With deal volumes down and exit environments still uncertain, private equity (PE) can no longer rely solely on financial engineering. As corporations offload noncore assets, PE firms have a timely opportunity to buy complexity at a discount and convert it into strategic clarity. The next phase of value creation will depend less on leverage and more on operational excellence, bolt-ons, and business model reinvention.

A market in reset: PE deal flow is down, but carve-outs are gaining traction

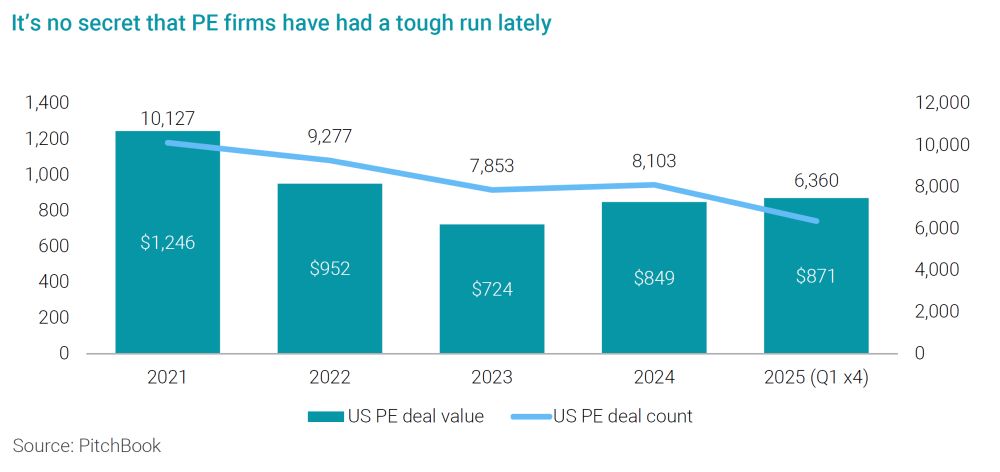

In 2021, US PE saw 10,127 deals totaling more than $1.2 trillion. As of 2025 (annualized from the first quarter), that figure has declined to 6,360 deals and $871 billion—a 37% drop in volume and nearly 30% in value—even though 2024 saw indications of recovery driven by expectations of potential interest rate reductions and more-favorable financing conditions.

Persistent uncertainties and high interest rates have negatively impacted leveraged buyouts and debt-driven transactions. Consequently, many PE firms are reassessing valuations, delaying decisions, or stepping back because typical levers like favorable financing and quick exits are proving less reliable.

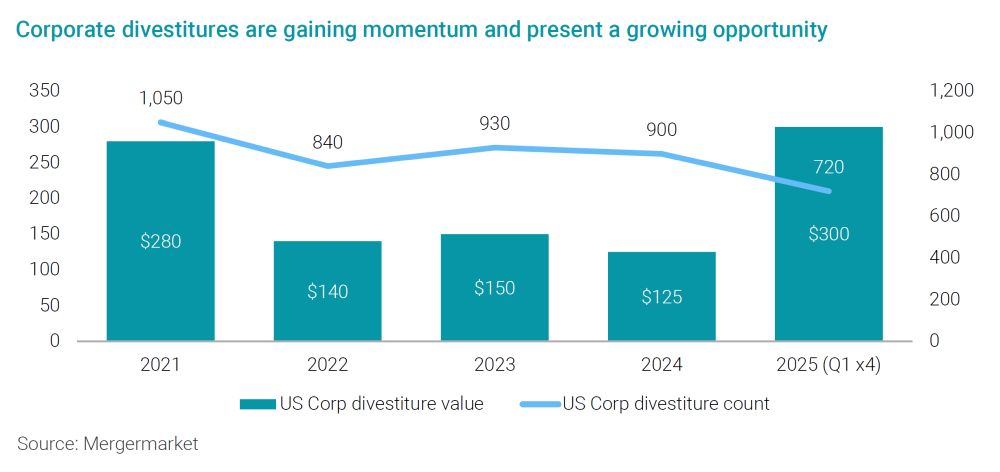

Meanwhile, corporations are streamlining by means of divesting to reduce complexity and by selling noncore businesses. Such divestitures and carve-outs are becoming strategic moves rather than last resorts.

US corporate divestiture count dropped from 1,050 in 2021 to 720 in 2025 (annualized from the first quarter), but deal value rebounded to $300 billion—up from $125 billion in 2024. Fewer businesses are being carved out, but those coming to market are larger, more deliberate, and operationally complex. Companies such as Atos, Global Payments, Philips, and 3M are actively reshaping their portfolios.

What's notable is that these divestitures are not distressed; they are considered decisions. And that is where potential opportunities for PE firms lie.

Why carve-outs win: Structural advantages in today's market

Discounted entry pricing and less competition

Carve-outs often come at inherent discounts. Corporate sellers prioritize both portfolio focus and speed over maximizing price, and many buyers get deterred by complexity. For example, DuPont divested its mobility and materials division to Celanese for $11 billion at approximately 10x EV/EBITDA versus an industry norm of 12–14x, thereby enabling Celanese to secure a strategic adjacency with significant synergy potential and ultimately delivering more than $450 million in value.

