- within Law Practice Management, Wealth Management and Insurance topic(s)

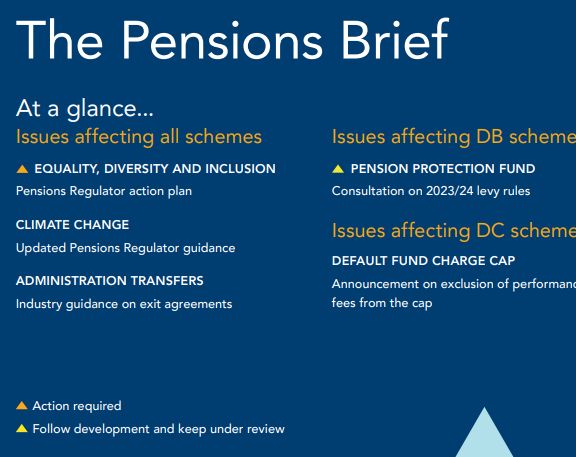

Issues affecting all schemes

Equality, diversity and inclusion – action plan

The Pensions Regulator has published an action plan to improve diversity and inclusion across trustee boards. The plan follows research which shows that few trustee boards are prioritising diversity. Among other things, the Regulator will produce a package of good practice guides, case studies and tools for employers, trustees and advisers. This guidance will be designed to support those parties to understand and meet the Regulator's expectations, and will focus on:

- What diversity and inclusion means for governing bodies

- Attracting diverse candidates to the trustee role.

- Attracting diverse candidates to the trustee role.

- Creating and maintaining an inclusive culture.

- Ensuring member communications are inclusive.

Once the Regulator has published this guidance, it will review its existing guidance and templates to identify where further changes may be needed.

Action

Trustees and employers should keep the progress of the Regulator's guidance under review. They should also consider whether they should be giving the issue of trustee board diversity greater priority and, if so, what steps they could take to improve diversity.

Climate change – Pensions Regulator guidance

The Pensions Regulator has updated its guidance on the climate change governance and reporting requirements to reflect the new requirement to calculate and disclose a portfolio alignment metric setting out the extent to which scheme investments are aligned with the Paris Agreement goal of limiting the increase in the global average temperature to 1.5 degrees Celsius above preindustrial levels. The new requirement came into force on 1 October 2022.

Action

No action required, but trustees that are subject to the governance and reporting requirements may find the updated guidance helpful.

Administration transfers – exit agreements

The Pensions Administration Standards Association has published guidance on administration transfer exit agreements. The guidance is designed to support trustees and administrators in planning and managing a transition of administrators. It includes a template exit agreement which can be used as a schedule to an existing administration contract, a schedule within a new administration contract, or as a checklist for trustees and administrators to check that their own exit agreement includes all recommended aspects.

Action

No action required, but trustees and administrators may find the guidance helpful when planning an administration transfer or when entering into or renewing an administration contract.

Issues affecting DB schemes

Pension Protection Fund – 2023/24 levy

The Pension Protection Fund (PPF) is consulting on the draft rules for the 2023/24 levy. The PPF intends to set a levy estimate of £200 million, down from £390 million in 2022/23, with almost all schemes expected to see a levy reduction. The 25% cap on individual risk-based levy increases that was introduced for the 2022/23 levy year will not be continued. No major changes are proposed to the levy rules for 2023/24.

The consultation also notes that the PPF's financial position has significantly strengthened in recent years and it is now entering a new phase where its focus will shift from building to maintaining its financial resilience. The PPF believes that this presents an opportunity to move over time to a levy methodology which is simpler and:

- Places more weight on underfunding and less on insolvency risk.

- Makes greater use of a scheme-based levy.

- Differentiates between schemes of very different sizes.

The consultation closes on 10 November 2022.

Action

Trustees and employers of schemes providing defined benefits should keep the progress of the consultation under review.

Issues affecting DC schemes

Default fund charge cap – performance fees

The government announced in the Growth Plan 2022 that it will bring forward draft regulations to remove well-designed performance fees from the scope of the DC default fund charge cap. Previously, in its response to its consultation on the exclusion of performance fees from the cap, the government said that in light of the concerns expressed by respondents, it would continue to consult and engage with stakeholders and any reforms would be carefully designed.

Action

No action required.

Visit us at mayerbrown.com

Mayer Brown is a global legal services provider comprising legal practices that are separate entities (the "Mayer Brown Practices"). The Mayer Brown Practices are: Mayer Brown LLP and Mayer Brown Europe – Brussels LLP, both limited liability partnerships established in Illinois USA; Mayer Brown International LLP, a limited liability partnership incorporated in England and Wales (authorized and regulated by the Solicitors Regulation Authority and registered in England and Wales number OC 303359); Mayer Brown, a SELAS established in France; Mayer Brown JSM, a Hong Kong partnership and its associated entities in Asia; and Tauil & Chequer Advogados, a Brazilian law partnership with which Mayer Brown is associated. "Mayer Brown" and the Mayer Brown logo are the trademarks of the Mayer Brown Practices in their respective jurisdictions.

© Copyright 2021. The Mayer Brown Practices. All rights reserved.

This Mayer Brown article provides information and comments on legal issues and developments of interest. The foregoing is not a comprehensive treatment of the subject matter covered and is not intended to provide legal advice. Readers should seek specific legal advice before taking any action with respect to the matters discussed herein.