- within Transport and Cannabis & Hemp topic(s)

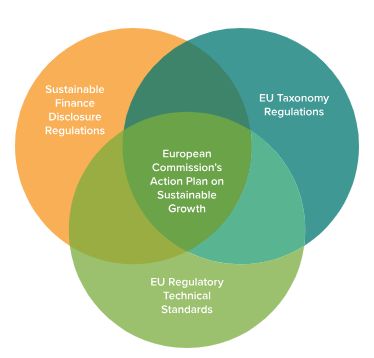

The Sustainable Finance Disclosure Regulation (SFDR) is a European regulation that has applied directly in the EU (and EEA countries) since March 2021. The aim of the SFDR is to provide harmonised disclosure requirements, qualitative and quantitative, with regard to the: (i) integration of sustainability risks in investment decision-making and asset management; (ii) consideration and assessment of Principal Adverse Impacts (PAI) of investment decisions on sustainability factors; and (iii) provision of sustainability-related information on financial products. The overriding intention is to redirect capital towards more sustainable investment and to assist investor decision-making through improving transparency and introducing common standards.

SFDR applies to 'financial market participants' (FMPs) and 'financial advisors' whose businesses are in Europe or who are marketing to investors based in Europe. FMPs include AIFMs, UCITS ManCos and MiFID investment firms providing portfolio management advice. For firms that are not 'large' (i.e., where they fall below the 500 employee threshold) this involves 'comply or explain' decisions in relation to publishing and maintaining sustainability factors/risks for due diligence policies and products they make available. Disclosures have to be made at entity level (covering sustainability practices and information that the firm has adopted for its business as a whole) and at product level (for specific funds to ensure that investors receive consistent fund-related sustainability information). Entity level disclosures are to be published on a firm's website and the product (i.e., fund-level) disclosures apply to pre-contractual, website and annual reporting.

The Taxonomy Regulation (TR) establishes an EU-wide classification system or taxonomy of environmentally sustainable activities. From January 2022 elements of the TR have been integrated into the SFDR disclosure obligations. In addition, the SFDR legislative package includes both regulatory technical standards (RTS) and guidance and supplemental delegated acts that integrate sustainability requirements into other directives (namely AIFMD and MiFID II, alongside similar measures in respect of the UCITS Directive, the Insurance Distribution Directive and Solvency II). These provisions will affect firms' general governance of and risk management in their businesses and ongoing management of funds and/or segregated mandates. They will not be limited to the distribution and marketing processes.

We would note the following three points.

- In its 13 June 2023 EU Sustainable Finance Package the European Commission (Commission) indicates that a consultation on assessing SFDR (which in due course may lead to SFDR II) will be launched in autumn 2023. This is in recognition of various shortcomings of the current regulatory framework, including the fact that SFDR has been mistakenly applied as a labelling (instead of disclosure) regime and there are inconsistent market interpretations. The review will focus on how to improve SFDR's legal certainty and enhance its usability and role in mitigating greenwashing. As a consequence, minimum standards/legislative amendments for the financial products in scope may well be produced in due course.

- This potential overhaul is also likely to affect other related sustainable finance legislation, such as the TR, Benchmark Regulation, MiFID and AIFMD supplemental legislation and the Corporate Sustainability Reporting Directive (CSRD).

- In the meantime, further outputs are still expected from the European legislators, for instance: (i) amendments to the SFDR RTS following the April 2023 consultation; (ii) from the ESA call for evidence on greenwashing; and (iii) from the ESMA consultation on guidelines on fund names using ESG or sustainability-related terms. The development of a taxonomy for social investments is also expected.

To view the full article, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.