Market overview

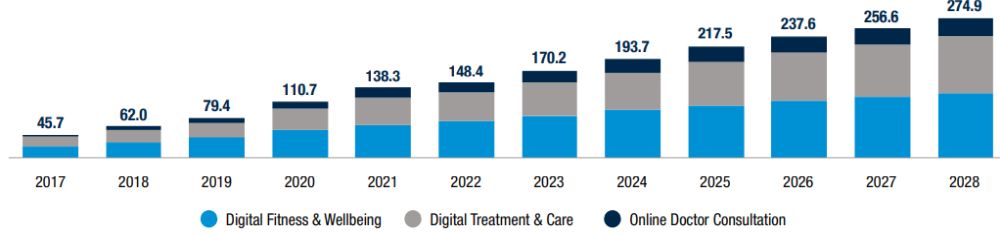

The global Digital Health market was valued at $170.2bn in 2023, and is expected to grow to over $275bn by 20281

Key drivers include changes in user preferences, the need for innovative solutions to more archaic healthcare services, COVID-19, and a growing focus on preventative healthcare

Consolidation is expected to provide integration across the value chain, with businesses progressively looking to service more of the patient pathway

With increasing levels of PE interest and larger companies entering the Digital Health sector, deal volumes are expected to rise

Introduction to Digital Health

Traditional health systems have often been plagued by archaic systems, manual processes and inefficiencies, which have created avoidable administrative burden and cost. Digital Health solutions aim to alleviate these pain points and give patients a new way to manage their health.

The COVID-19 pandemic was a key driving force in stimulating the Digital Health sector. Lack of access to health facilities led to innovation in finding alternative solutions such as TeleHealth, which provides remote access to health professionals. These innovations have accelerated the normalisation of innovative technology as imperative to people's daily lives and healthcare needs.

Additionally, in 2019, the NHS Long Term Plan outlined the importance of technology in realising NHS improvement goals. In 2023, NHS Digital and NHS England merged to create a more unified digital agenda. The recent investigation from Lord Darzi, an academic surgeon part of the House of Lords, on the state of the NHS also emphasises that a "tilt toward technology" is imperative to improve productivity and transform care systems. Digital Health adoption at a governmental level has been key to the delivery of a more streamlined healthcare system.

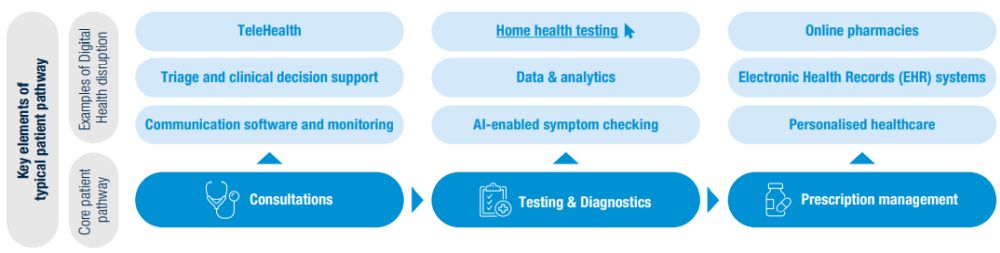

The illustrative patient pathway below highlights some ways in which Digital Health solutions have disrupted the way healthcare is managed and practised.

Market dynamics in Digital Health are propelling growth in the sector

Fig. 1 - Global Digital Health Market Size, 2017-2028 (USD $bn)2

The Digital Health market is growing rapidly, with these solutions increasingly being integrated into health systems. Some trends underpinning this growth include:

1. Individuals increasingly focussing on convenience

Individuals are increasingly looking towards online consultations for convenience, cost-effectiveness, and time-saving benefits. In 2021, 16% of people had to wait a week or more to see their GP, and in 2024 this increased to 33%3 . Around two in five patients in OECD countries who used remote solutions during the pandemic prefer telemedicine services to in-person appointments4 . Thus, particularly for non-emergency issues, TeleHealth options can provide patients the support they need more efficiently than traditional methods. Personalised health solutions also incentivise and allow users to take charge of their health. Solutions such as Vitl enable individuals to obtain personalised vitamins through a digital subscription. Furthermore, individuals are increasingly opting for 'ondemand' services. One such example is Bupa's launch of its new subscription-based private GP service. For a low monthly fee, subscribers gain access to same-day GP appointments, prescription deliveries, and round-the-clock support through a dedicated 'healthline'5 .

