Attraction and retention remain challenging for organizations worldwide

Organizations grapple with sourcing talent for major roles at every level

| Location | Average voluntary attrition rate |

|---|---|

| Brazil | 7% |

| China | 12% |

| United Arab Emirates | 9% |

| United Kingdom | 10% |

| United States | 11% |

Major roles employers plan to hire for in the next 12 months

| Location | Information technology | Engineering | Sales |

|---|---|---|---|

| Brazil | 62.5% | 59.6% | 54.8% |

| China | 43.1% | 73.5% | 53.0% |

| United Arab Emirates | 58.7% | 68.3% | 58.7% |

| United Kingdom | 56.9% | 66.5% | 50.3% |

| United States | 60.8% | 70.1% | 50.0% |

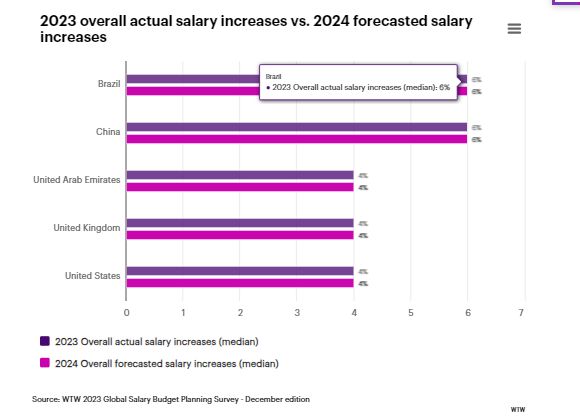

Salary budget increases continued in 2023

Because salary impacts an organization's ability to attract and retain talent, this pattern is expected to continue in 2024, but employers will be cautious about allocating their salary budget.

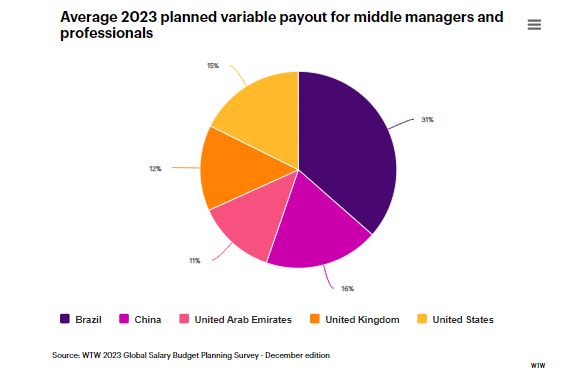

Organizations also granted higher bonus payouts for 2023, and are expected to repeat it in 2024.

Employers (60% or more) in every industry worldwide have taken or are considering taking the following measures:

- Compensation review of specific employee populations

- Full compensation review for all employees

- Targeted increases for specific employee populations

- Hire people higher in relevant salary range

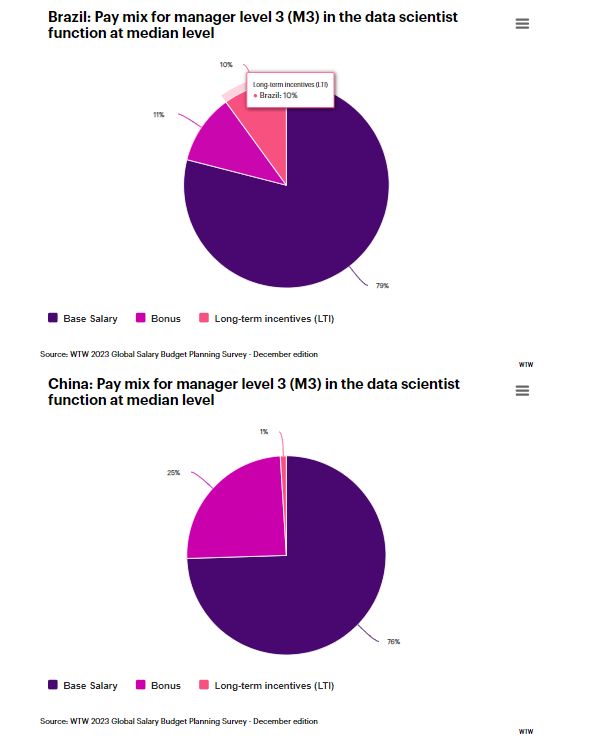

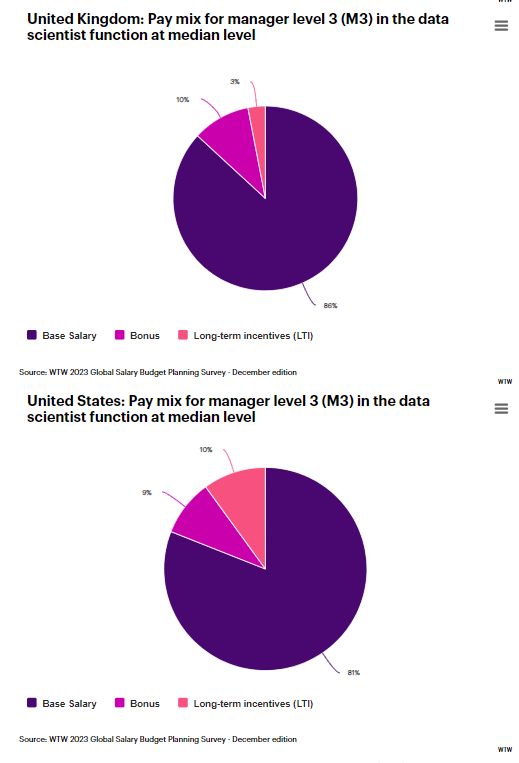

Top 3 functions at professional level (P3) with the highest pay across all industries

| Rank | Brazil | China (Shanghai) | United Kingdom | United States | United Arab Emirates |

|---|---|---|---|---|---|

| 1 | Data Science and Business Intelligence | Legal | Strategic Planning/Corporate Development | Research | Technology/Systems consulting |

| 2 | IT Development | Technology Product Development | Technology Product Development | IT development | Business consulting |

| 3 | Sales, Marketing and Business Development | IT development | Financial Analysis and Tax | Data science and Business Intelligence | Technical Sales Support |

A few skills will receive the highest pay premiums across regions

| Region | Skills | Pay premium (median in percent of base salary) |

|---|---|---|

| Asia Pacific | AI/machine learning frameworks | 15% |

| Europe, Middle East and Africa | AI/machine learning frameworks | 20% |

| Latin America | Cryptography, distributed ledger development, smart contract programming | 15% |

| North America | Cryptography, distributed ledger development, smart contract programming | 15% |

2023 has seen an increase in the number of unique organizations participating in WTW's 2023 TMG surveys contributing to an 4% overall increase in data submissions.

Trends expected to shape 2024 rewards decisions

- Despite recent high-profile layoffs, the demand for key talent continues to outpace supply in the tech industry. Therefore, organizations will need to look beyond pay and take a holistic view of total rewards to create employee experiences that attract and retain the right talent.

- The dynamics of work are truly changing, and this will likely mandate greater flexibility, adaptation and innovation in Work and Rewards. In some cases, embracing flexible work, new talent sources and automation technologies are no longer optional but essential.

- Given increasing legislation around pay transparency, organizations must prepare now to meet regulatory requirements. Objective job and pay structures, robust data and analytics, and manager education are likely to help your organization confidently deliver a pay narrative to internal and external stakeholders.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.