Reflections of the D&O market in 2023 and comparisons made with previous years. What can we expect in 2024?

Introduction

This update analyses our observations of the current market conditions for Directors' and Officers' insurance and the impact this has on board directors, non-executive directors and insurance buyers and is based on our observations of the market with our WTW clients and not a whole of market review. For ease of understanding, the percentages have been presented as rounded figures.

Overview

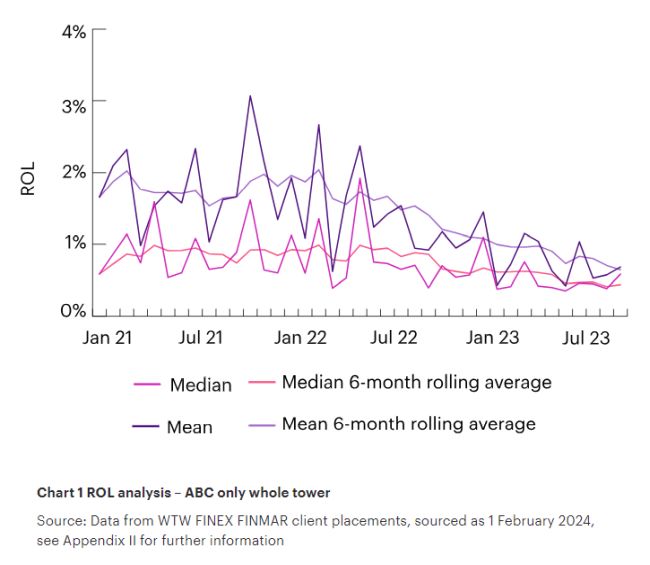

The D&O market experienced significant rate reductions throughout 2023 when compared to previous years, with mean rates stabilizing at the end of the year. The increased competition between insurers has continued to drive market improvements and rate reductions.

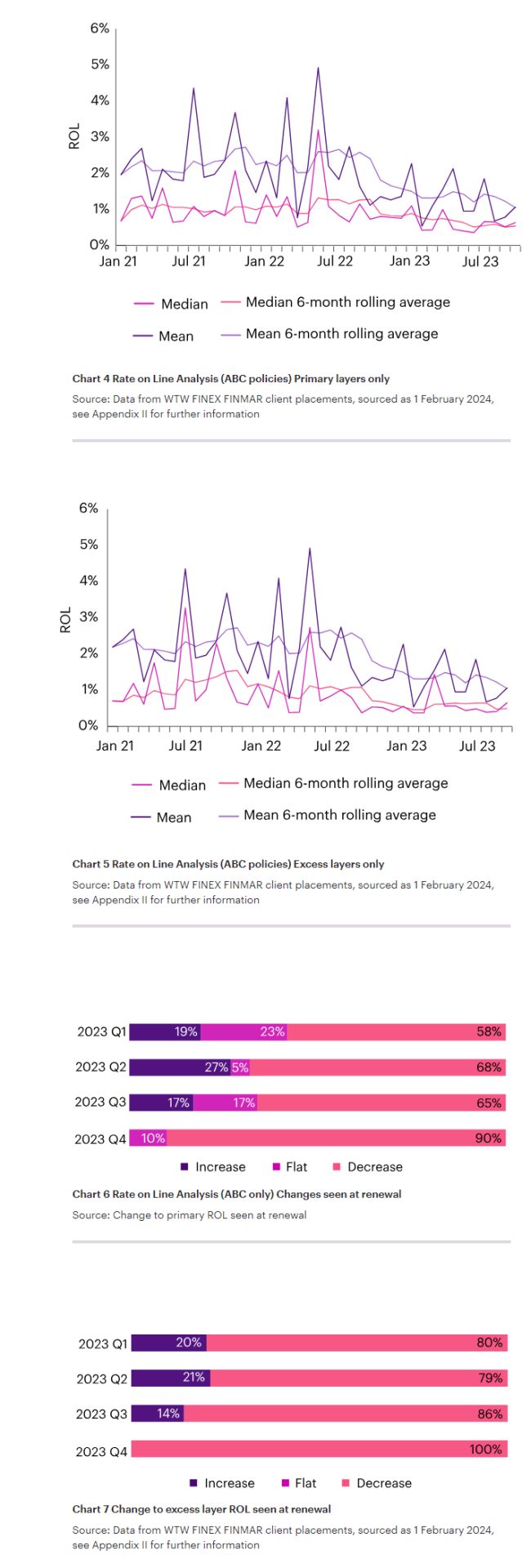

Throughout the entire year, most of our clients saw decreases in their renewals and H2 rates followed the decrease trend of H1: in Q3, 65% of clients saw their primary layer renew with a decrease on last year's premium whilst 86% saw their excess layers renew with a decrease (further detail can be found in chart 6 in Appendix I). Q4 results are even better: 90% of clients saw their primary layer renew with a decrease and 100% of our clients saw their excess layers renew with a decrease.

