- in United Kingdom

- within Finance and Banking, Consumer Protection and Corporate/Commercial Law topic(s)

- in United Kingdom

- with readers working within the Banking & Credit and Retail & Leisure industries

Associate Director Rahool Patel delves into ARR lending and the key considerations for borrowers.

How can ARR lending help?

For many Software as a Service (SaaS) businesses, maintaining rapid growth momentum in respective addressable markets is paramount. Here traditional financing options can feel like square pegs in round holes, restricting the pace at which businesses can grow, while demanding mature profitability and ability to service EBITDA-based covenants.

Leveraging recurring revenue is a powerful, cost-effective tool that provides complementary capital to fuel growth. Lenders can monitor the performance of the borrower through ARR leverage in the short to medium term, typically up to three years, allowing a business to maintain topline growth before the test 'flips' to a traditional EBITDA-based covenant as profitability naturally becomes a stronger focus for all stakeholders.

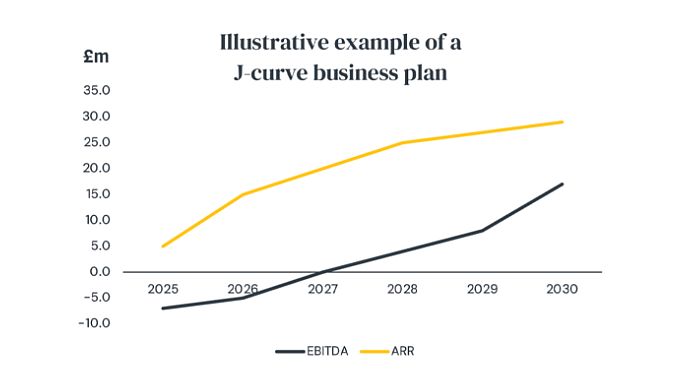

The so-called J-curve perfectly illustrates this relationship. A scaling business will likely demonstrate high ARR growth with low or negative EBITDA due to significant investments in customer acquisition costs. As the business matures and begins to realise operational efficiencies, EBITDA turns positive and ARR growth normalises. Flexibility in a financing is key as we have also advised on scenarios where a business has already shown to be profitable yet wants to reaccelerate growth again e.g. entering a new geographic market and therefore will need to incur short-term losses through expenditure on sales and marketing.

What's (re)occurring?

While this all sounds very exciting in principle, there's an important point to reinforce regarding the nature of recurring revenues. The amount of debt you can secure is anchored to your ARR, and therefore the quality of the ARR underpins the financing outcome. Be prepared to prove it.

Alongside business specific KPIs, lenders will scrutinise customer repeatability, retention, diversity, churn and price elasticity – ultimately, how 'sticky' is the ARR to lend against and creditworthiness of the borrower.

When assessing revenue models, it's essential to distinguish between recurring and reoccurring revenues. Recurring revenues are a consistent, stable and predictable source of income – think of a business's software license for Microsoft's Office applications which for many, are business critical and contracted. By contrast reoccurring revenues tend to have some repeatability, yet not on a fixed schedule – think of IT repair where services are requested on an ad-hoc basis which can be unpredictable and vary in frequency. Therefore, they are not as predictable as recurring revenues and so can be more challenging to lend against.

In many businesses, we tend to find a grey area between both income types that can be quite wide, thus through preparation and negotiation, there is a significant amount of scope to retain as much ARR value as possible to ensure no credit leakage as part of your financing package.

Approaching the lending landscape

A key part of the preparation phase with an adviser involves ensuring you are ARR 'book ready' before going out to the debt markets. We often work hand-in-hand with Private Equity, Owner-Managers and CFOs to build ARR Snowball models to clearly demonstrate the trends in historical ARR and MRR (Monthly Recurring Revenue) to forecast future growth and determine the art of the possible for ARR debt capacity. The nature/activity of existing customers and effect on overall ARR through Renewals, Upsell, Downsell and Churn which generates Net and Gross Retention metrics are key to understanding the overall health and performance of a SaaS business. The stronger the metrics, the more competitive tension amongst lenders, and so the better the overall financing.

Like many areas in leveraged finance, ARR financings can be structured in different ways. However, a key objective is to retain as much cash within the business as possible given cashflow available for debt service is likely to be low and any excess cash will want to be reinvested for growth. Contractual repayments tend to be required to support derisking of a lender's initial exposure, however, we have experience negotiating manageable amortisation profiles and capital repayment holidays also remain an important feature. Further, the ability to Payment in Kind or (PIK) some of your interest can provide additional flexibility for reinvestment, particularly in the early years.

We continue to see ARR financing as a popular non-dilutive tool for accelerating business growth, whether through new product development, expanding sales and marketing teams, entering new markets, or investing in operational efficiencies. While still somewhat nascent in Europe, ARR financings has continued to mature but there are now an increasing range of lenders willing to consider the full range of ARR financings from £5m to £200m and above. The stable of lenders has steadily grown across banks and credit funds in the past decade which has meant sourcing the right pockets of capital who have proven activity is becoming ever more important to achieving an optimal financing package.

The UK continues to be an incubator for IP-rich, innovative and technology-driven businesses, and funding options have followed suit. Therefore, a robust ARR financing strategy has become a key factor in a business's competitive advantage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.