- within Corporate/Commercial Law topic(s)

- with readers working within the Banking & Credit industries

- within Law Department Performance, Consumer Protection and Environment topic(s)

- with readers working within the Retail & Leisure industries

AGM arrangements and shareholder engagement

The AGM is the one forum where a listed company can hear from all its shareholders. Institutional investors have regular opportunities to meet the board and senior management, but it's at the AGM that their voice is clearly and publicly heard through the exercise of voting rights. Meanwhile, for smaller shareholders, including retail investors, the AGM may be the only opportunity for direct communication with the board.

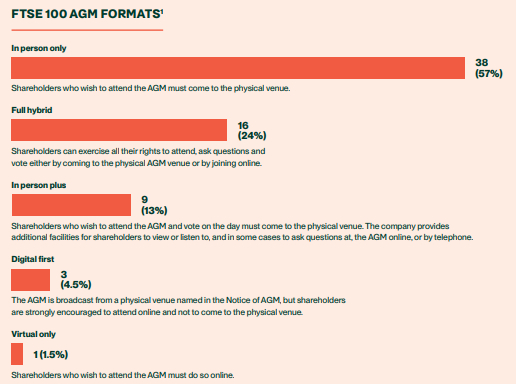

So far in 2025, AGMs have again varied widely in scale and profile, with companies continuing to seek a balance between providing engagement opportunities for shareholders and using their resources efficiently. This is reflected in the range of formats seen even within the FTSE 100 AGMs (67 in total) held between 1 January and 31 May 2025.

Outside the FTSE 100, an even higher proportion of AGMs have been held "in person only". In some cases, this format has been chosen following a cost-benefit analysis of providing online facilities, taking account of low uptake in years when they have been offered. At the same time, companies have tried other ways to increase engagement. Examples include holding the AGM in a different city for the convenience of local shareholders, inviting shareholders to submit questions by email in the run up to the AGM (with responses before the proxy voting deadline to facilitate informed voting decisions) and, separately from the AGM, encouraging participation in retail investor forums, including through online platforms, and convening stakeholder panels.

Looking ahead, we believe further movement away from "in person only" and hybrid meetings towards online formats will require both a clarification in UK company law2 and a positive shift in institutional shareholder views3. Recent reports indicate that the much-anticipated Audit Reform and Corporate Governance Bill may "clarify the legality" of virtual general meetings, while considering the interests of shareholders4 , and this would certainly reignite the debate around virtual AGMs. However, given the large number of companies that would need to update their articles of association to enable virtual only shareholder meetings5 , those institutional shareholders who drive voting trends, as well as companies, would need to be convinced of and embrace the benefits of the virtual format.

AGM share capital authorities

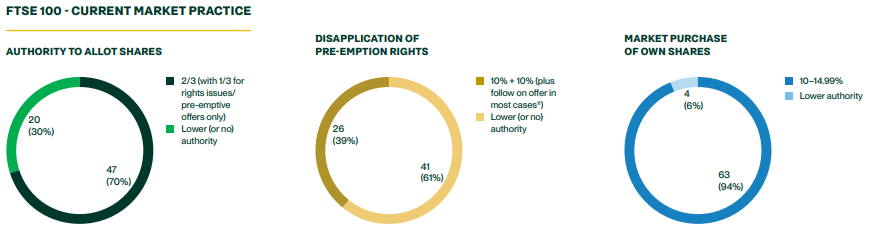

The share capital authorities proposed by most companies at their AGMs (authority to allot shares, disapplication of pre-emption rights and market purchase of own shares) are viewed as routine resolutions, because they are included in the AGM business every year. However, having these authorities in place is crucial to enable companies to manage their capital effectively and to remain agile when considering how to finance organic and inorganic investment opportunities throughout the year.

