- in United States

- with readers working within the Accounting & Consultancy industries

An Accountant based in Atlanta, Georgia provided valuable advice to a new Client who was starting a kitchen design business with a business partner.

The Client asked whether they should be 50/50 owners, or if one partner should own a majority share.

Here's how the Accountant explained the issues... an approach which gained the trust of the Client and led to a long-term, lucrative advisory relationship.

What is the advisory challenge?

Owning a business 50/50 versus having one majority partner (e.g. 51/49) has both advantages and disadvantages.

Accountants can provide valuable advice to help Clients decide on this important point.

What are Features of a 50/50 Structure?

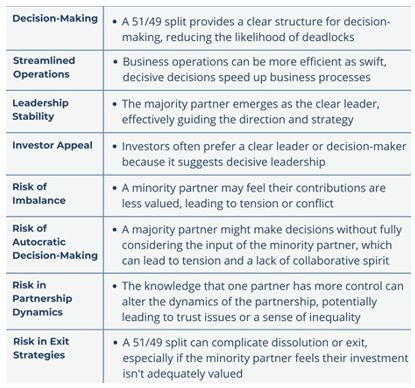

What are some features of a 51/49 Structure?

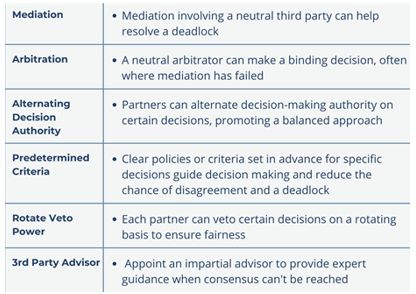

If Deadlocks are a risk of a 50/50 Partnership, how can they be avoided?

Effective partnerships require strong communication and mutual respect. Accountants can help partners weigh the merits of different approaches to arrive at the best path for them.

Do you have Clients you could advise on ownership structure?

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.