This article was first published in the October 2024 issue of Butterworths Journal of International Banking and Financial Law.

Overview

NAV facilities for credit funds have unique features when compared to NAV facilities for other asset classes. This article explores these points of difference by looking at various stages in the life of a NAV facility.

In the fund finance market, net asset value (NAV) facilities were developed as tools for secondaries funds (or funds of funds) to acquire and leverage purchases of limited partner interests in other funds. However, NAV facilities now (and increasingly) provide finance for funds operating other strategies, including private equity buyouts, infrastructure, real estate and credit.

Whatever the asset class, all NAV facilities have a common characteristic – they "look down" to a fund's underlying assets, providing lenders with recourse to those assets in the event of a borrower default. They also use common technology, notably including loan-to-value (LTV) calculations, measuring the value of the NAV loan against the net asset value of the fund's underlying assets and cash. LTV impacts NAV facilities in a variety of ways. For instance, the margin may ratchet and, at higher levels, cash sweeps may operate to require pay down of the NAV loan. Invariably, a financial covenant will usually place a ceiling on LTV.

Across asset classes, there are also many other commonalities between (for example) private equity, real estate and infrastructure NAV facilities. These similarities between these facilities are arguably greater than their differences.

However, NAV facilities for credit funds (Credit Fund NAVs) stand apart and have unique features when compared to NAV facilities for these other asset classes (Other NAVs). This article explores these points of difference by looking at various stages in the life of a NAV facility – starting before the facility is put in place with use cases and lender due diligence and ending with a look at lender recourse in a distress/downside scenario.

- PRE-LEND MATTERS

- LTV CALCULATIONS, ELIGIBILITY CRITERIA AND CONCENTRATION LIMITS

- REGULATORY TREATMENT

- MAXIMUM LTV THRESHOLDS AND SECURITY

- CONCLUSION

PRE-LEND MATTERS

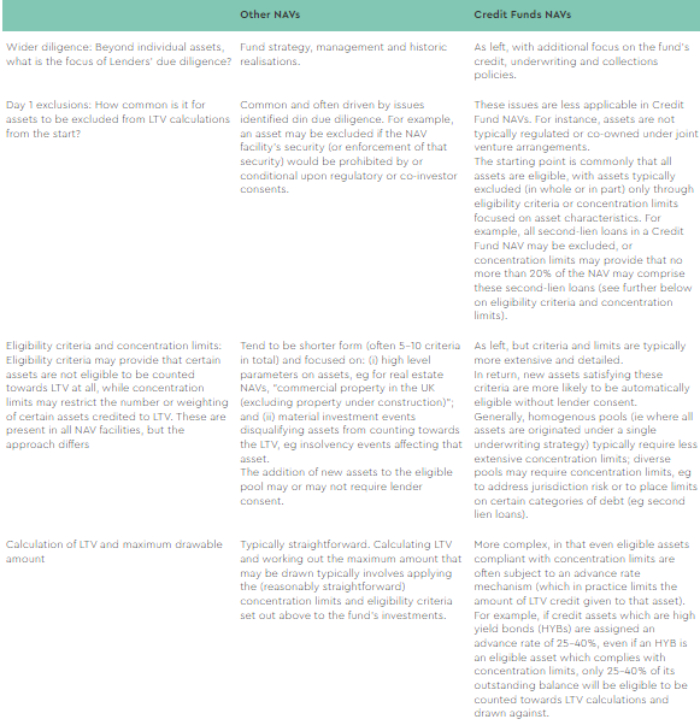

The differences between Credit Fund NAVs and Other NAVs start early in the lifecycle of these loans. In this section we explore differences in the purpose of these loans and the due diligence lenders conduct (see Table 1 below).

LTV CALCULATIONS, ELIGIBILITY CRITERIA AND CONCENTRATION LIMITS

Once a NAV facility is in place, LTV is a key metric. However, in NAV facilities of all descriptions, not all assets are counted In Practice in full in calculating LTV. Some assets are excluded entirely or partially, either initially or during the NAV facility's life. Again, the approach varies between Credit Fund NAVs and Other NAVs (see Table 2 below).

REGULATORY TREATMENT

Recently there has been discussion of how lenders are increasingly securitising their lending positions in both subscription line and NAV facilities extended across all asset classes. The focus is on how banks and other credit institutions can pool fund finance credit assets to create securitisations falling within the EU and UK Securitisation Regulations.

The incentive for these funders to do so is to raise finance against their lending position and/or benefit from preferential capital treatment in respect of those positions.

Credit Fund NAVs are unique in that they are more likely than Other NAVs to fall within the definition of "securitisation" under the EU and UK Securitisations in their own right, ie without being pooled with other fund finance loans. Among other factors, this is because one criterion for a transaction to qualify as a securitisation under the EU and UK Regulations is that it must be "dependent upon the performance of [an] exposure or pool of exposures". Credit assets are more naturally described as "exposures" than the assets in Other NAVs.

This presents both opportunities and challenges. On the one hand, lenders may benefit from better capital treatment on NAV facilities structured as securitisations and be able to offer better pricing for borrowers. Conversely, the EU and UK Securitisation Regulations impose significant administrative obligations on both borrower and lender. For the borrower, periodic (usually quarterly) and detailed asset-level reporting will be required on specified templates, risk retention will be required (often through the provision by the sponsor to the borrower of a subordinated loan or note), and a transaction summary (similar to an abbreviated prospectus) will need to be prepared. Of these obligations, the most significant tis likely to be reporting; in a private equity NAV, reporting might be limited to passing on (fairly modest) reporting already provided to LPs on as few as 12-15 assets. However, for a Credit Fund NAV, templates requiring dozens of data points on each individual credit asset may be required and the pool may comprise dozens or hundreds of individual assets.

MAXIMUM LTV THRESHOLDS AND SECURITY

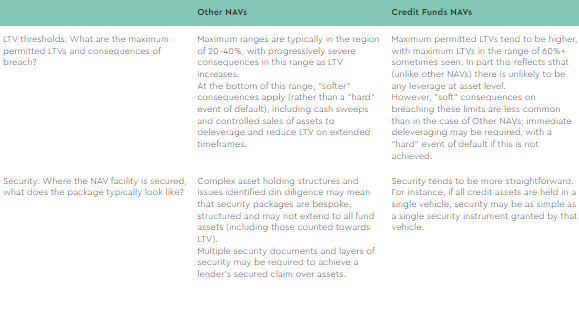

Finally, focusing on downside scenarios and protections for lenders, there are significant differences between maximum LTV thresholds and the security package available to lenders upon a borrower default (see Table 3 below).

CONCLUSION

NAV facilities of all asset classes are increasingly popular and, within asset classes, increasingly standardised as market practices develop. However, we expect the important differences above between Credit Fund NAVs and Other NAVs to remain. Credit Fund NAVs remain in an (asset) class of their own.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.