Policy terms are also reflecting the market softening with insurers increasingly willing to underwrite business on "any one claim" limits as well as using WTW's proprietary wording (DARCstar 2023). WTW's recently launched Side A DIC facility is also showing great results (A-star).

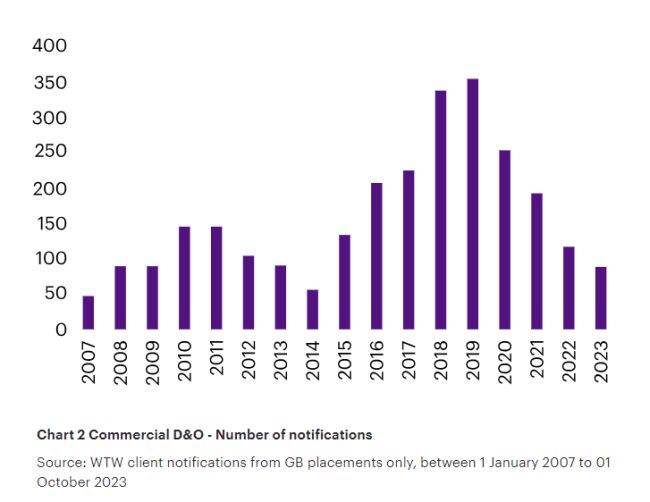

Following a period of significant decreases in the volume of claim and circumstance notifications between 2020 to 2022, the number of notifications up until October 2023 if annualised would see a similar, comparatively low, level as seen in 2022 (see chart 2 below).

According to The Stanford Law School/Cornerstone's Securities Class Action Clearing house, US Securities Class Actions for 2023 were down from the historic highs of 2017-2020 but slightly higher than 2022 (see chart 3 below).

Looking forward, we continue to expect further rate decreases in H1 2024, albeit not necessarily with some of the steep discounts that we saw in 2023.

Primary layer rate on line figures have had some variation throughout the year but still remained at the lowest levels of the last 3 years. In 2023, for those clients which saw a discount, the mean discount was 18%. See Chart 4 in the Appendix.

Excess layer median rate on line continues to trend down but remains above the level that it was in January 2020. For those clients who saw decreases in their excess layers in 2023, the mean decrease was 25%. See Chart 5 in the Appendix.

Notifications

While H1 2023 saw an uptick in notifications, this wasn't sustained throughout the year and if the trend established in notifications up until October 2023 was annualised, it looks like notifications will continue to be at a similar level to 2022, i.e. the lowest since 2014.

US Securities Class Actions

Although still down when compared to the highs of 2017-2020, Securities Class Actions filings through 2023 reflect year-over-year increases at a total of 213, which is slightly more than 2022.

Directors' and Officers' Survey Report 2024

Following the launch of our biggest Directors' and Officers' Survey to date (in collaboration with international law firm, Clyde & Co LLP), we now have responses from more than 50 countries around the world (up from 40+ countries last year) and we are busy collating the results and preparing insights and articles based on the survey findings. We are aiming to publish this year's report in March 2024.

Appendix I

Appendix II: Methodology for statistics

| Min | Max | Notes | |

|---|---|---|---|

| Rate on Line | 0.01% Rate on Line | No max | Rate on Line is calculated by dividing the premium by the limit of liability that is being purchased and expressing that as a percentage. This shows the proportional cost of the limit of liability being purchased by each client. |

| Rate on Line change | 0.01% Rate on Line | No max | We are comparing the Rate on Line paid last year to the Rate on Line paid this year for a given client at renewal. |

Figures in this report are based on WTW FINEX FINMAR client

placements, sourced as 1 February 2024, and WTW client

notifications from GB placements only, between 1 January 2007 to 01

October 2023. They will be updated periodically to reflect

additional records. Graphs in this report show the moving average

between 2021 and Q4 2023.

An ABC placement is one which includes cover for Side A (D&O non-indemnified loss), Side B (D&O indemnified loss) and Side C (Company Securities Claims).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.