2025 pay trends to watch

2025 salary budgets increases are expected to be 3.5% or more across all regions. Demand for individuals with specialized IT skills, including machine learning, cybersecurity and data analysis, remains strong across the financial services industry.

Trends in employee pay

Financial services firms are looking holistically at total rewards programs to support multiple objectives, including encouraging employees to develop new skills, supporting the employee value proposition and promoting retention of high-performing employees.

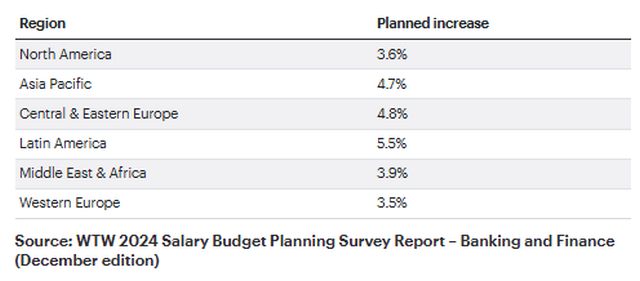

Planned salary budget increases

2025 salary budget increases are expected to be the highest in Latin America (5.5%), followed by Central & Eastern Europe (4.8%) and Asia Pacific (4.7%). U.S. salary budget increases are projected to be more moderate in 2025 than in 2024 as inflationary pressures and labor market pressures have eased. Median 2025 salary budgets are projected to be up 3.7% at the median compared to the actual median increase of 4% in 2024.

