- within Food, Drugs, Healthcare and Life Sciences topic(s)

- in United States

- within Antitrust/Competition Law, Real Estate and Construction and Intellectual Property topic(s)

Mid-market medical device companies are grappling with underperformance, driven in part by over-diversified portfolios and fragmented management focus. As these companies seek profitable growth and greater shareholder value, many are realizing the need to re-center on their core business. A well-executed divestiture of non-core assets can unlock margin expansion, sharpen strategic focus, and revitalize investment potential. However, achieving success requires more than just deal execution—it demands disciplined planning and targeted transformation before and after the transaction.

Less is often more.

Experienced professionals know the limits of multitasking—no matter your level of expertise, quality and efficiency begin to suffer when you try to do too many things at once. Like erosion, the effects might be gradual, but they will compound and eventually hit a breaking point. The cracks emerge in time.

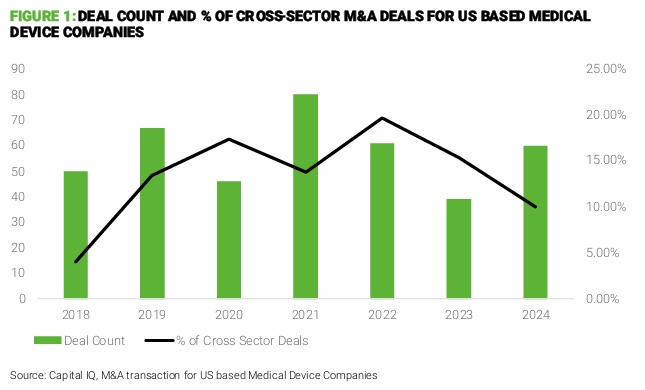

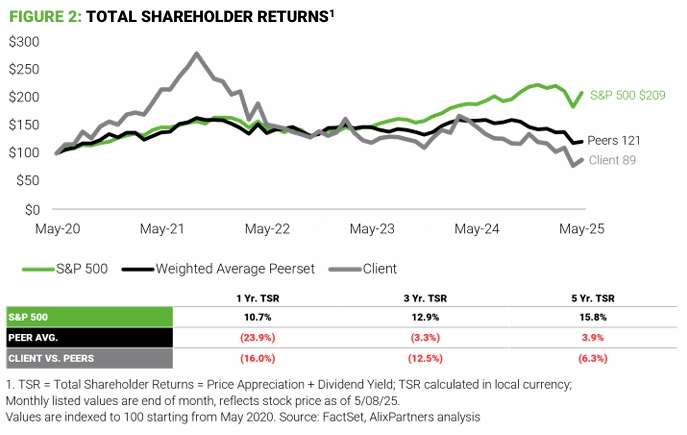

Such is the case for midmarket medical device companies today. In search of total addressable market (TAM) expansion and profitable growth, many companies diversified their portfolios through organic and inorganic expansion in past years (see Figure 1). Nonetheless, various macroeconomic and market-specific headwinds have created challenges, and many companies, and not just our client, in the segment have underperformed (see Figure 2). Preliminary data shows mid-market MedTechs are underperforming relative to the health and life sciences (HLS) industry overall, as well as the S&P500.

This underperformance driven by fragmented management attention and resources compels a new strategic imperative: the need to re-center on a core, which may include divestment of non-core assets. But doing this right is no small task, and it calls for a thoughtful approach. The first challenge is to identify which business(es) should be divested (DivestCo). This requires a disciplined portfolio review, including re-evaluating the strategic plan for the remaining business (RemainCo). Based on the updated RemainCo strategic plan, companies can define the deal perimeter. From there, MedTechs should focus on two priorities: maximizing exit value and quickly transforming RemainCo operations.

Unsuccessful diversification

There is a rationale for MedTech players to diversify their businesses in this mid-market space (~$1~$5B range). Spurred in part by sluggish growth in core markets due to slow surgical procedure volume recovery, tighter hospital budgets, and disruptive technologies, companies have looked to white space for growth; however, despite their pursuit of both organic and inorganic paths to product and service diversification, these players lag the market in terms of shareholder return and profitability (see Figure 2).

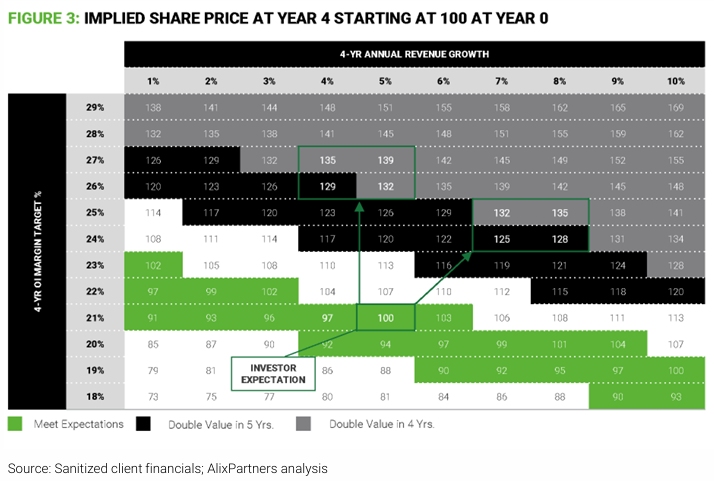

To illustrate this, let's refer to an example client, normalizing the current (Year 0) share price to $100 at the intersection of investor expectations for revenue growth and margin. Figure 3 shows how that specific client could double its shareholder value in the next four or five years. We propose two potential paths to doubling shareholder value. The first focuses on value creation through margin expansion by optimizing operating costs. The second uses a combination of growth and margin expansion. In either scenario, it is critical to manage capital carefully to avoid increasing the growth and margin requirements to generate the additional shareholder value. Divesting the non-core business units (BUs) could help the client both increase margin and pursue a growth path—organic or inorganic—and be better positioned to adapt to changing market conditions.

