- in United States

- within Insurance, Wealth Management and Tax topic(s)

The Digital Operational Resilience Act (DORA) is a transformative regulation introduced by the European Union to bolster the resilience of financial institutions against Information and Communication Technology (ICT) risks. As Indian banks expand their operations into Europe, ensuring compliance with DORA has become a critical priority. We explore the challenges Indian banks face, key provisions of DORA, and how our tailored support enabled these banks to achieve compliance effectively.

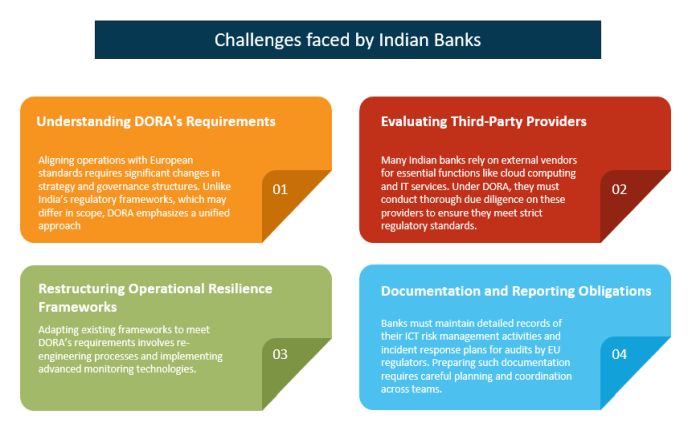

Challenges Faced by Indian Banks While Implementing Dora

Indian banks operating in Europe face several significant barriers while implementing the Digital Operational Resilience Act (DORA). As they expand their operations into the European market, these banks must navigate a complex regulatory landscape that emphasizes stringent compliance and operational resilience. The shift from Indian regulatory frameworks to DORA's unified approach requires a comprehensive understanding of new standards and practices, which can be daunting. In this context, the following challenges emerge as critical for Indian banks striving to achieve compliance with DORA.

Overview of DORA

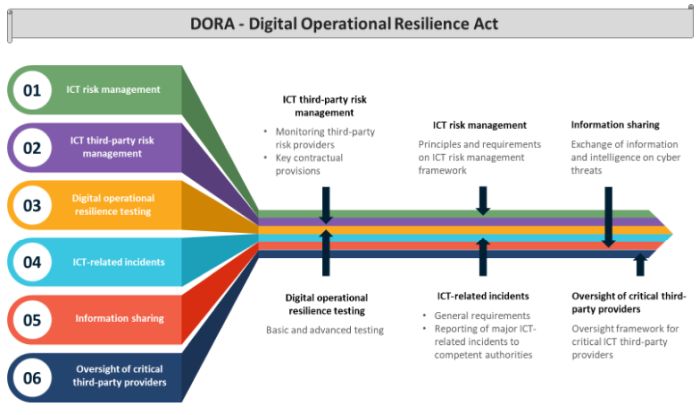

DORA, officially enacted on January 16, 2023, and effective from January 17, 2025, establishes a unified framework for managing ICT risks across the EU financial sector. It aims to harmonize operational resilience regulations and ensure that financial institutions can withstand and recover from ICT-related disruptions. The regulation applies to various types of financial entities, including banks, insurance companies, investment firms, and ICT third-party service providers.

Key Provisions of DORA

DORA introduces a unified framework to enhance the resilience of financial institutions against ICT risks.

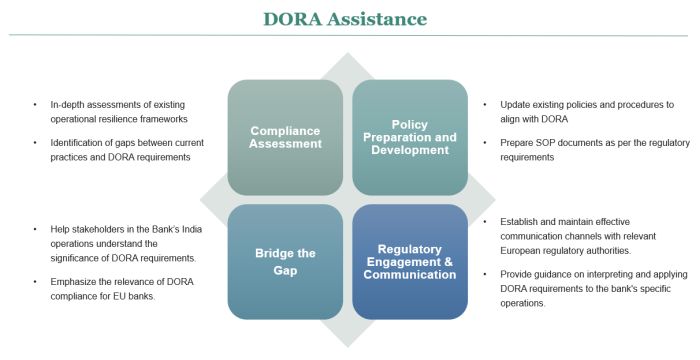

Ankura's Tailored Support

At Ankura, our team provided comprehensive support to Indian banks navigating DORA compliance. We began by conducting assessments of existing operational resilience frameworks within these banks, identifying specific gaps compared to DORA requirements. Our assessments were tailored to each institution's context, ensuring we pinpointed areas needing improvement. The assessment included the following primary activities to assist the bank in enhancing readiness.

By leveraging our expertise in risk management and compliance, Ankura empowered Indian banks operating in Europe to enhance third-party vendor compliance by 83%, reducing risks associated with ICT service providers and increasing operational resilience testing success rates to 95%, ensuring preparedness for ICT disruptions. This not only enabled the banks to meet DORA's requirements but also to enhance their overall operational resilience. Our support ensured these institutions were prepared for the evolving regulatory landscape while safeguarding against potential digital threats.

Conclusion

DORA represents a significant regulatory development for financial institutions operating within the EU. Indian banks need to take proactive steps to ensure compliance with DORA. Seeking expert guidance is invaluable in navigating these complexities. Ankura's commitment to supporting these banks through tailored strategies ensures they are well-prepared while fostering a secure digital banking environment.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.