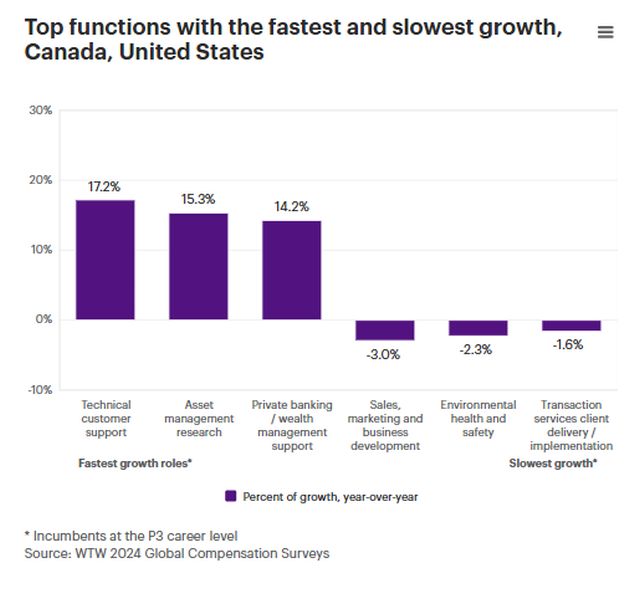

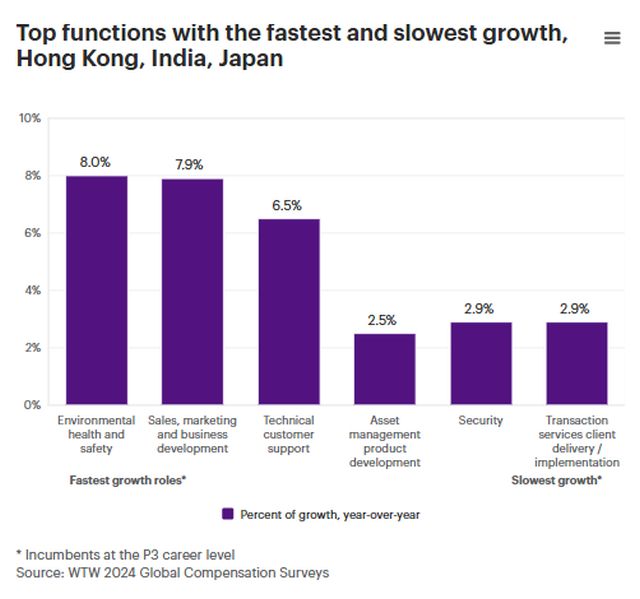

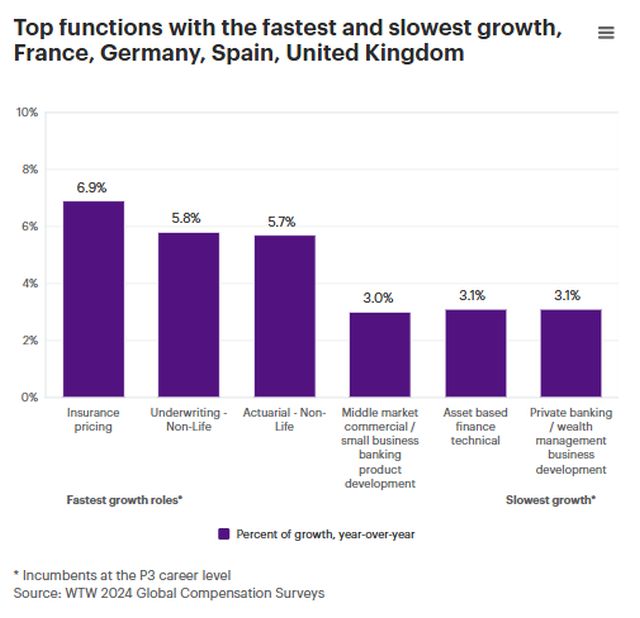

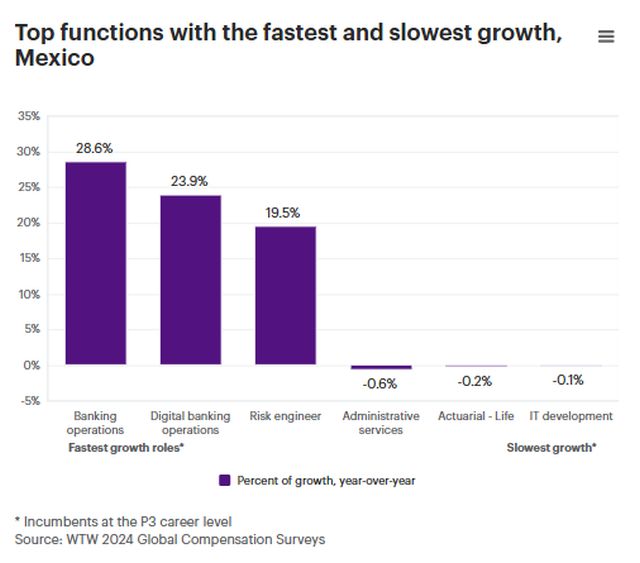

Industry disciplines and functions seeing the fastest and slowest compensation growth

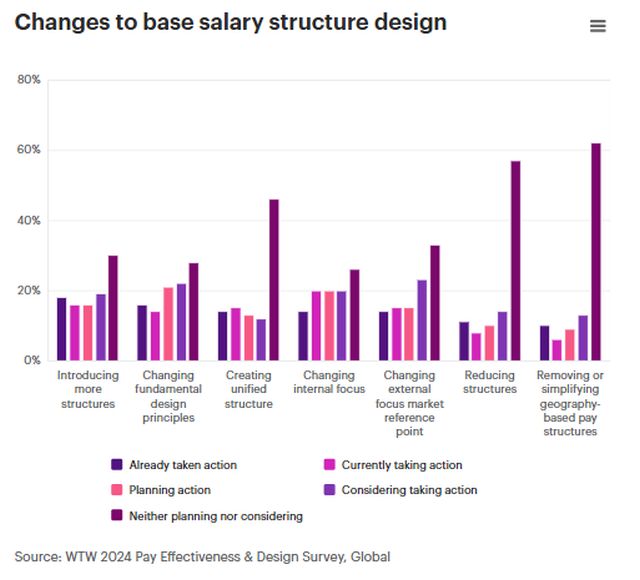

Changing labor market and economic conditions as well as socio-economic trends have increased the pressure on organizations to update their pay programs, according to the results of our 2024 Pay Effectiveness & Design Survey's global results.

The latest data from WTW's 2024 Global Compensation Survey uncovers trends in compensation growth across various disciplines within the financial services industry in key markets across Asia, Europe, Latin America and North America. This analysis highlights where the most significant and modest salary increases are occurring, providing valuable insights for both industry professionals and employers. The roles with the fastest-growing compensation vary significantly by region.

Changes to base salary structure design

Most respondents to WTW's global Pay Effectiveness & Design Survey indicated that they have already made changes or are planning or considering making changes to their base salary structure design. Commonly cited changes include introducing more structures, changing fundamental design principles and changing the internal focus.

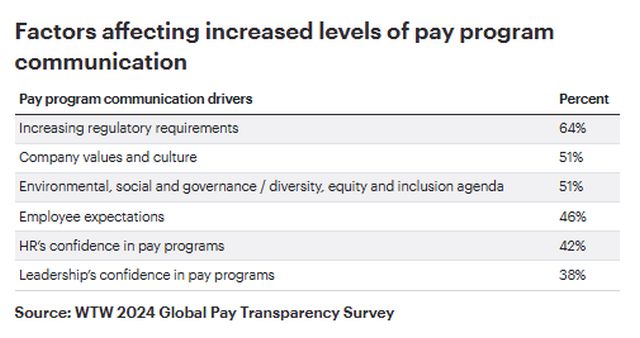

Compensation communication

Multiple factors are encouraging increased levels of pay program communication within organizations.

