It is nearly impossible to avoid news of the latest rise or fall in the cryptocurrency markets. Investments in cryptocurrencies such as bitcoin have made incredible fortunes for some people, while others have lost big time. When reading Satoshi Nakamoto's seminal paper on bitcoin,1 one has to wonder whether Satoshi predicted the remarkable impact that their invention would have on the world. At best, Satoshi's paper acknowledges that the technology underlying bitcoin (commonly known as blockchain) facilitates a trusted system for electronic transactions without having to rely on a centralized financial institution to properly account for every transaction.

Bitcoin was designed to solve a problem identified as a result of evolving technology and commercial reality. Electronic transactions are now critically important to the functioning of the world economy. However, such transactions rely on trust in the financial institutions that underpin them. Although there is a high degree of trust in financial institutions due to the systems they have put in place, this trust could be eroded if a bad actor is able to manipulate these systems and carry out fraudulent activity.

An analogy can be made with cash. Cash facilitates economic activity by allowing purchases to be made. A purchaser acquires cash by taking on debt or as payment for producing something or providing a service. Economic activity leads to improvements in living standards and therefore cash could be regarded as a key lubricant for economic activity. This system is degraded if a counterfeiter can create cash without having done, or promised to do, the work corresponding to the value of the purchase. For this reason, cash notes with high values incorporate security features to help a seller distinguish between legitimate and counterfeit notes.

As printing technology evolves and counterfeiters become motivated to exploit this technology, increasingly sophisticated security features have to be incorporated in notes to defeat them. Innovations continue to be made in this technical field, as indicated by the patent filing data. By way of example, the number of international patent applications filed in the field of security printing increased significantly in the early nineties and has remained fairly consistent since then. There has been a downward trend more recently, which we could speculate is due to the increasing use of electronic transactions instead of cash.

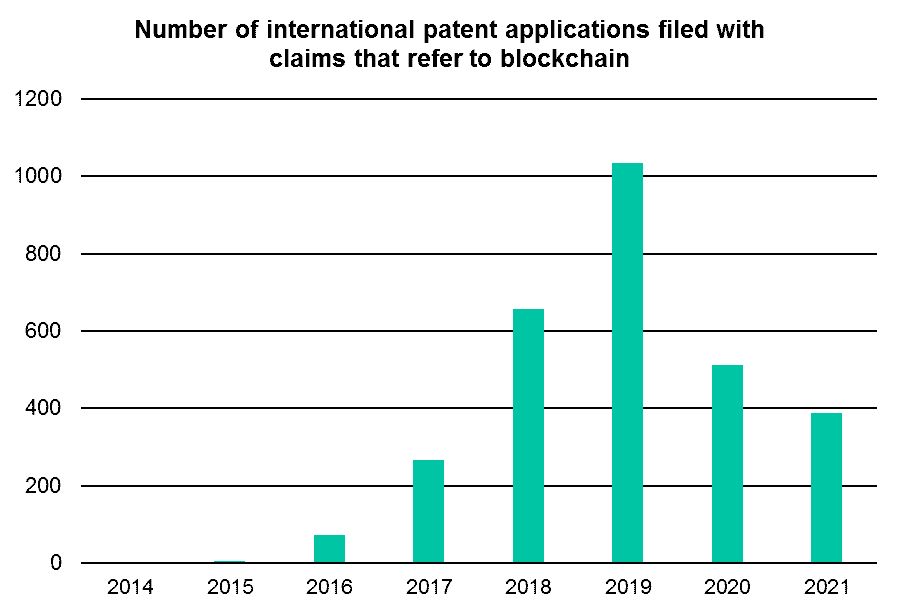

Patent filing data is therefore useful for identifying, and possibly predicting, trends in technology. Since realizing the commercial opportunities made possible by blockchain, a large number of related patent applications have been filed, as indicated by the chart below.

We see a significant increase in international patent filings prior to the pandemic, followed by a perhaps unsurprising drop since then.

It will be some time before we find out if the blockchain patent filings resume their pre-pandemic trend. In any case, this author is confident that blockchain technology will continue to unlock innovations in many fields for years to come. This is because blockchain has already enabled a diverse range of use cases including supply chain management, digital voting and management of intangible assets such as intellectual property rights and NFTs (non-fungible tokens).

Blockchain technology can therefore be used to increase trust in digital innovations, which may lead to improvements being made to existing products and services and may even facilitate the creation of new products and services. Whether these innovations are introduced by tech SMEs or large corporates, it is important for these businesses to assess the viability of patenting their innovations to maximize commercial advantage over their competitors. Equally, it is important for businesses to stay informed of the patenting activity of their competitors, in case this threatens their market share or future opportunities.

A future article will explore the characteristics of blockchain patent applications that improve the likelihood of securing a granted patent for blockchain-based inventions.

Footnote

1.Nakamoto, S. (2008) Bitcoin: A Peer-to-Peer Electronic Cash System. https://bitcoin.org/bitcoin.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.