- within Corporate/Commercial Law topic(s)

- within Transport, Employment and HR and Antitrust/Competition Law topic(s)

- with Inhouse Counsel

In July 2025, there were five Rule 2.7 announcements made across the UK public M&A market and three further possible offers announced.

Firm Offers announced this month:

- Recommended cash offer by Brookfield Wealth Solutions Ltd for Just Group plc – £2.4 billion – public to private

- Recommended cash offer by Corpay, Inc for Alpha Group International plc – £1.81 billion

- Recommended loan notes offer by DBAY Advisors Limited, Alan Sellers and Samantha Moss for Anexo Group plc – £70.8 million – public to private – loan notes and unlisted securities alternative

- Recommended cash offer by an Investment vehicle to be advised by Apax Partners LLP for Apax Global Alpha Limited – £794.5 million – public to private – cash and unlisted securities alternative

- Recommended (after revisions) cash and shares offer by Kohlberg Kravis Roberts & Co. L.P for Spectris plc – £4.2 billion – public to private

Possible Offer announced this month:

- Possible cash offer for BasePoint Capital LLC by International Personal Finance plc – £482.1 million

- Possible cash offer by Legacy UK Holdings Limited for Empresaria Group plc – £33.4 million

- Strategic review including sale process announced by NCC Group

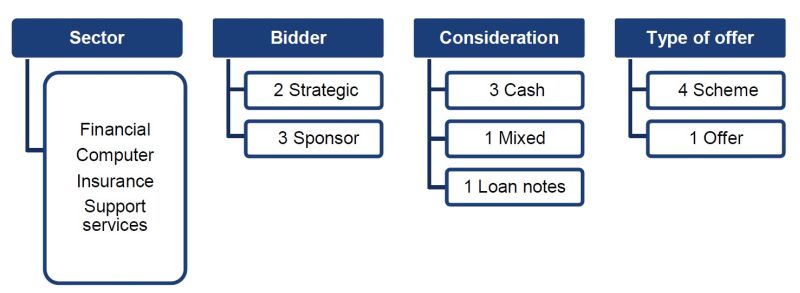

Firm Offers breakdown this month:

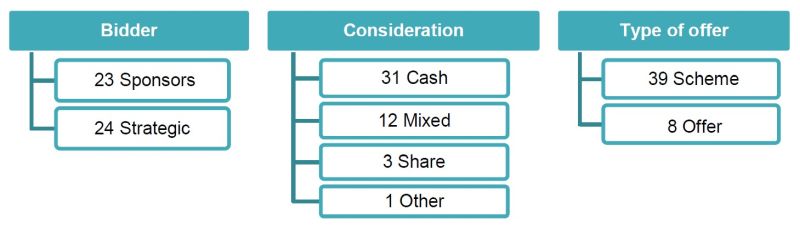

Year to date breakdown:

July 2025 Updates:

UK Public M&A podcast Ep 35: UK Takeover Panel Practice Statement on unlisted share alternatives

In this episode, we talk about Practice Statement 36 which has recently been published by the UK Takeover Panel on unlisted share alternatives.

Topics we discuss include:

- what terms for an unlisted share alternative are acceptable, and what is not acceptable;

- what rights can be attached to the shares; and

- the disclosure required.

UK Public M&A podcast Ep 36: Shareholder influence on M&A

In this episode, we talk about the influence we have seen shareholders have on recent transactions.

Areas we discuss include shareholders:

- pushing for M&A;

- influencing M&A, including through the use of irrevocable undertakings and stub equity;

- looking to block deals; and

- being directly targeted for support by both targets and bidders.

We also discuss the key takeaways for companies when dealing with shareholders.

July 2025 Insights: .jpg)

The number of firm offers announced this month has increased slightly compared to the previous three years but still lags behind 2021, with the announcement of five firm offers. This year has seen the same number of possible offers as last year with three possible offers. This is also comparable with 2022 and 2021. Overall, across the last four years, there is a steady but slow upward trend in firm offers announced, which could indicate an improving and busier market during the summer months.

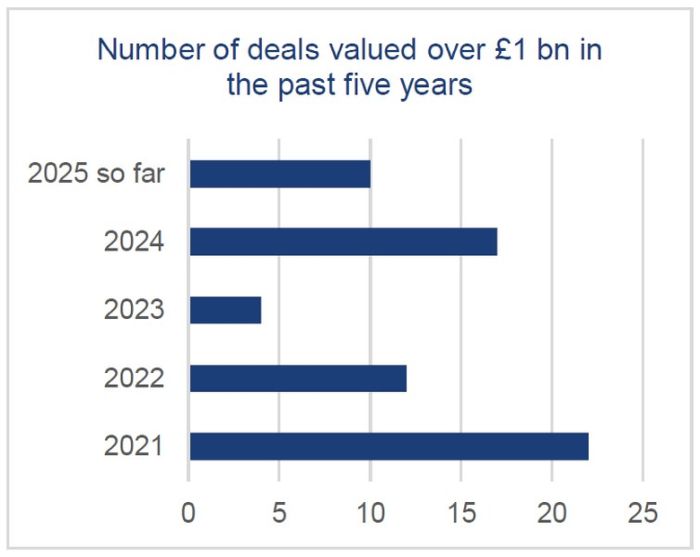

While 2025 is not yet the highest year for deals with a value over £1 billion, it is shaping up to be a strong contender. Ten deals have been announced so far with a value over £1 billion in 2025, compared to 17 in 2024 and only four in 2023. Three of these deals came in July: Kohlberg Kravis Roberts & Co LP made a £4.2 billion offer for Spectris plc; Corpay Inc made a £1.81 billion offer for Alpha Group International; and Brookfield Wealth Solutions Ltd made a £2.4 billion offer for Just Group plc. The increase in deals valued over £1 billion may suggest that previously reserved capital is now being actively deployed, reflecting a shift in investor sentiment and market confidence compared to 2023 and 2024.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.