Re-centering on the core to achieve profitable growth

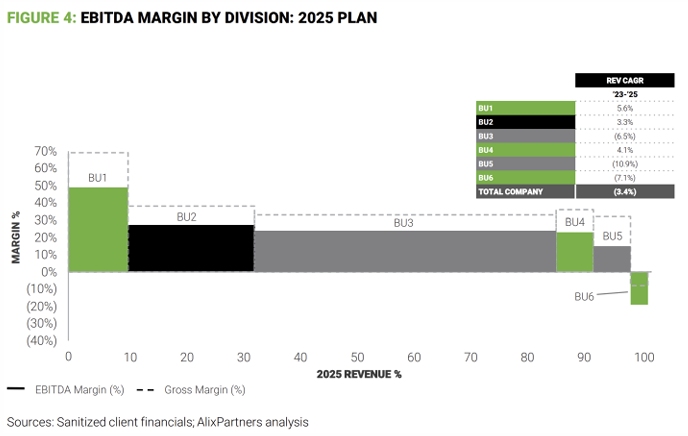

Re-centering on the core and building on a company's unique strengths can lead to sustainable advantages such as price leadership, customer loyalty, and talent retention. Figure 4 illustrates this with a client example. Here, BUs 5 and 6 have been shrinking and creating a drag on overall margins. Divesting those two units would potentially allow management to double down on the higher performing and/or core segment of the business—in this case, BU 3.

Mid-market medical device companies have, in general, struggled to achieve consistent profitable growth. There are notable exceptions, of course. These include companies that have established new platforms, such as Intuitive Surgical's robotic soft-tissue surgery platform, or those that have led paradigm shifts, such as Insulet Corporation's innovations in diabetes care. For a company that has stagnated, however, a key step to regaining momentum is to make a purposeful evaluation to discern its core strength—and then, once that core is more clearly understood, focus on it.

Key to a winning divestiture

If a company wants to re-center by divesting its non-core assets, it should begin with the end in mind—that is, with deliberate strategic planning for the eventual RemainCo. The deal perimeter should be informed by the markets, products, capabilities, and operations that will support the RemainCo's future growth and profitability. Once that informed deal perimeter is determined, the company can then shift its focus to maximizing the exit value of the DivestCo, along with streamlining the RemainCo's operating model.

|

Maximizing DivestCo value Priming the DivestCo for a high valuation is inherently challenging for two reasons. First, potential buyer profiles can vary; second, value- creation plans are unique for each bidder. That said, companies can pursue select steps to prepare the DivestCo for exit. One such approach is a buyer-agnostic preparation, which might include streamlining the supply chain, sales channels, and operations—including thoughtful transition service agreement (TSA) scoping. Doing so helps maintain the revenue-generating power and growth runway of the DivestCo. Another approach is buyer- specific. With this approach, a company proactively communicates with bidders during diligence about their specific value-creation plan and offers tailored data validation and potential changes to the deal perimeter (e.g., customer/product validation and operational metrics for G&A optimization). |

Internal transformation It's important to acknowledge that a divestiture will inevitably cause some disorientation in the organization, affecting the operating model of the RemainCo. This means that, at a tactical level, a company will need to develop a well-vetted plan to smoothly transition the business, exit TSAs, and manage stranded costs. At a strategic level, it will need to pursue transformations in key value- creating functions to prepare the RemainCo for profitable growth. If orchestrated well, a winning divestiture will position a company for accelerated growth, acting on a clear strategy to strengthen and leverage its core. The organization as a whole—and crucially, its operating model—will be redesigned precisely to enable strategic initiatives and investments that fuel profitable growth. To cap it off, going through this process will revitalize the "war chest" for investment, allowing renewed flexibility in capital deployment. |

|

Defining a clear path to profitable growth While most mature businesses go through a periodic strategy plan review, it's critical to re-define strategy during a contemplated divestiture. Decisions related to setting the deal perimeter should be made only after a company has identified its winning markets and products, as well as the corresponding capabilities and infrastructure it needs to support profitable growth for the RemainCo. Of course, it's also crucial to maximize the value of the DivestCo—a win/win for both ends of the deal. |

|

Now is the time to sharpen your company's focus

For business leaders in the mid-market medical device space, strategies

to strengthen the core and build a competitive advantage are nothing

new; however, what is unique in today's environment is an increased need for leaders to quickly identify divestiture scenarios and re-define the strategic plan. Companies tend to pay considerable attention to the transaction execution phase of divestitures—which is good. That said, the game is really won or lost by the quality of re-defined strategic planning that companies undertake pre-divestiture, coupled with a focus on executing and capturing the value of key strategic initiatives post- divestiture.

5 key actions for a successful divestiture

- Define a clear winning go-forward strategy for the RemainCo

- Thoughtfully set deal perimeter balancing RemainCo strategy and DivestCo value

- Pursue "no regrets" DivestCo preparation

- Hold bidder-specific value discussions during diligence

- Transform the RemainCo to right-size operations and support strategic initiatives

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.