2. Improved outcomes through technology

Telemedicine solutions have the potential to promote positive outcomes for patients. One report found that 81% of clinical staff found that mental health telemedicine solutions were good or excellent. Another example is improvement in remote patient monitoring – a surgical oncology ward in the Netherlands has been able to generate early warning signs for deterioration to nurses6 . Telemedicine solutions therefore have an increasingly important role in healthcare outcomes.

3. Innovators are taking traditional systems fully

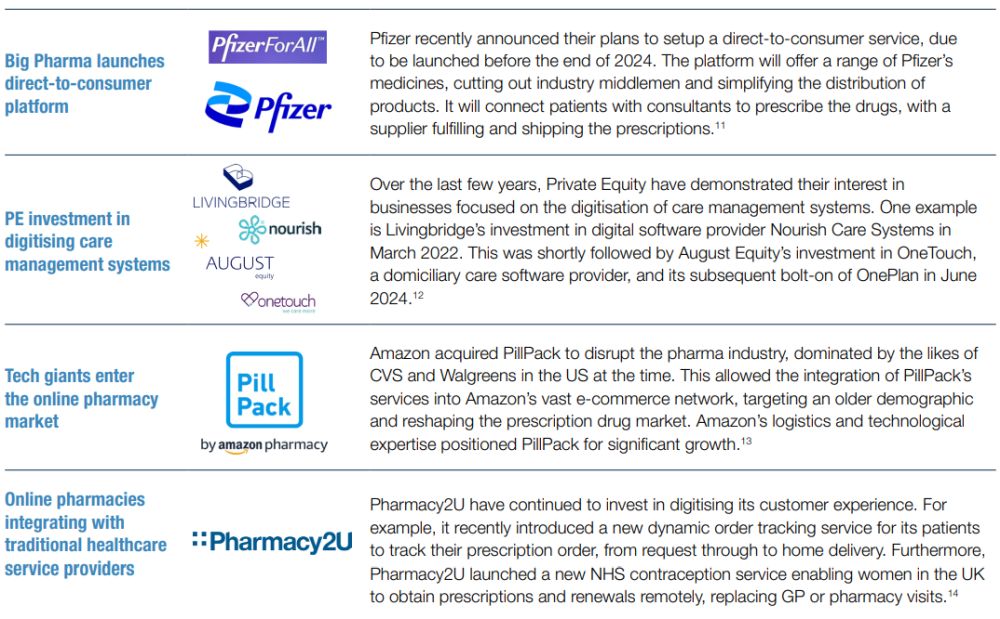

The pharmacy industry, for example, has been revolutionised through digital solutions. Backed by G- Square, Pharmacy2U offers an NHS online pharmacy solution, including prescription fulfilment. Pharmacy2U, Simply Online Pharmacy, and others also offer an online doctor, which means that these pharmacies can directly support patients in obtaining prescriptions as well as receiving medication. This supports the Government ambition to have community pharmacies take on more of a role in order to alleviate the burden on the NHS.

4. Government involvement

Lord Darzi's report suggests that the NHS must work to get people off waiting lists, support British companies, and invest in technology in order to revitalise the health system. One example of active work in this space is through partnerships with private companies to roll out digital solutions. eMed, who acquired Babylon in 2022, offers an NHS TeleHealth solution. Through eMed, patients can access NHS GPs and Nurse Practitioners through video or phone consultations. Patients can then be referred to various NHS specialists as necessary. This supports the NHS in creating a more streamlined triage system through a digital solution, helping patients obtain the support they need more quickly

