- within Antitrust/Competition Law and Intellectual Property topic(s)

- with readers working within the Retail & Leisure industries

In a new era of uncertainty, risks are hitting organizations from all angles. Yet more than 60% of organizations are insufficiently prepared to address nearly all of them.

Our Global Risk Survey offers insights on the pressing risks facing today's businesses, major gaps in preparedness, and where regional and industry peers stand.

A consequential year of elections has unleashed rapid-fire policy changes—from sanctions to tariffs to cybersecurity requirements—at a pace that has fast become the new normal. At the same time, AI-related disruption, technological advancements, and economic volatility show no signs of letting up.

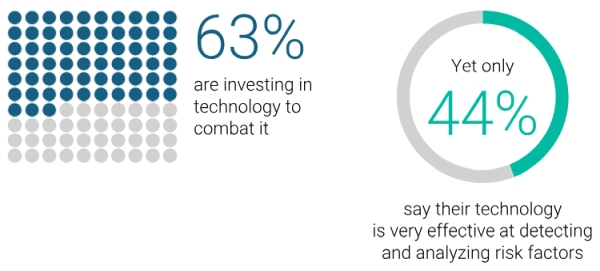

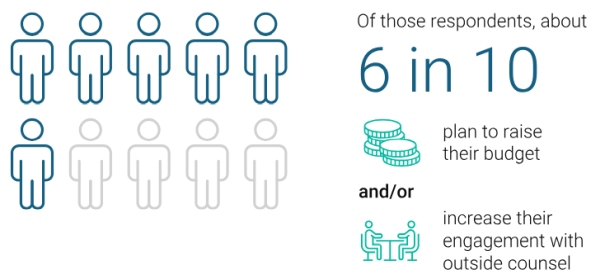

For today's executives and their advisers, it's not enough to identify and understand these risks. Business leaders must prioritize and proactively address them, often with limited (or overextended) resources at their disposal. Even the tools meant to mitigate risks add complexity: while investing in new technologies can help detect and analyze risk factors, our research reveals that these tools can create more vulnerabilities if poorly implemented.

The AlixPartners 2025 Global Risk Survey aims to bring insights to business leaders faced with solving organizations most critical problems, by drawing on responses from 1,000 senior executives serving in legal, regulatory/compliance, and risk functions across the globe. Respondents were surveyed in February and include professionals from the U.S., the UK, Western Europe, Asia Pacific, and Latin America working in financial services, technology, manufacturing, and other major industries.

KEY FINDINGS

Financial Crime

63% believe financial crime will increase in the next 12 months

"With regulatory enforcement expected to ease, most

legal and compliance leaders believe financial crime will increase.

While technology is a cost-effective way to mitigate risk and

reduce exposure, these tools are still evolving and have yet to

fully prove their effectiveness—creating potential

vulnerabilities for organizations of all kinds."

Sean Dowd, Partner and Managing Director

"For financial institutions and corporates alike, it is

important to remain vigilant and invest in proactive compliance in

the fast-evolving regulatory landscape. Organizations that harness

human expertise with advanced technology will be better equipped to

navigate this new era."

Meaghan Schmidt, Partner and Managing Director

Regulatory

Fewer than half of respondents feel very prepared to adapt to potential regulatory changes

"While we expect more clarity in the U.S. as senior

agency officials are installed, one thing that's certain is

that there will be shifts in priorities. State and local regulators

in the U.S. will likely seek to fill the void left by changes at

the national level. We could also see shifts in international

compliance priorities from one jurisdiction to the next. All of

this could result in multi-national companies needing to assess

compliance in areas where they may not have historically

focused."

Brad Mroski, Partner and Managing Director

"In today's fragmented and rapidly transforming

regulatory environment, a lack of preparedness exposes

organizations to prominent compliance gaps, enforcement actions,

and reputational risk. Rather than treating policy changes as a

series of one-off hurdles, organizations should view regulatory

compliance as a continuous and strategic business function. The

question is no longer if rules will change, but how quickly firms

can respond."

Lisa Osofsky, Partner and Managing Director

Technology

Fewer than 40% say their organizations are very prepared to address cybersecurity incidents, data privacy breaches, and digital disruption

"As business leaders increasingly look to adopt AI

tools across their organizations, they should create a dedicated AI

leadership role and/or cross-functional task force to oversee

implementation, risk management, policies and guidance, and ethical

considerations. At the same time, organizations should invest in

robust cybersecurity and data privacy frameworks, including

proactive monitoring systems, as well as employee trainings and

incident response plans to minimize the impact of data breaches and

digital disruptions."

Vineet Sehgal, Partner and Managing Director

"As threat actors grow more coordinated and technology

advances at breakneck speed, firms can no longer afford to operate

with siloed cybersecurity functions and outdated response plans.

The most forward-looking companies are embedding cyber risk into

enterprise-wide strategy—treating it not just as an IT issue,

but as a board-level imperative tied directly to brand, innovation,

and market value."

Beth Musumeci, Global Leader of Cyber

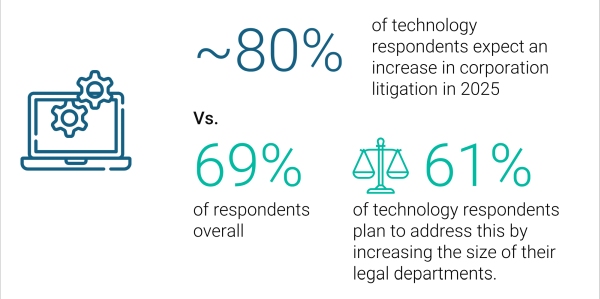

Litigation

Nearly 70% believe corporate litigation will increase in 2025

"As risks increase, so does the likelihood of

litigation. Such litigation is often handled in-house—but as

disputes become more and more complex, businesses will look for

specialized and sophisticated outside counsel who can address their

most critical compliance gaps."

Greig Taylor, Partner and Managing Director

"Organizations that treat litigation risk as a core

business driver—integrating legal analytics, cross-functional

scenario planning, and early warning systems—will be far

better equipped to navigate the challenges associated with

potential legal risks arising from the rapidly changing economic,

regulatory, and geopolitical landscape."

Iona McCall, EMEA Co-Head of Economics Consulting

Regional Spotlights

Our survey included a significant number of respondents from key regions including the U.S., Asia-Pacific (China, Hong Kong SAR, Japan, Singapore), Western Europe (Austria, France, Germany, Switzerland, Italy), the UK, and Latin America (Brazil, Mexico).

INDUSTRY HOT SPOTS

Financial Services Respondents

Manufacturing Respondents

Technology Respondents

LOOKING FORWARD

"Changes are happening so fast it's hard to

keep up while also training staff."

- Chief Compliance Officer, accountancy

"[We] do not have the resources necessary to

adapt to major changes."

- Chief Regulatory Officer, consumer goods

"Too many unknowns, too much

unpredictability."

- Chief Compliance Officer, healthcare and life sciences

These sentiments from senior executives who took our survey ring truer than ever as the year advances. While the comments refer to potential regulatory changes, they could easily apply to the many other risk factors facing today's organizations—from economic volatility and new tariffs to heightened cybersecurity threats and AI advancements to anticipated spikes in financial crime and corporate litigation.

As new challenges are added to the global risk landscape, the insights from our survey and subject matter experts can help business leaders navigate this complex period. In addition to our key findings, we'll be rolling out subsequent perspectives, taking a deeper dive into key themes and industries as well as region-specific findings. Throughout, we'll update our analysis to incorporate the latest headlines and key policy changes impacting your business.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.