From late 2018 all FCA-regulated firms will begin to transition into the Senior Managers and Certification Regime – the regulatory framework which has applied to Banks since March 2016.

On 13 December the FCA published Consultation Papers setting out its proposals for how firms and individuals will transition from the current Approved Persons Regime ("APR") into the Senior Managers and Certification Regime ("SM&CR").

The key points to note are:

- For all firms, bar insurers, the FCA

does not expect the transition to take place until

"mid-to-late 2019". Previously the FCA

had indicated that implementation would be "from

2018"';

- As was the case when the SM&CR

entered into force for Banks there will be a system of

"grandfathering" ("Conversion") of current

Approved Persons into equivalent Senior Management Functions:

2.1 "Enhanced Firms" will need to submit a "Conversion Notification" along with Statements of Responsibilities and a Responsibilities Map to transition existing approved individuals to new Senior Management Functions; and

2.2 Most "Core Firms" and "Limited Scope Firms" in the new regime will benefit from "automatic" transitioning of individuals.

The FCA set out its proposals for the extension of the SM&CR across financial services in July 2017 ("the July Consultation" – CP17/25). A summary of those proposals, and the definitions of "Enhanced", "Core" and "Limited Scope" firms, can be found in our previous alert.

Conversion of existing Approved Persons into Senior Management Functions

Prior to the entry into force of the SM&CR for Banks, in March 2016, individuals who performed certain Controlled Functions were able to grandfather into equivalent Senior Management Function ("SMF") without the need for a substantive application to perform the new, equivalent SMF.

A Chief Executive (previously Controlled Function 3 – "CF/3") could grandfather into the new SM&CR Chief Executive Function – SMF/1.

A similar system of "conversion" will apply in the extended Senior Managers Regime.

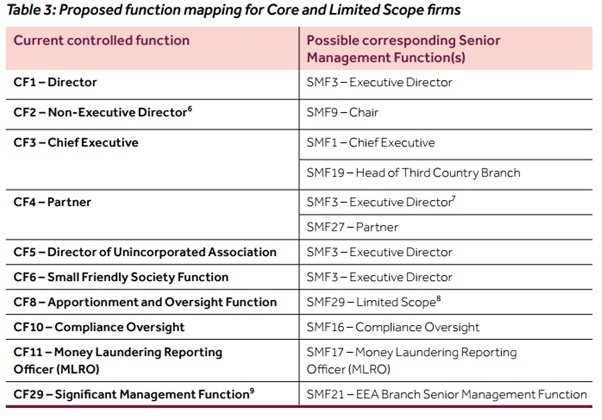

For Core Firms and Limited Scope Firms, the following table shows how conversion will work in practice:

For all other controlled functions (e.g. CF/30 – the Customer Function) regulatory approval will no longer be required and existing approvals will lapse when the new regime begins. These individuals may become part of the Certification Regime.

For Enhanced Firms Table 6 in the Consultation Paper sets out the SMFs which existing Approved Persons can Convert into, based on their current CF.

As set out in the July consultation, Enhanced Firms will need to consider and apply a greater number of SMFs relative to Core Firms. Accordingly, the range of SMFs a current CF holder will be able to convert into is wider for Enhanced Firms.

For example, an individual who currently holds CF/1 (Director Function) will be able to convert into any of the following SMFs:

Transitioning individuals to SMFs: what will firms need to do?

The FCA notes that "individuals at Limited Scope Firms and Core Firms will be automatically converted wherever possible, with no action required by firms".

Automatic transitioning for Limited / Core firms does not apply where a firm has a current non-executive director (CF/2) performing the role of Chairman. The FCA proposes that Firms with a non-executive Chair will need to submit a Conversion Notification (Form K) to the FCA, to convert the CF/2 holder to SMF/9 – the SM&CR Chair Function.

Where firms have an executive Chair (e.g. where an individual holding CF/1 performs the role of Chair), the FCA proposes to convert that function (e.g. CF/1 becomes SMF/3) and require that that an application be submitted, by way of Form A, for the SMF/9 Chair Function.

Enhanced firms will not benefit from automatic conversion of individual regulatory statuses. Instead, Enhanced Firms will need to follow the process which Banks were subject to prior to March 2016, and submit Notification of the proposed conversions to the FCA. Along with the Conversion Notification (Form K) Enhanced Firms will need to submit Statements of Responsibility ("SORs") for each SMF candidate and the Firms Responsibilities Map.

The Certification Regime – a year's grace

The Extended SM&CR will roll out in the same way it was rolled out for Banks. Firms will have 12 months after the initial commencement date to (1) issue Certificates of fitness and propriety to Certification Regime staff and (2) to provide training the wider population of staff (nearly all employees) who will be subject to the Conduct Rules.

The extended SM&CR will therefore have effect as follows:

- On the commencement

date:

- Mapping of CFs to SMFs will need to have taken place, with Notifications and submissions (e.g. SoRs) having been made to the FCA, as required, to give effect to transitioning;

- Prescribed Responsibilities will need to have been allocated to SMF holders;

- Former CF holders will transition to SMFs, and be subject to the Conduct Rules and Duty of Responsibility;

- Firms will need to have identified Certification Regime staff, and provide training on the Conduct Rules, which will apply to these employees from Commencement;

- Individuals who held CFs, but who have not transitioned to SMFs (e.g. former CF/30 holders), will no longer appear as Approved Persons on the Financial Services Register;

- For Enhanced Firms: Responsibilities Maps will need to have been submitted to the FCA and Handover Procedures will need to have been created and implemented.

- 12 Months after

Commencement:

- Firms will need to have designed, implemented and completed a process to will assess the Fitness and Propriety of Certification Regime staff, and issue Certificates of Fitness and Propriety for the first time;

- The Conduct Rules will apply to nearly all employees (all bar "ancillary support staff"); and

- Appropriate training will have been provided to all employees covered by the Conduct Rules.

What firms can do now to prepare

- The most significant point to determine, in the short term, is whether the Firm will be a Limited Scope, Core Firm or an Enhanced Firm, with reference to the criteria set out in the July Consultation Paper (See new SYSC 23 Annex 1, 6.2R and 7.1R; pp.95 – 98 of the July Consultation Paper).

- The FCA notes that firms "may wish to think about whether [they] have the appropriate people in the correct approved functions before the conversion of approved individuals from the APR to the SM&CR take place. This will help to make your transition to the new regulatory regime as easy as possible".

- Accordingly, Firms can usefully review their current list of Approved Persons, and map out how those existing CF holders will transition into new SMFs.

- Firms that plan any structural or personnel changes to management in the coming twelve months may wish to have in mind the pending changes to the regulatory status and obligations of Senior Managers.

- More fundamentally, a brand new, annual process will need to be created, for "certifying" the fitness and propriety of certification regime staff. Consideration might usefully be given at this juncture to which function will take the lead on certification (typically Human Resources, with Compliance, Legal and Senior Management input).

- Implementing the SM&CR will (for most firms) involve a project requiring significant commitment of human and financial resource. Forecasts for compliance, HR and training and regulatory change budgets might usefully reflect the resource that the SM&CR will require from 2018 – 2020 and beyond.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

[View Source]