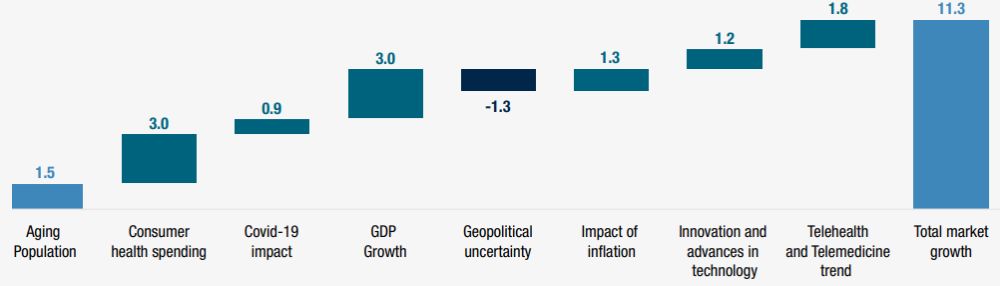

Fig. 2 – Key Market Drivers for Value Change (% growth)2

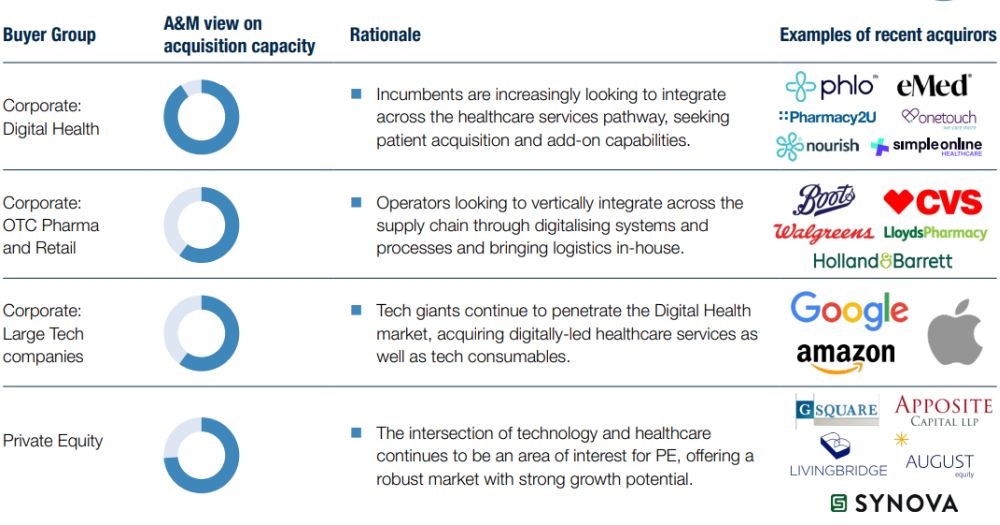

A highly fragmented market, primed for consolidation across the value chain

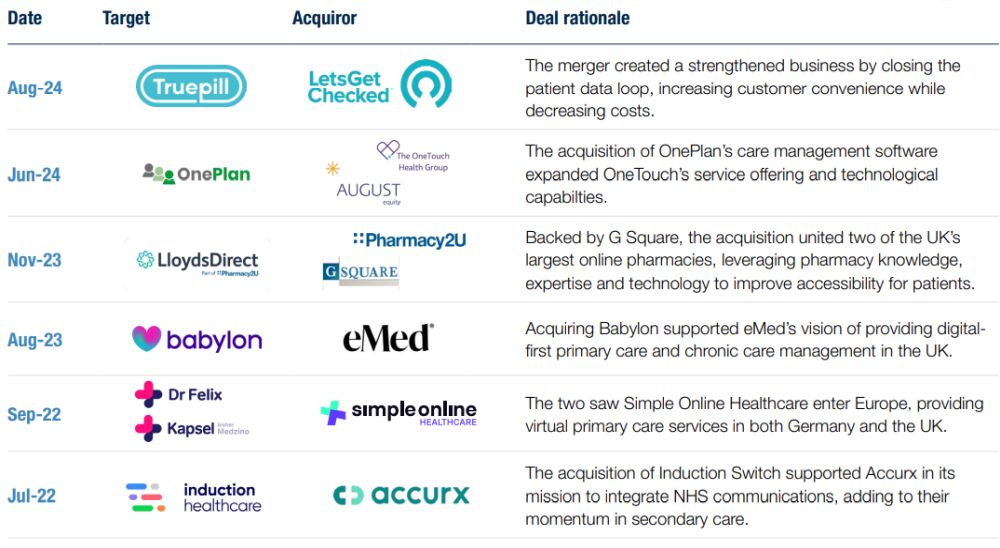

As awareness of the crucial role Digital Health plays has increased, particularly post-pandemic, so too has the scope of companies looking to break into the Digital Health sector, with M&A playing a vital role. Companies are looking to pursue acquisitions that enhance their digital capabilities, integrate tech-driven health services, as well as grow their patient network. Driving integration across the value chain results in an interconnected healthcare ecosystem and a seamless patient pathway.