The strategic value of AGM authorities can be seen through their practical use. Over the last two years6, in addition to a number of completed rights issues and open offers amongst FTSE companies, 12 have filed post transaction reports with the Financial Reporting Council (FRC) following a capital raising in which they have utilised their authority to disapply pre-emption rights7 . In addition, over the same period, and in the FTSE 100 alone, 63 companies have returned capital to shareholders via a share repurchase programme.

Many companies have adopted the maximum flexibility for AGM share capital authorities permitted under current guidelines. Based on the 67 FTSE 100 AGMs held between 1 January and 31 May 2025, current market practice is as illustrated in the pie charts below.

We note that there continues to be lower market uptake of the enhanced disapplication of pre-emption rights authorities permitted under the Pre-emption

Group's statement of principles from November 2022 by comparison with the other standard (and longer established) AGM share capital authorities, particularly in the FTSE 100 group8. We understand the lower uptake reflects nervousness among some companies that their shareholders may be sensitive to the level of dilution to which they could be exposed if the disapplication of pre-emption rights authorities were used in full.

Nonetheless, shareholder support for disapplication of pre-emption rights resolutions remains strong overall. The public register of the Investment Association (IA) has only recorded 12 "significant"9 votes against disapplication of pre-emption rights resolutions across 8 companies in the whole FTSE index between 1 January and 31 May 202510.

Executive remuneration and share plans

The 2025 AGM season has marked a pivotal juncture in the ongoing debate on executive remuneration in UK listed companies. The IA's updated Principles of Remuneration (IA Principles), effective from October 2024, provided boards and remuneration committees with enhanced flexibility to tailor pay policies to their specific business needs and global talent strategies. Several substantive changes have been introduced under the revised IA Principles, two of which have sparked particular discussion.

IA PRINCIPLES - CHANGES IN FOCUS

Recognition of Hybrid Pay Schemes:

The IA's endorsement of "hybrid" schemes, which combine performance-based and service-based vesting, has been welcomed by companies seeking to align more closely with U.S. practices. We expect market practice to evolve as companies embrace this new flexibility.

Shareholding Requirements and Transaction and Retention Bonuses:

Updated guidance on minimum shareholding requirements and a more permissive stance on transaction bonuses and retention awards have also featured in several remuneration reports and policy votes this season.

These changes to the IA Principles have come at a time when UK companies are facing intensifying competition from the U.S., where executive compensation levels remain significantly higher. The widening gap between U.S. and UK executive pay has remained a central theme throughout the 2025 AGM season. With U.S. S&P 500 CEOs earning, on average, three times more than their UK counterparts, concerns about the UK's ability to attract and retain top executive talent have intensified.12 This has prompted a growing number of FTSE 100 companies to seek shareholder approval for more innovative and competitive pay structures, including higher value long-term incentive schemes and hybrid awards. Some of the biggest companies on the London Stock Exchange by market capitalisation are among those implementing improved pay deals for their chief executives this year. The removal of the "bankers' bonus cap" (albeit in 2023) has also seen multiple banks seeking shareholder approval to increase the maximum remuneration their chief executive can receive. Indeed, UK pay packages have grown faster this year than their counterparts in the U.S., with the median pay at FTSE 100 companies that have reported this year having increased 11% to USD6.5 million13. However, given the heightened scrutiny from shareholders, proxy advisers, and the broader public, a balance needs to be struck when designing and implementing executive incentive arrangements.

Director re-elections and shareholder concerns

The 2025 AGM season is once again seeing more "significant"14 votes against director (re-) election resolutions than against any other type of resolution, with the IA's public register recording 16 companies receiving such a vote against at least one director (re-)election resolution from 1 January to 31 May 2025, corresponding to 32 resolutions in total15.

The higher number of significant votes against these resolutions is unsurprising, given the number of director (re-)election resolutions proposed at AGMs by comparison with other categories of resolution and the broad range of concerns that might lead shareholders to vote against a director (re-)election. Nonetheless, votes against directors do attract attention; they can feel personal when driven by individual issues such as commitment or tenure, and they can also shine a light on broader issues for which a director may be held accountable such as company performance (executive directors), executive remuneration (remuneration committee chair) and diversity performance (nomination committee chair)

Over-boarding, or perceived over-boarding, remains a common concern, with shareholders keen to ensure other business commitments do not impact directors' effectiveness16. Where there is concern, criticism and a vote against a director seem particularly likely where board or committee meetings have been missed17.

