- with Finance and Tax Executives

- in North America

- with readers working within the Securities & Investment industries

History and Consequences

Fund raising and fund management activity in Europe changed significantly in 2013 with the introduction of the Alternative Investment Fund Managers Directive ("AIFMD"). The popularity of onshore Europe for fund management and fund domicile activity increased significantly as a result of the ability to "passport" the offering of European domiciled alternative investment fund products throughout the 28 member states of the European Union (the "EU").

While undoubtedly a benefit for an EU Alternative Investment Fund Manager ("AIFM") seeking to raise investor funds in any or all member states of the EU, the ability to passport does, however, come with increased regulation and scrutiny for the AIFM. In practice, the passport requires the AIFM to fulfil a plethora of regulatory obligations and procedures each adding a layer of cost and administrative burden to the fund management structure. Research shows that AIFMD has in essence made marketing into the EU harder, slower and more expensive with increased costs ultimately absorbed by the fund structure.

Whilst Channel Islands domiciled fund products cannot yet be passported into all member states of the European Union, access to the EU can still be achieved through the National Private Placement Regimes ("NPPR") of each member state. Research shows that a majority of European investors into real estate and private equity are based in just three countries (the United Kingdom, Switzerland and the Netherlands). It won't escape attention that Switzerland and the United Kingdom are not in the European Union. Importantly, Channel Islands funds continue to have access to UK investors post-Brexit.

Channel Islands-based AIFMs are located in a "third-country" for EU purposes and as a result, the full scope of AIFMD does not apply to them (unless they elect to be fully compliant). As such, some of the more onerous elements of AIFMD do not apply.

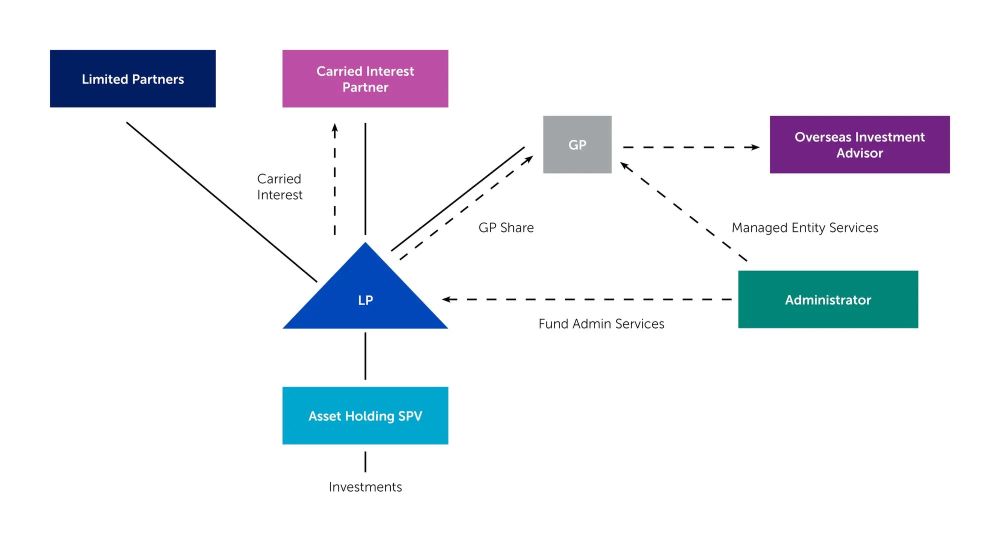

The Channel Islands Solution

In addition, despite EU-AIFMs having the ability to passport, European Commission statistics show that only 3% of EU-AIFMs apply to market their funds to more than three EU member states.

The reality, therefore, is that most AIFMs do not require full access to all member states of the European Union when seeking to raise funds in Europe. NPPRs offer Channel Islands AIFMs a recognised, cost effective route that provides easy access to the most common fund raising markets in the European Union. The requirements of each EU member state's NPPR vary with certain conditions attached.

Some of the further benefits of a Channel Islands solution include:

- Speed to Market: "weeks not months" timescales are significantly less than the EU equivalents; the typical time-line for the establishment of a fund structure set out in the case study below is six weeks (including all regulatory applications and approvals. Shorter timescales have been achieved. The Channel Islands regulatory process for certain fund products can be as prompt as 24 hours.

- Pragmatic Regulation: regulation that is appropriate for the investor base and level of sophistication of the target audience. Regulation meets all international standards (International Monetary Fund, the International Organisation of Securities Commissions, the European Securities and Markets Authority and the Financial Action Task Force).

- Cost Effective: quick and effective regulation leads to lower establishment and ongoing costs.

- Tax Simplicity: a tax neutral environment including no applicable value added tax or capital gains tax, together with a standard corporate income tax rate of 0%. Self-determining in tax affairs with a system that is not reliant on reliefs, exemptions or tax rulings. The Channel Islands are "whitelisted" by both the OECD and EU for tax transparency and economic substance compliance, and have adopted the BEPS minimum standards.

- Political and economic stability: the Channel Islands are politically and fiscally autonomous and stable British Crown Dependencies. The special relationship with the United Kingdom has been secured post Brexit.

- World class financial services sector: with more than 50 years' experience in structuring, managing and administering fund vehicles, the financial services sector is extremely well appointed to provide expertise in relation to the structuring, establishment, administration and ongoing advice to fund structures and managers.

- Flexibility: investment fund structures can be established in the form of companies (including incorporated and protected cell companies), limited partnerships (including incorporated limited partnerships and in Jersey separate limited partnerships) or unit trusts, and can be open or closed ended.

- ESG investing: investors in a Guernsey Green Fund are able to rely on the Guernsey Green Fund designation, provided through compliance with the Guernsey Green Fund Rules, to represent a scheme that meets internationally agreed eligibility criteria of green investing and has the objective of a net positive outcome on the environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.