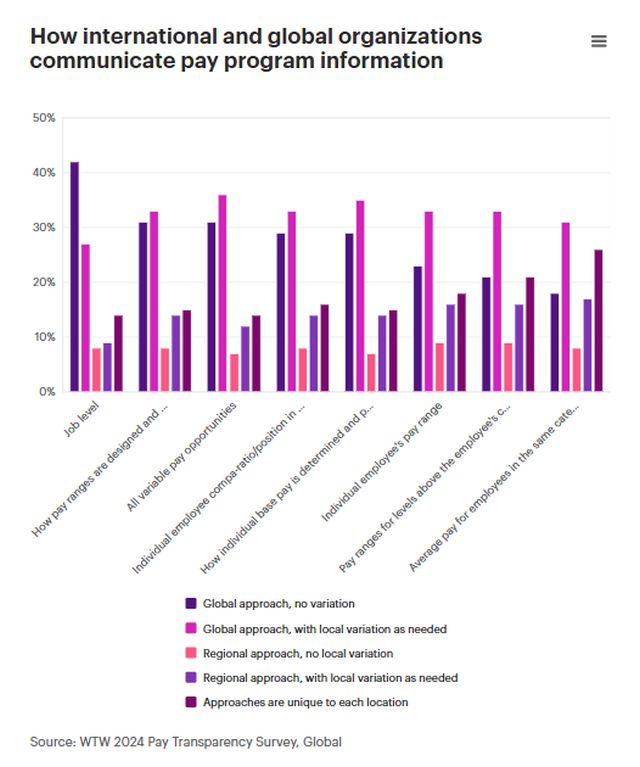

International and global organizations generally approach the way they communicate pay program information on an organization-wide basis, with local variation where required.

Trends in attraction and retention

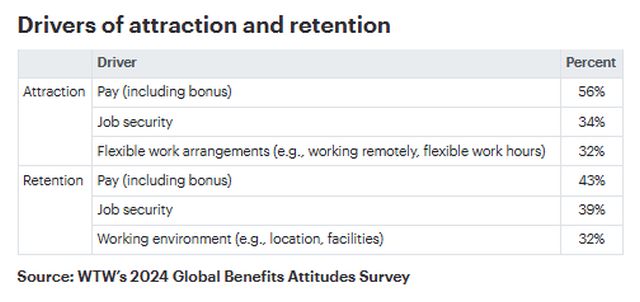

Employee attraction and retention is one of six core objectives for pay programs in organizations around the world, especially as employees are most likely to say pay is a driver of attraction and retention, according to WTW's 2024 Global Benefits Attitudes Survey.

Drivers of attraction and retention

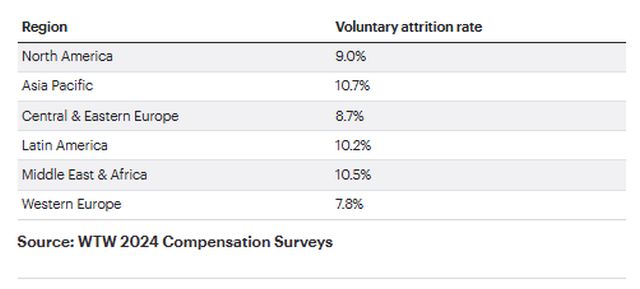

Average voluntary attrition rate, by region

Voluntary attrition is highest in Asia Pacific, while voluntary turnover is lowest for Western Europe. Many organizations still report issues with sourcing talent, including reporting a shortage of available labor supply.

41% of organizations report labor shortages in multiple talent segments.

In-demand jobs and skills

Software engineer, application developer, data Scientist and relationship banker are the most in-demand jobs in Europe and international markets. The most in-demand skills include sales management, financial reporting and compliance management.

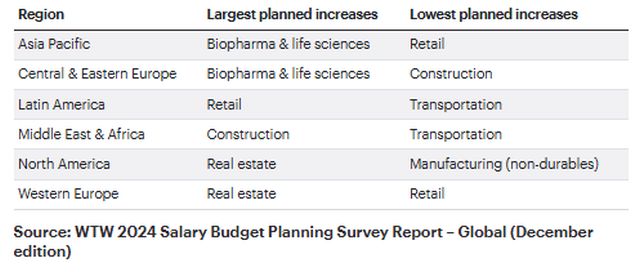

Highest and lowest headcount expectations, by industry and region

Organizations are sharing pay information with job candidates

Two-thirds of organizations around the world are already or are planning / considering communicating pay rate or pay range information to job candidates, according to our 2024 Pay Transparency Survey's global results.

77% of organizations are more likely to

communicate the

hiring rate / range for the job to external job candidates.

56% of organizations apply a consistent approach for all job levels and types to external job candidates.

Firms with operations in locations with increased legislation tend to apply a consistent approach across the entire enterprise when sharing pay rates and ranges with prospective employees.

Locations sharing pay rates and ranges with prospective employees:

- 86% of U.S. employers

- 63% of UK employers

- 60% of EU employers

- 58% of Canadian employers

Trends expected to shape 2025 rewards

- Emphasis on skills over knowledge Organizations are shifting their focus from traditional knowledge-based roles to skills that are both prevalent and emerging. This includes identifying and rewarding skills that are critical for current and future business needs.

- Continued demand for cybersecurity, digital and artificial intelligence (AI) talent The demand for cybersecurity, digital and AI talent remains high. Companies are investing in these areas to stay competitive in an increasingly digital world.

- Modernizing employee value propositions (EVP) Companies are modernizing their EVP to better align with the drivers of attraction and retention. This involves leveraging technology and data analytics to tailor rewards programs more effectively, ensuring they meet the diverse needs of the workforce.

- Increased focus on benefits in total rewards decisions There is a growing emphasis on a holistic total rewards package that includes financial, physical and emotional wellbeing. Benefits such as mental health support, personalized and flexible options and incentives for sustainability and social responsibility are becoming more prevalent.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.