped 6.5 percentage points between 2005 and 2008, indicating slightly improved efficiency and the benefits of the insurance cycle. However it is the belief of industry commentators and senior insurance executives that there is much scope for efficiency gains within insurance. In fact, 90 per cent of insurance analysts in our sample suggested insurance was less efficient than other areas of financial services.

10 In the United Kingdom, the Retail Distribution Review's ban on commissions in 2012 may result in fewer new business sales in the UK life industry. IFAs may be less able to churn portfolios to sell new products. However, on the upside, less churn in back books increases persistency, resulting in the value of back books improving and a lower management burden. This primes the back book for disposal to a consolidator. See: Deutsche Bank, UK Life Assurers: Living in the Past, 28 July 2009.

11 Some global capital efficiency may also be achieved through the use of an intragroup reinsurance vehicle. Business operating models and capital structures should be congruent.

12 According to JP Morgan, IAS 39 accounting changes could have a profound effect on reported numbers, making equities less attractive. See: JP Morgan, European Insurance, Europe Equity Research, 8 July 2009.

13 The Economist Consensus forecasts: 2009, Deloitte Analysis.

14 OECD Composite Leading Indicators, 2009.

15 Use of this term is adapted from Allan Afuah, Business Models, Allan Afuah, (University of Michigan, Irwin, 2004).

16 In the 'adaptive' insurance organisation, there are few overarching goals for the organisation at Group/Corporate level. Rather, the global business strategy is "pluralistic", comprising many objectives set at the local level.

17 Of a US (largely domestic) sample, 6.1 per cent were country-led, 14.5 per cent were product-led, and 14.8 per cent were customer-led. Among major global insurers we would expect the country-led numbers to be significantly higher. See: Deloitte DTT, New Global Operating Models in a Shifting World, Insurance D-Brief, March 2009.

18 Many executives have been burnt by expensive integration projects which have not worked out. However, integration technology has dramatically improved in a very short time making integration a more realistic prospect.

19 Insurers are behind the curve in using shared services. Deloitte Research, Fifth Annual Survey: Offshoring in the Financial Services Industry, 2008.

20 Specialist teams in the area should be represented at the highest levels and be integral to BOM change initiatives.

21 Regulation in Europe is in principle fostering a region-wide approach. Solvency II is an example of how supranational regulation can facilitate the consolidation of balance-sheetrelated processes. However, the financial crisis has erected some barriers to this approach. National governments have been concerned to ensure that capital in each national jurisdiction is adequate to underwrite risks within that jurisdiction. This potentially restricts the flow of capital from one part of the business to another, and makes the case that not all processes – even within finance, actuarial and risk functions – can be translated globally.

22 For more information on Deloitte's perspective on distribution see: Deloitte Research UK. Face to Face with the Future: Sustainable solutions for the £66 billion distribution change facing life and pensions providers, 2006.

23 Broking is attractive in today's conditions as intermediating is less capital-intensive than underwriting.

24 Front-office activities tend to be market-specific (specific to either a local market or product-type) while back-office functions and support and governance functions have more similarities. There are often good reasons for localised or product-specific front offices (for example, regulations in certain jurisdictions or customer-centred policies where variations are significant). But improved controls can be created in more standardised mid- and back-office functions and certain product/customer types.

25 Open business models are based on the idea that companies look outside their boundaries and across the supply chain for solutions, H. Chesbrough, Open Business Models: How to Thrive in the Innovation Landscape (Harvard Business School Press, 2006).

26 Retention strategies tend to be local and market-oriented as they are based on enhanced customer contact.

27 Focusing on core is a clear trend. HSBC has a strategic relationship with AXA Solutions to run telephony and back-office support of functions for selected commercial lines. This initiative started in France and was recently rolled out for their UK operations.

28 Zurich Financial Services has shifted some national shared-service functions offshore to regional/global hubs in Poland and India.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.