An example of such integration is the $14.8 billion acquisition of Livongo by Teladoc in 20206 , focused on creating a more cohesive virtual care platform, combining patient monitoring, telemedicine and greater access to health analytics. Competitors followed suit, being forced to adapt to similar models of long-term care utilising virtual health. In 2022, Simple Online Healthcare (SOH) acquired Kaspel, a German TeleHealth brand, and Dr Felix, a UK-wide online GP clinic7 . The acquisitions realised SOH's expansion into Europe, supporting its vision for offering patientcentric care at a global level.

This trend continued to extend itself into the latter half of 2023, as yet another online consultation service – Babylon Health - was acquired by eMed. The shift towards a market that favours home-based solutions and patient convenience highlights itself as a consistent theme, evident in cases like the $300 million UnitedhealthGroup acquisition of Divvy Dose and Welzo's acquisition of Meedoc, offering online consultations6.

The vast potential of Digital Health is becoming more familiar to PE firms; healthcare-specialist G Square Capital recently acquired a £40 million majority stake in Pharmacy2U8 , with the aim of pursuing the potential to enhance nationwide prescription delivery. With this backing, Pharmacy2U went on to acquire LloydsDirect, the online pharmacy. While there has been limited PE activity in the sector to date, interest in the sector from investors is high and, as smaller businesses generate scale either organically or through consolidation, the volume of sponsor-led mid-market deals is expected to increase.

Transaction volume in this sector shows no signs of slowing and 2024 continues to have great traction, through deals such as LetsGetChecked's acquisition of Truepill for $525m in August9 . The acquisition was able to better facilitate care for Truepill's large customer base by using LGC's at-home testing devices to provide necessary diagnostics. Meanwhile the UK arm of Truepill was picked up by online pharmacy provider Phlo back in 2022.

Patient demand for increasingly accessible and digitised healthcare services means operators are being driven to innovate and integrate their service offering across the full value chain. The resultant effect is a market characterised by its increasingly competitive nature where traditional providers are compelled to prioritise technology-driven solutions. Combined with an improving UK economy and following the large influx in investment during the COVID-19 pandemic, the market is primed for further consolidation and continued growth in M&A volumes.

Selected Precedent Transactions6

Buyer landscape Recent acquirors10

Key case studies

Digital Health is an increasing area of strategic focus and investment for corporates operating in adjacent markets. We have highlighted a few recent examples below that shine a spotlight on these types of strategies and partnerships.

Sector outlook

Increased prevalence of data analytics, AI, and machine learning

From drug discovery to personalised treatment plans, AI and machine learning are transforming various aspects of healthcare, including automation of currently manual processes and increased utilisation of health data. This technology will facilitate personalised recommendations and improve patient interactions throughout their healthcare journey.

Shift further towards remote patient monitoring and TeleHealth solutions

As patients seek convenient and accessible healthcare, more elements of diagnostics and care are expected to be delivered remotely, including home health testing and virtual appointments. Alongside this, there is expected to be additional connectivity with devices and wearables to support TeleHealth providers and remote patient monitoring.

Further integration within Traditional Healthcare Systems

Integrating digital health solutions with existing healthcare systems is essential for seamless patient care. Virtual wards, for example, enable patients to obtain hospital-level care whilst at home. Efforts to bridge the gap between traditional and digital healthcare are ongoing, ensuring integration with public systems and utilisation of the vast quantity of NHS data available.

Consolidation across the value chain, with increasing PE and Trade interest

There is a continuing race among incumbents to be the first truly end-to-end platform, housing elements of digital healthcare across the value chain under a singular entity. Consolidation is expected to continue as businesses look to service more of the patient pathway, with increasing PE and Trade interest as providers achieve sufficient scale.

Footnotes

1. Statista – Digital Health Market Insights Report 2023

2. Statista – Digital Health Market Insights Report 2023,

3. Lord Darzi NHS Report,

4. "The COVID-19 Pandemic and the Future of Telemedicine" – OECD Health Policy Studies,

5. Health and Protection – "Bupa Launches Two Tier GP Subsctiption Service", 6 "...Future of Telemedicine" – Imperial

6. MergerMarket

7. Insider – "Scottish pharmacy expands into Europe following acquisitions

8. Insider Media – "40m Investment for Pharmacy2U", 9 Axios

10. MergerMarket

11. BioPharma Dive

12. MergerMarket

13. Forbes

14. Pharmacy2U

Originally published 30 September 2024

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.