- within Energy and Natural Resources, Food, Drugs, Healthcare, Life Sciences and Insolvency/Bankruptcy/Re-Structuring topic(s)

The Treasury has confirmed final rules which impact both authorised and unauthorised firms making financial promotions in reliance on exemptions for high net worth individuals (HNWI) and self-certified sophisticated investors.

These changes form part of the Government's broader investor protection work and the continued tightening of regulation of financial promotions. In particular, recent changes made earlier this year mean that authorised firms are now subject to stricter rules when promoting certain high-risk investments1 and must also apply for an additional permission to approve financial promotions for unauthorised firms.

What are financial promotions?

A financial promotion is a communication made in the course of business that contains an invitation or inducement to engage in investment activity. Generally, firms which are not authorised under the Financial Services and Markets Act 2000 (FSMA) cannot make financial promotions unless:

- the content is approved by an authorised firm (which must now seek a regulatory permission to make such an approval);2 or

- the firm relies on an exemption under the FSMA (Financial Promotion) Order 2005 (the FPO).

This is known as the "Financial Promotion Restriction" and it is a criminal offence to breach it.

Authorised firms are also restricted from issuing financial promotions where the promotion is in respect of unregulated collective investment schemes unless the promotion is made in accordance with certain FCA rules or an exemption under the FSMA (Promotion of Collective Investment Schemes) (Exemptions) Order 2001 is available (the CIS Order).

What is changing and why?

The exemptions in the FPO and the CIS Order relating to HNWI and self-certified sophisticated investors are available for promotions relating to investments in unlisted companies. These exemptions have not been substantively updated since 2005. They were originally implemented to enable small and medium sized enterprises to raise finance from HNWI, sophisticated private investors or "business angels" without the costs of having to comply with the financial promotions regime.

Firms are able to rely on these exemptions for financial promotions directed to individuals whom the firm believes on reasonable grounds to be HNWI or self-certified sophisticated investors. Although these exemptions will remain broadly in place, they are now being reformed. The Treasury has explained that the changes are necessary to reflect current circumstances and to address the risk of the exemptions being misused and causing investor detriment when inappropriate products are marketed to ordinary retail investors.

The key changes include:

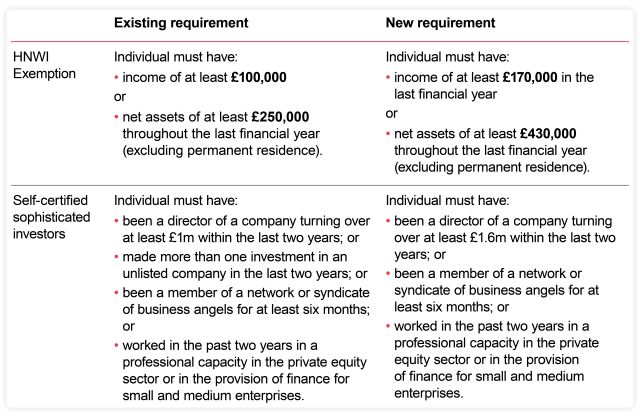

- updates to the financial/qualifying criteria for the HNWI and self-certified sophisticated investor exemptions (as set out in the table below);

- a new requirement for businesses to provide identifying details in any communications made using the above exemptions (i.e. company address, contact information and registration details); and

- updates to the prescribed form of investor statements for HNWI and self-certified sophisticated investors. The changes are designed to make it clearer to investors the protections they are losing by receiving financial promotions in reliance on the relevant exemptions.

The table below sets out a summary of the changes to the financial/qualifying criteria for the exemptions.

When will these changes be introduced and what should firms be doing now?

Subject to the parliamentary process, it is the Government's intention for these changes to be implemented on 31 January 2024. Given the criminal consequences of breaching the Financial Promotion Restriction, firms seeking to rely on these exemptions should act now to ensure that any financial promotions made after 31 January 2024 are compliant with the new criteria. In particular, firms should:

- review and update their processes for making financial promotions to ensure compliance with the reformed regime from 31 January 2024;

- ensure their existing financial promotion records are up to date (with appropriate and in-date investor statements from relevant recipients of financial promotions where current exemptions are relied on);

- reassess existing recipients of financial promotions to determine if they meet the updated criteria to be a HNWI or self-certified sophisticated investor; and

- provide relevant staff training to ensure that financial promotions are only directed at individuals in compliance with the Financial Promotion Restriction and that staff understand the obligations on the firm to discharge the requirement that the firm has "reasonable grounds" to believe that recipients of their financial promotions meet the relevant criteria.

What about ongoing communications to investors which previously met the relevant criteria and no longer do?

The Treasury has confirmed that where financial promotions have been made in compliance with the existing regime prior to 31 January 2024, the follow up communications provisions in the FPO and CIS Order will remain available.3 This means that any follow up financial promotions relating to the same investment made within 12 months of the first communication will not require updated investor statements provided that the other relevant requirements of those provisions are met.

Footnotes

1. These rules are set out in COBS 4.12A and COBS 4.12B and came into effect in February 2023

2. From 6 November 2023 authorised firms are able to submit applications for permission to approve financial promotions. The initial application period will close on 6 February 2024. On 7 February 2024, amendments to Section 21 FSMA will come fully into force and authorised firms that have not applied to the FCA for permission as a financial promotion approver will no longer be able to approve financial promotions (subject to certain exemptions).

3. Article 14 FPO and article 11 CIS Order.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.