Companies may be able to provide some reassurance through explanation in their annual report of a director's overall contribution, the reasons for permitting new external appointments18, and the context of missed meetings (for example short notice, or shortterm illness or personal reasons). However, investors are increasingly making their own judgements as to how many commitments is too many, sometimes based on their own internal guidelines on this issue which may diverge from the guidelines of major proxy advisers, and so ongoing dialogue with larger shareholders is strongly recommended to minimise the risk of negative voting outcomes.

Diversity at both board and senior management level has also continued as an area of focus, but for some companies, and particularly those with a significant U.S. presence, the content and emphasis of reporting has started to shift in response to the evolving D&I landscape in the U.S. and globally. In particular, companies have recently been grappling with the tension between the UK emphasis on setting and reporting against targets as a means of driving improvement in diversity performance and concerns over the legality of such targets in the U.S. Of course, UK companies must continue to comply with all their UK disclosure obligations, including reporting, on a "comply or explain" basis, against the board level diversity targets set out in the UK Listing Rules, with such additional explanation or contextual information as they think appropriate for readers based in other jurisdictions. However, we have observed some companies with a significant U.S. presence reconsidering their approach to reporting against targets on a voluntary basis, including choosing to apply senior management representation targets to employees based in the UK only or eliminating targets altogether.

To view the full article clickhere

Footnotes

1_Based on AGMs held between 1 January and 31 May 2025 of companies named in the FTSE 100 index constituents table as at 31 May 2025.

2_s.311(1)(b) Companies Act 2006 requires the Notice to state the "place" of the meeting. There is debate around whether this requires a physical location to be stated. A&O Shearman has previously received advice from Counsel that, while there is no definitive answer, the better and only safe view is that it does require a physical location. 3

_ISS, Glass Lewis, the Investment Association, PLSA and PIRC have all stated that they would not usually support virtual only meetings for UK companies and so companies proposing amendments to their articles of association to enable such meetings risk strong opposition.

4_"An end to sandwiches and protests? The rise of the virtual AGM" (Financial Times article dated 5 May 2025).

5_Updates to articles of association must be approved by a special resolution, requiring 75% of votes to be in favour for the resolution to pass.

6_31 May 2023 to 31 May 2025.

7_Based on information appearing on the FRC Post Transaction Reports Database as at 17 June 2025. Of the 12 reports filed between 31 May 2023 and 31 May 2025, 8 relate to transactions that completed during this period.

8_The Pre-emption Group Annual Monitoring Report published in November 2024 noted that 67.1% of FTSE 350 companies holding an AGM within their study period of 1 August 2023 to 31 July 2024 sought enhanced disapplication of pre-emption rights authorities.

9_20% or more of votes received were against the board recommendation for the resolution. 10_Based on information appearing on the public register as at 17 June 2025.

11_Three out of the 26 companies in this group proposed 10% + 10% disapplication of pre-emption rights resolutions in line with the Pre-emption Group's template resolutions, but did not include the additional follow-on offer limb of the template resolutions.

12_The High Pay Centre estimates that median FTSE 100 CEOs earnings GBP4.22m in 2024. An AFL-CIO report confirmed that the average compensation at S&P 500 companies was USD17m. 13_According to data from ISS corporate.

14_20% or more of votes received were against the board recommendation for the resolution.

15_Based on information appearing on the public register as at 17 June 2025.

16_UK Corporate Governance Code 2018/2024, Principle H.

17_Shareholders can assess this based on annual report disclosure of meeting attendance pursuant to UK Corporate Governance Code 2018/2024, provision 14.

18_UK Corporate Governance Code 2018/2024, provision 15.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.