Steady, strategic supply

Strategic reviews and cost pressures, including higher costs of capital, are prompting companies, including PE-owned companies, to divest noncore units. In the first quarter of 2025 alone, carve-out value in the United States reached the highest levels in four years. Data collected for the 2025 AlixPartners Disruption Index reveal that 39% of companies—and 46% of companies with significant PE ownerships—say they expect to undertake material divestitures in the coming year.

Less reliance on leverage in a high-rate environment

Carve-outs facilitate value creation through operational transformation rather than by relying mostly on arbitrage via financial leverage for value gains. A case in point is Brookfield's acquisition of Clarios, carved out from Johnson Controls, wherein the deal thesis focused on operational improvements and generated $300 million in value with minimal leverage.

How PE can create value: Strategic levers in carve-out execution

| Stand-alone optimization Carve-outs frequently carry stranded costs, excess general and administrative expenses (G&A), and legacy systems. However, those costs, expenses, and systems create a unique opportunity to shed the burdens and focus operations on efficiency and value creation from Day One. |

Case: Atar Capital acquired BorgWarner's controls division at a sub-7x multiple. Through lean manufacturing, site consolidation, and working-capital efforts, Atar repositioned the business into a streamlined, cash-generating asset. |

| Strategic repositioning and go-to-market

revamp Beyond cost improvements, PE firms can refine commercial models, reset leadership, and modernize strategy. |

Case: Francisco Partners acquired Litmos and overhauled the sales approach, expanded into new verticals, and upgraded infrastructure, resulting in a focused, software-as-a-service (SaaS) growth business. And in another case, EQT repositioned Schülke & Mayr for international expansion, B2B digital scaling, and innovation-driven growth. |

| Platform building and bolt-on enablement Carve-outs can be starting points for building scaled platforms, especially within sector or theme-driven strategies. |

Case: iNova Pharma, acquired by TPG and PEP for approximately $2 billion, became a foundation for an Asia Pacific health platform. The firms added bolt-ons, removed low-margin stock-keeping units (SKUs), and expanded direct-to-consumer (DTC) reach, thereby elevating iNova from regional player to category leader. Similarly, Bain and Goldman Sachs built Dade Behring by combining multiple diagnostics carve-outs, and expanding globally, which resulted in an approximately 8x return. |

| Premium exit optionality Once stabilized and scaled, carve-outs often appeal to both strategic acquirers and secondary sponsors. The difference between entry and exit multiples can be widened through operational clarity and market repositioning. |

Case: Gresham House acquired Ascential's events division at an approximately 13–14x multiple, implemented digital targeting and operational improvements, and exited to Informa at 16.6x fiscal year 2025 estimated EBITDA. |

Across industries, PE firms that prioritize operational strategy—not only financial structuring—are seeing stronger results with carve-outs.

A new mandate: PE must evolve its typical playbook

Carve-outs are not plug-and-plays. Carve-outs are often structurally incomplete businesses requiring targeted execution. Based on AlixPartners' experience in providing carve-out support, the following challenges frequently arise, and many PE firms are usually not structurally built to overcome them alone:

Business entanglement complexity: Most

carve-out targets lack independent infrastructure, and they operate

for a time under transition service agreements (TSAs) with their

former owners. Core systems such as enterprise resource planning

(ERP), customer relationship management (CRM), and cybersecurity

must be implemented—usually with TSA timelines—with

minimal disruption.

Talent and organizational design gaps: Key

leadership and functional roles typically remain with the seller.

The buyer has to assess team depth, define interim operating

models, and fill talent gaps quickly.

Stranded cost and G&A disaggregation:

Shared services such as human resources, procurement, and

accounting rarely transfer. Without early structure redesign, the

new company can find itself saddled with excess cost or hobbled by

inadequate functional capabilities.

TSA overhang risk: Poorly scoped TSAs can

give false senses of stability. Lack of a clear TSA exit strategy

can slow execution and cause leakage. On the other hand, when

exiting a TSA is done right, it can provide the new company with a

leaner and better infrastructure than it had before.

Vendor/client contract migration: Carve-outs

are often not fully separated from their suppliers and customers.

Vendor and customer transitions must be planned to avoid continuity

risks. Sales force coverage is especially urgent, because gaps put

revenues at immediate risk.

These factors are central to realizing value. Many PE firms are

still adapting their internal models to support those areas

effectively, and almost by definition, the firm's own

management team is unlikely to have had previous carve-out

experience. Execution capabilities—especially in Day One

readiness stand-up acceleration, and integration—play

important roles in achieving success.

Conclusion: Evolve the playbook, unlock the premium

Carve-outs offer an opportunity to generate value through disciplined execution, strategic repositioning, and operational improvement. For PE firms ready to take a more hands-on approach, carve-outs can be a well-aligned fit in today's market.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.